Bitcoin Price Could Crack $10 Million, Become New Gold Standard: Asset Management Firm

Asset manager Lucid makes the case that the bitcoin price could one day rise as high as $10 million. | Source: Shutterstock

By CCN.com: Throughout the 2017 crypto market bull run, bitcoin price predictions kept the crypto hype train fat and happy. Whether it was eccentric ICO promoter John McAfee promising to emasculate himself if bitcoin failed to reach $1 million within three years or Fundstrat setting a “conservative” price target at $25,000, every crypto influencer had a price target — and most represented significant upside, often in the extremely short-term.

Increasingly, though, such optimistic — and specific — bitcoin price targets seem like a relic from a bygone era. Even Tom Lee, perhaps Wall Street’s biggest crypto bull, rage-quit the bitcoin price prediction game, complaining that the market failed to recognize that the asset’s true value was far above its current level.

Lucid: Global Debt Crisis Creates Major Opportunity for Bitcoin

Against this bearish backdrop, asset management firm Lucid Investment Strategies is breaking away from the pack to make a bull call that sounds like a throwback to 2017: The bitcoin price could one day reach $10 million, become the new gold standard, and solve the world’s debt crisis.

According to Lucid, the ratio of global debt to wealth has spiraled out of control, creating a “grotesque imbalance” of wealth inequality. As of the end of 2018, total world debt was an estimated $247 trillion, compared to $317 trillion in total world wealth. But while global wealth continues to outpace debt, the gap is quickly closing; Over the past 20 years, debt has ballooned by 394 percent, while wealth has climbed just 133 percent.

Writing in a new report , Lucid claims that this status quo is not sustainable and that the world economy must eventually locate a solution to address the debt crisis. The five most likely strategies, the firm says, are the adoption of a gold standard, the creation of a new commodity/currency basket, economic growth, outright default on sovereign debt, or mass investment in bitcoin.

While perhaps not the likeliest outcome, the firm maintains that bitcoin is the best alternative since it would provide a “permanent fix” to the debt crisis while limiting the damage that will inevitably accompany widespread economic upheaval.

From the report, which was drafted by Lucid President and Chief Investment Officer Dean Tyler Jenks and Executive Vice President Leah Wald:

[I]s this [mass bitcoin adoption] feasible? Probably not. But we believe it is possible and we believe it offers the greatest benefits with the least collateral damage to the least number of individuals, corporations, institutions, and countries. Most importantly, it would provide a permanent fix, a quality that none of the other solutions provide.

Were this to occur, the bitcoin price would inevitably enter the stratosphere. But how high could it go? Lucid says that $10 million is a good estimate.

Why $10 million? At that level, Bitcoin would provide a sufficient reserve to alleviate the world debt burden. Bitcoin would be worth between $180 trillion and $210 trillion (depending on when that price was reached). Assuming world debt had reached $500 trillion at that time, remember it has grown by 394% over the past 20 years, Bitcoin would represent a 40% reserve against the debt.

