Bitcoin Price Plunges to $3,966 as Bitcoin Cash Hits All-Time High

The bitcoin price plunged on Saturday, falling to $3,966 on Bitfinex. The CoinMarketCap average bitcoin price is $4,032, but it would not be surprising if it dipped below the $4,000 threshold. Bitcoin cash now has a market cap of nearly $14 billion, while bitcoin’s has slipped to $66.6 billion.

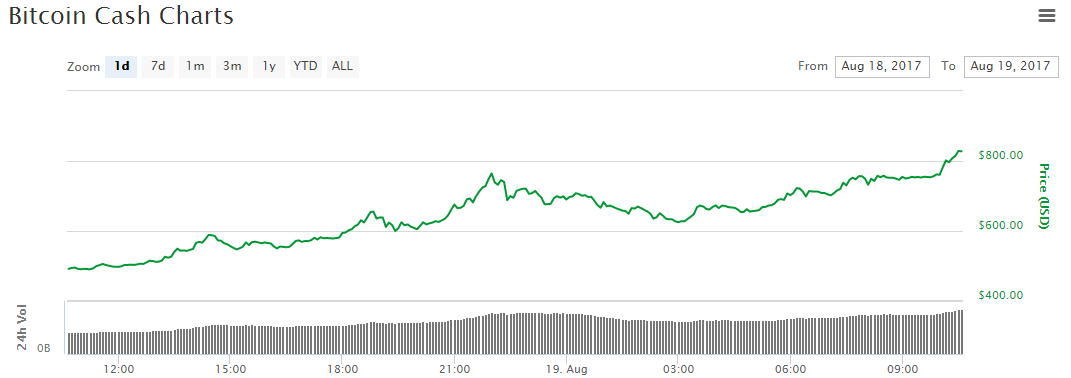

Bitcoin’s weekend decline is directly correlated with bitcoin cash’s rapid ascension. In the past 48 hours, the bitcoin cash price has nearly tripled, reaching a new all-time high of $871. Bitcoin, meanwhile, has fallen 7% in the past day alone.

Indeed, bitcoin cash is profiting almost exclusively at bitcoin’s expense. Amazingly, bitcoin’s largest exchange trading pair is BCC/BTC on Bittrex, and BCH/BTC pairs comprise its third- and fourth-largest pairs (bitcoin cash does not yet have a universally-accepted symbol).

No BTC/CNY pair appears in the top 5, and only one BTC/USD pair is listed in the top 10.

The bitcoin cash price surge has caused trading volume for both BCH and BTC to soar. Bitcoin cash now has the most volume of any cryptocurrency, posting $3.6 billion for the day. Bitcoin volume, meanwhile, has increased to $3 billion. Ethereum’s $822 million is a distant third.

Factors Causing the Bitcoin Price to Slip and the Bitcoin Cash Price to Soar

Several factors have coalesced to produce today’s market movement. First, as reported yesterday, bitcoin cash has seen a trading volume explosion on Korean exchanges. Bitcoin cash’s top three trading pairs are with the Korean Won, and BCH/KRW volume is approaching $1.5 billion on Bithumb alone.

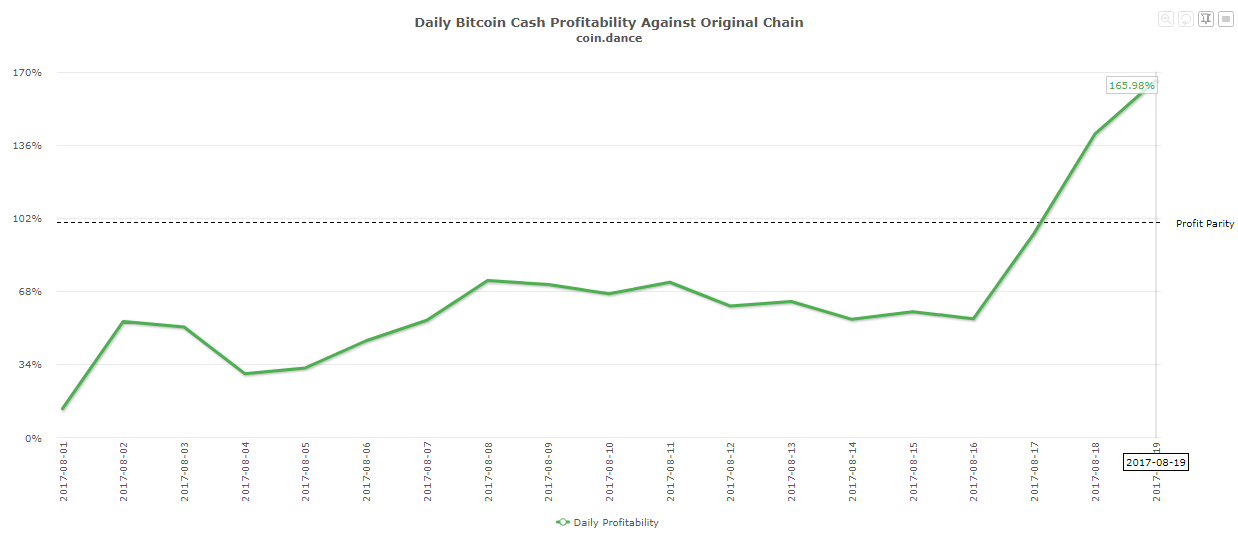

Next, many people anticipate that bitcoin cash will begin attracting miners away from the main bitcoin blockchain. The network difficulty was expected to see a significant decrease this weekend, making bitcoin cash more profitable to mine. Thanks to market movement, however, mining profitability parity has already been reached–and exceeded.

According to Coin Dance, bitcoin cash is currently 66% more profitable to mine, and that number will increase following the difficulty adjustment, depending on whether or not bitcoin cash can sustain this price advance.

Finally, many bitcoin proponents fear another hard fork in the near future. These fears were worsened by a recent BitPay blog post , which told users they needed to upgrade their nodes to prepare for SegWit implementation. However, the node BitPay told users to download was a SegWit2x node, and many people accused BitPay of deliberate deception. Peter Todd went so far as to accuse BitPay of committing fraud . Bitcoin Core still opposes SegWit2x, and they reiterated in a statement that they do not plan to follow the SegWit2x hard fork. If both sides remain entrenched, bitcoin could see another chain split in the near future.

Featured image from Shutterstock.