Your Old Baseball Cards Are a Better Store of Value Than Bitcoin

Your old baseball cards are a better store of value than bitcoin. That's true even if the cryptocurrency's price keeps going up. | Source: Pexels (i), Shutterstock (ii). Image Edited by CCN.com.

One of the primary arguments in favor of bitcoin is that it is a “store of value.” It makes sense on the surface, but when one digs into the meat of this claim, it comes up with less beef than a Beyond Meat burger.

Evaluating Bitcoin as an Investment Commodity

The category of “investment commodity” refers to things that people buy that represent a store of value because of their end use, aesthetic , historical, and/or emotional value.

Baseball cards, and other collectibles like art and rare coins, are such examples. People are willing to pay for these items for these reasons.

Cryptocurrency Has ‘No Intrinsic Use Value’

So what makes bitcoin different?

Todd J. Zywicki is a Senior Scholar of the Mercatus Center at George Mason University . He points out:

“Economist Vernon Smith has shown that investment markets are more prone to boom and busts then markets involving end-use goods. The argument is not so much about subjective value, but that the value of an investment commodity is your expectation as to what everybody else will value it at. Bitcoin has no intrinsic use value. Its value derives from your expectations about other peoples values, which is in turn based on their expectations of everybody else’s views.”

Bitcoin has no end-use, aesthetic, historical, or emotional value.

“It’s 100% speculation with no clear use value to ground it.”

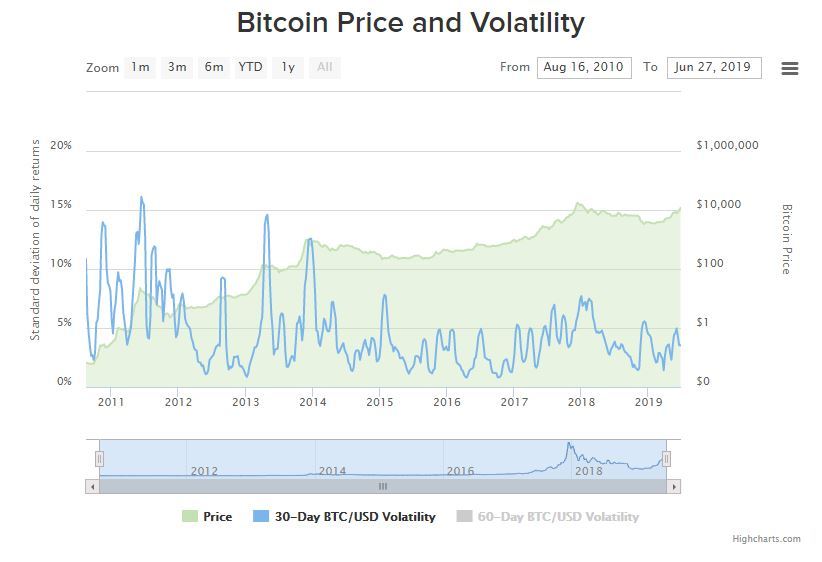

That’s the reason behind bitcoin’s volatility. Without anything to anchor bitcoin’s value, the price instead depends on multiple layers of investor expectation, effectively making it a derivative of a derivative based on nothing.

A store of value is not a store of value when it has a 95 percent probability of swinging 166 percent in either direction in any given year – which bitcoin has.

Why Baseball Cards Are Better Than Bitcoin

Maybe you think baseball cards aren’t such a hot store of value either? Actually, they are.

