Bitcoin Is ‘The Most Extraordinary Bubble of Our Generation’ Says Trader

Bitcoin is up by almost 180% year-to-date. To some, the disbelief rally has run its course, and it is now time to short the market. While a quick short might be profitable now, one trader believes that the rally from $3,000 to almost $14,000 is…

The next bitcoin bull market is only getting started, analyst claims. | Source: Shutterstock

Bitcoin is up by almost 180% year-to-date. To some, the disbelief rally has run its course, and it is now time to short the market.

While a quick short might be profitable now, one trader believes that the rally from $3,000 to almost $14,000 is nothing but a warm-up. According to an analyst, all four BTC bull runs were massive local bubbles. In his humble opinion, bitcoin is the future.

Analyst: Every Bitcoin Bull Run ‘Has An Order Of Magnitude’

If you look at the history of every bitcoin bull run, you’d see that every run skyrocketed by a minimum of over 340% from the previous bull cycle top.

| Date | Bull Market Top | Percentage Change |

| April 2011 | $0.80 | N/A |

| April 2013 | $259.34 | 32,317.5 percent |

| November 2013 | $1,163 | 348.85 percent |

| December 2017 | $19,666 | 1,590 percent |

Tops of every bitcoin bull run. | Source: Weisscrypto

Cole Garner , a cryptocurrency analyst, shared this pattern when he spoke exclusively to CCN, He said,

Each bull market topped out at a minimum of [nearly] 5x the previous top, and I expect that to happen again the next time around.

In other words, each bull cycle has an order of magnitude according Mr. Garner. He then added,

Each BTC bull market is more dramatic than the previous one.

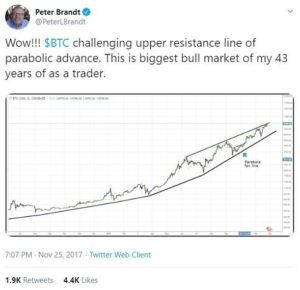

Cole Garner then referred to Peter Brandt’s tweet in November 2017 to drive his point.

The analyst might be on to something because recently one of the most followed traders on Twitter, Peter Brandt, tweeted that the king of cryptocurrencies may have entered a fourth parabolic phase.

Cole Garner: ‘The Previous Bull Run Didn’t Have A Fraction Of The Institutional Buy-In That The Current One Has’

The trader is dead serious when he tweeted that the previous bull runs were massive local bubbles. That’s because they were mostly funded by retail investors.

This current bull run is being powered by large institutions. They were buying the bottom late last year while retail traders were cutting their losses.

Cole Garner illustrates the significance of institutional entry:

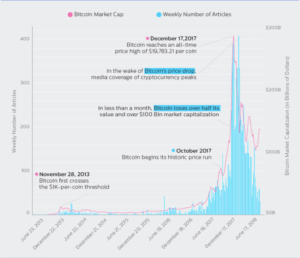

Barely anyone noticed the first bull market of 2011. The next time around, in 2013, we saw real capital flow into crypto, but no media attention. In the bull market of 2017 crypto approached a trillion dollar market cap, with global media attention.

The trader added,

Each has more fiat inflow, more media attention.

Reports have shown that media attention partially drives the price of the digital asset.

With institutions scaling in to bitcoin, it’s only a matter of time before the mainstream media catches wind. In addition to news outlets, Cole Garner predicts that governments will start paying attention. He said,

I expect governments to take notice.

He also went to twitter as he regretted using the word “bubble.” In a tweet, the analyst wrote,

Big picture, BTC is not a bubble in any way, IMHO. It’s the future.

Last modified: January 10, 2020 2:49 PM UTC