How the Bitcoin Price Could Climb to $10 Million

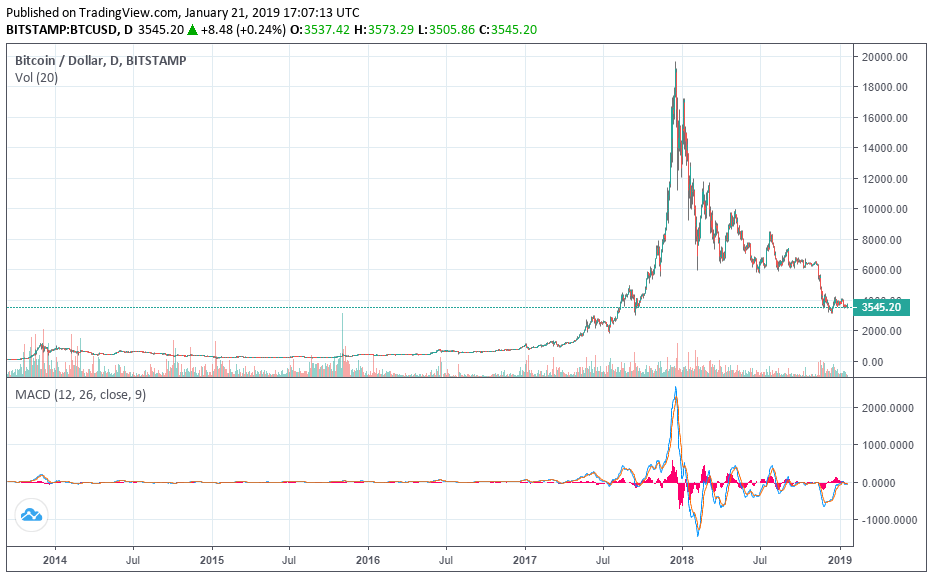

From there, the report examines what sort of path bitcoin would have to take to reach the $10 million mark from where it is today, knee-deep in a 13-month bear market and languishing near the $3,500 mark.

The first step, of course, is breaking out of that slump. Unfortunately, that might happen later rather than sooner. Like many analysts, Lucid believes that the bitcoin price has not yet bottomed — far from it, in fact — but will likely crash below the $1,000 mark before the firesale runs its course.

Exposing Altcoins as Cheap Knockoffs

One important trigger for establishing a bottom will be the “utter decimation” of altcoins and initial coin offering (ICO) tokens, which will prove once and for all that bitcoin is digital gold, and its so-called competitors are just cheap knockoffs.

The next big step in this journey will be the utter decimation of altcoins, ICOs, and the realization of the important attributes of Bitcoin. That process has begun, but the regulators must regulate. We believe they will. During this time, Bitcoin will continue to lose value, but at a much slower rate than its competitors.

With the bottom in and no more nonsense about “building a better bitcoin,” the flagship cryptocurrency would begin to grind upwards. After facing initial resistance, the bitcoin price would begin to quicken its ascent as it breaks through key technical hurdles on its way to setting a new all-time high around $20,000.

Replacing Gold as Premier Store of Value

Bitcoin’s next major challenge would come at $100,000, the mark at which it would begin to rival gold as the world’s premier economic hedge. If investors begin to sell gold for bitcoin, the cryptocurrency could quickly eclipse the yellow metal. If not, the path would be slower, though still possible.

Scaling, Institutional Adoption, & Regulatory Clarity

Notably, it’s also here that Lucid believes developers must begin delivering on promises to scale the cryptocurrency’s protocol to accommodate a much more crowded network. Scaling, coupled with institutional adoption and regulatory clarity, would put bitcoin on track to become not just a store of value, but the world’s reserve currency.

“This accomplished, the road to $1 million will smooth and straighten. The hurtles will be $1 million both psychologically and financially,” Jenks and Wald wrote. “At $1 million, Bitcoin will have a market cap of $18 trillion. It will be in the major league of asset classes and pockets of wealth. It will be a contender.”

As the fastest growing asset class in world history, it will no longer be ignored by pension funds, sovereign wealth funds, institutional money managers, endowments, financial institutions, and even governments. These will fuel the trip, at high speed to $10 million.

When Pricing Bitcoin, Ask the Right Question

Again, Lucid acknowledged upfront that this thought experiment is unlikely to manifest in the real economy. However, they maintain that it could happen, and if it could happen, then why shouldn’t bitcoin bulls gamble that it will, even if only to a much smaller degree?

“Do we believe Bitcoin will be chosen [as the solution to the debt crisis]? That is the wrong question,” Jenks and Wald said as they concluded the report. “The right question is: will there be a choice? Alternatively, will the economic disequilibrium force resolution, probably default?”

Featured Image from Shutterstock. Price Charts from TradingView.