Bitcoin Cash Price Soars to $568 Following Surge in Korean Trading

The bitcoin cash price soared to $568 on Friday following a surge in trading volume on Korean exchanges. This resulted in a 24-hour climb of more than 86%, although the bitcoin cash price has since tapered to $554.

Bitcoin cash now has a market cap of more than $9.1 billion, making it the 3rd-largest cryptocurrency by a wide margin (4th-place Ripple has a $6.2 billion valuation). This is the highest mark for the bitcoin cash price since August 2, when its markets were still largely illiquid and most exchanges had yet to fully enable bitcoin cash deposits and withdrawals.

Bitcoin Cash Trading Volume Leaps to $2.2 Billion

The rapid climb came amid an explosion in trading volume. For most of its brief history, bitcoin cash’s daily trading volume has stayed within the $100 million to $200 million range. That changed on August 17, when trading volume vaulted to $744 million from $106 million the day before. Bitcoin cash volume continued to increase on August 18, nearly tripling to reach $2.2 billion.

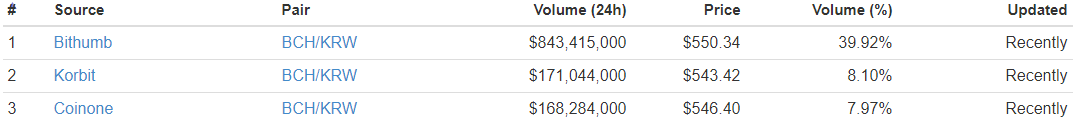

The majority of bitcoin cash volume is currently concentrated on Korean exchanges. In fact, BCH/KRW pairs alone account for more than $1.2 billion. That said, there has also been a several-hundred million dollar spike in BCH/USD and BCH/BTC trading.

Interestingly, the bitcoin cash price is significantly lower on the high-volume Korean exchanges than elsewhere. On Korbit, for instance, bitcoin cash is trading at $543, which is $11 below the CoinMarketCap average.

Bitcoin Cash More Profitable to Mine than Bitcoin

There are several potential factors influencing bitcoin cash’s rapid ascension. The bitcoin cash network recently demonstrated it could successfully process an 8MB block, which supporters view as validation of larger block sizes as a scaling solution. Additionally, the Zurich-based Falcon Private Bank announced it would add bitcoin cash (along with several other coins) to its recently-launched blockchain asset management service, lending legitimacy to BCH.

However, the real answer might lie with the upcoming network difficulty adjustment. The profitability of mining bitcoin cash was expected to approach parity with the main bitcoin blockchain following this adjustment, sparking speculation that some miners might be tempted to switch from BTC to BCH. However, due to the bitcoin cash price surge, it has already become more profitable to mine bitcoin cash than bitcoin.

According to Coin Dance, bitcoin cash mining is currently 10% more profitable than bitcoin, and that gap could increase further following the difficulty adjustment (assuming the bitcoin cash price holds at or near its current level). Of course, these numbers do not factor in profits from transaction fees, which are much higher on the main bitcoin network.

Featured image from Shutterstock.