Bitcoin Price Oversold, May Have Found a Bottom: Bloomberg Analyst

The bitcoin price has the potential to soar as high as $14,000 by the end of 2019, according to eToro analyst Simon Peters. | Source: Shutterstock

By CCN.com: A new analysis in Bloomberg suggests that the Bitcoin bottom is somewhere around $3,000 or $3,100. Using the GTI Global Strength Technical Indicator, the analysis says that Bitcoin is probably oversold at this point.

[The indicator] for Bitcoin is nearing oversold levels, clocking in at 35.6. That’s the lowest level since December. Bitcoin appears to be stabilizing around $3,500, with clear support at $3,000 to $3,100, the measure suggests.

The Bloomberg report also says “many regular investors remain wary of crypto market.” It suggests that a clear bottom can help reignite mainstream interest in cryptocurrency. Clear support currently exists around $3,100 or as low as $3,000.

The Bitcoin price has been stabilizing above $3,500. But this is crypto. The market could get a bear scare and drop $1,000 tomorrow. It could do the opposite and start a bull run. The latter scenario is unlikely, however, given an overall cooling in sentiments toward blockchain development and crypto adoption.

Impending Short-Term Bitcoin Rally?

The data from the GTI GSTI suggests a short-term Bitcoin rally is on the cards. Bitcoin, analysts who use this indicator suggest, is likely to boom for a short period before beginning a settling period down to where the majority of its support is, about $4-500 beneath its current price levels.

However, the True Strength Indicator, which measures short-term price shifts in market charts, shows a heartbeat monitor over the past five days.

At the time of writing the TSI was around 27, down from a 5-day high of over 44. This is a marked improvement from the very recent 5-day low of nearly 70.

Will The Rally Extend into a Minor or Major Bull-Run?

One question that is surely in the back of everyone’s mind is whether or not the likely impending short-term rally could morph into an all-out bull run.

News has a way of playing heavily into the Bitcoin trading markets. If news of a bull rally broke, people who regularly fear missing the next all-time high might seize the opportunity and further propel buying activity.

Again, this is crypto. Anything can happen.

One decidedly bullish trader says:

Zoom out, take a deep breath, close your eyes and use your pineal gland to visualize the future.

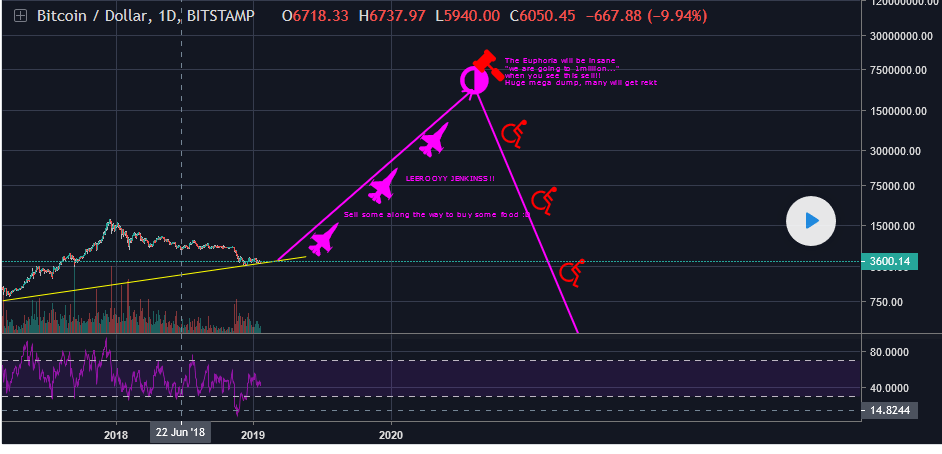

The trader known as Hakichan seems to suggest a ridiculous bull run up into the millions of dollars.

Whatever happens, long-term Bitcoin trading is still waiting on an ETF and other big news to spur interest from the mainstream. Nearly half a trillion dollars exited the market over the course of 2018, but a certain portion of that, along with other new money, is bound to re-enter when they feel conditions are right.

Featured Image from Shutterstock. Price Charts from TradingView .