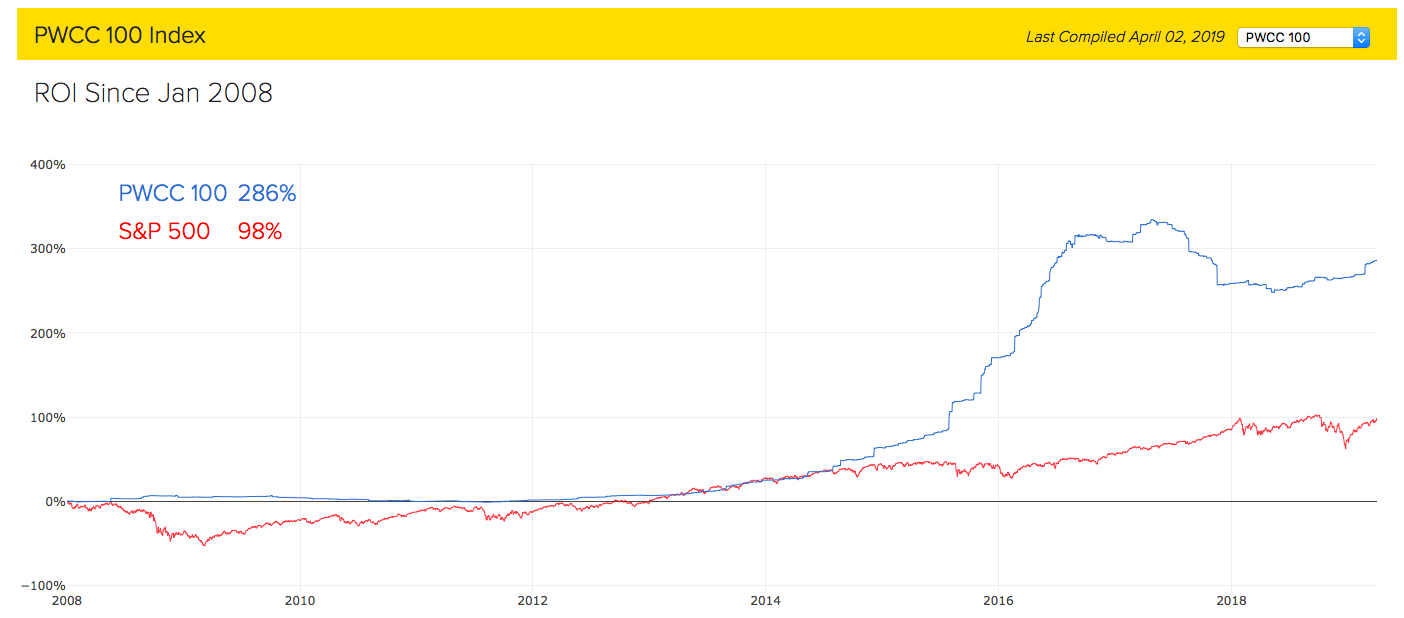

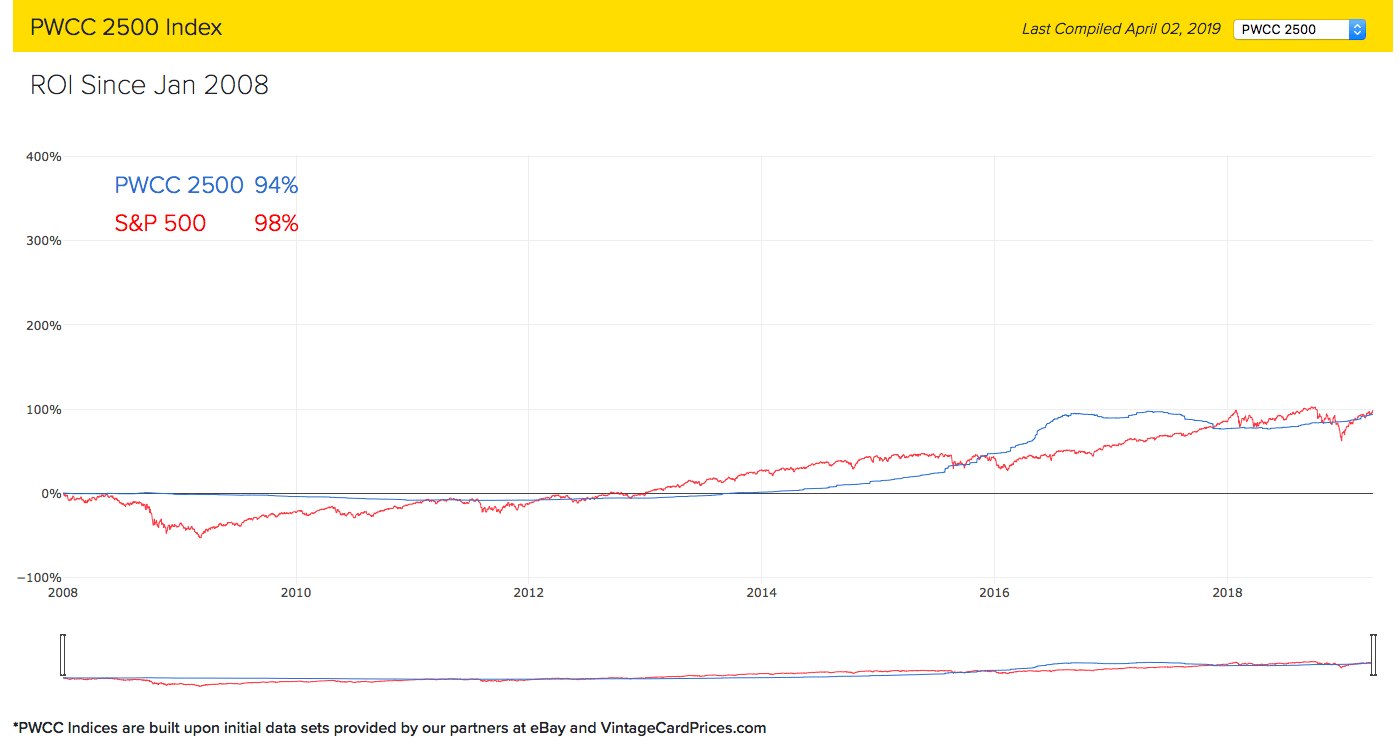

Not only is their volatility significantly less than bitcoin, but the top 100 rarest baseball cards have also outperformed the S&P 500 by 200 percent since the financial crisis.

The top 2,500 baseball cards have matched the S&P 500’s return and with even less volatility.

Compare the volatility of baseball cards in the charts above to that of bitcoin.

It’s not even close.

A store of value allows an investor to sleep at night knowing when he wakes up that there will be minimal movement in the holding value of his asset.

Bitcoin can move 15 percent in an hour. How is that a store of value?

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.