Bitcoin Cash Price Careens Downward

The bitcoin cash price has careened downward this week, falling 11% on Wednesday to bring its 7-day decline to 21%.

Bitcoin Cash Price Drops 21%

Bitcoin cash is not alone in regressing for the week. Among the cryptocurrencies with the 10 largest market caps, only bitcoin and Ripple have posted a 7-day price increase. However, bitcoin cash’s 21% retreat has outpaced that of every other top-tier coin–and by a considerable margin.

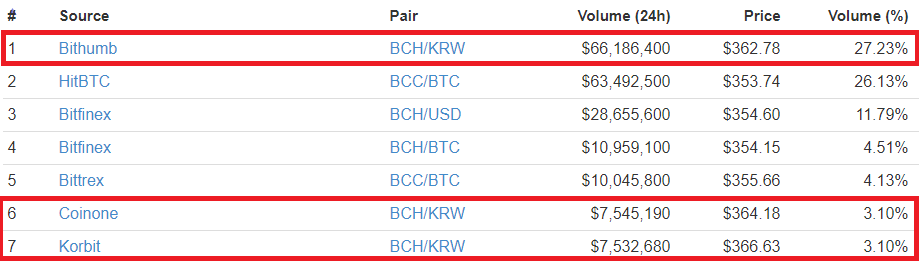

A week ago, the bitcoin cash price was trading at $457. It gradually declined throughout the week, dropping below the $400 threshold on October 3. Since breaking below that barrier, the bitcoin cash price took an even steeper downturn, falling to a global average of $357 at the time of writing. That said, bitcoin cash has more support on Korean exchanges, where it is trading as high as $366.

This pullback has reduced bitcoin cash’s market cap below $6 billion for the first time since September 15, placing it more than $2.2 billion behind third-ranked Ripple.

Miners, Profits, and the EDA

Part of Wednesday’s decline should be attributed to the recent emergency difficulty adjustment (EDA) in the BCH network. When too few blocks are found, an EDA is triggered, making it much easier for miners to find blocks and accumulate coins. This incentivizes miners to switch from the bitcoin network to bitcoin cash, causing the BCH hashrate to skyrocket. Since most miners cash out their coins immediately, low network-difficulty periods place extra downward pressure on the bitcoin cash price.

The increased hashrate eventually triggers another EDA that adjusts the difficulty upward to support the increased hashrate. Of course, once that happens, BCH mining profitability plummets, and the majority of the hashrate transitions back to bitcoin.

It’s no secret that miners exploit the EDA to maximize their profits, creating hashrate volatility and block time inconsistency. However, as blockchain tracing firm Chainalysis pointed out in a blog post published earlier this week, the EDA is also what ensures bitcoin cash’s survival.