Bitcoin Cash: Where the 4th-Largest Cryptocurrency Stands the Day after the Fork

Yesterday, the Bitcoin Cash network activated its second scheduled semi-annual hard fork since the cryptocurrency split away from the original Bitcoin blockchain. Unlike the previous protocol upgrade, however, this fork was contentious, with development teams launching two competing, incompatible BCH implementations.

Background: Another Fork in the Bitcoin Cash Road

The group adhering to the “official” Bitcoin Cash roadmap was Bitcoin ABC, which had support from most node operators, as well as prominent individuals and companies such as Roger Ver (Bitcoin.com) and Jihan Wu (Bitmain).

Several months before the fork, blockchain startup nChain, which is associated with self-described Bitcoin creator Craig S. Wright, announced that it would launch a competing client, Bitcoin SV, which introduced an alternative set of consensus changes. Billionaire Calvin Ayre, the owner of CoinGeek — the largest bitcoin cash mining pool — was SV’s other major backer.

Fellow BCH development group Bitcoin Unlimited released a BCH client that followed the ABC consensus changes by default but allowed miners to manually configure support for individual features in the ABC and SV clients in an unsuccessful bid to broker a compromise and avoid a chain split.

Strictly speaking, there could have been three competing versions if any miners decided to continue mining according to the pre-fork consensus rules, but all of the hashrate migrated to one or the other of the two new rulesets, killing off the original chain.

For more on the events that led up to the fork, consult this article from CCN.com.

Nov. 15: The Hash War Begins

Note: Once the dust finally settles, Bitcoin ABC is expected to retain the “Bitcoin Cash (BCH)” label. In the interim, the community has not yet reached consensus on how to refer to the competing blockchains. In the remainder of this article, to avoid confusion, we will refer to Bitcoin ABC’s chain as BCHABC (other common names include BAB and ABC) and Bitcoin SV’s chain as BSV (also known as BCHSV and SV).

Leading up to the Nov. 15 fork, the Bitcoin Cash civil war was largely framed as a contest between users (BCHABC) and miners (BSV), with the latter boasting as much as three-quarters of the hash rate in the days preceding the split and threatening to use this superior hash power to not only acquire the most accumulated Proof-of-Work (PoW) but also to attack the BCHABC chain until users capitulated and moved to BSV.

BCHABC Builds the Longer Chain

That quickly changed following the fork, however, as BCHABC mined the first two blocks under the new consensus rules and for the most part maintained a blockchain that was consistently longer than BSV’s. As of the time of writing, roughly 185 blocks had been mined under the new consensus rules, and the BCHABC chain was 30 blocks ahead of BSV, according to Coin Dance .

At one point, BCHABC’s hashrate was more than double the size of BSV’s, a reversal of how the hash rate was signaling ahead of the fork, though the gap narrowed on Friday to 6.7EH/s for BCHABC, 5.0EH/s for BSV, and — curiously — 17PH/s for the original BCH chain, whose hashrate flatlined following the fork and remained at 0PH/s for 10 consecutive hours.

This sequence of events, ironically, is reminiscent of the fork that created Bitcoin Cash in the first place, which was activated with broad miner support even though users largely backed BTC. Despite brief uncertainty, profit-driven miners eventually gravitated back to Bitcoin, whose hashrate is now around seven to 10 times larger than BCH.

Did BSV Mount an Unsuccessful Attack?

Presumably, some miners had signaled for BSV ahead of the fork but shifted their hash power to other networks, such as BTC, following the fork to avoid mining at a loss.

However, a significant percentage of the missing hashrate belonged to CoinGeek and BMG (which is operated by nChain). Recognizing this, Bitcoin ABC head developer Amaury Séchet warned that CoinGeek and nChain were likely following through on their promises to launch a malicious mining attack against BCHABC.

“What we are seeing right now, though – or rather, what we are not seeing right now, is CoinGeek and BMG’s hashrate. Right? It’s completely gone. It’s not winning, mining anywhere that we can see. What that tells me is, you know, they have not thrown like 2 exahash at this, right? So they are preparing some kind of attack,” he said several hours after the fork.

That attack had not yet materialized as of the time of writing, however, and by Friday it appeared that BMG had shifted its hash power to BSV, as Séchet (who tweets under @deadalnix) later noted.

Post-Fork Mining Heavily Centralized

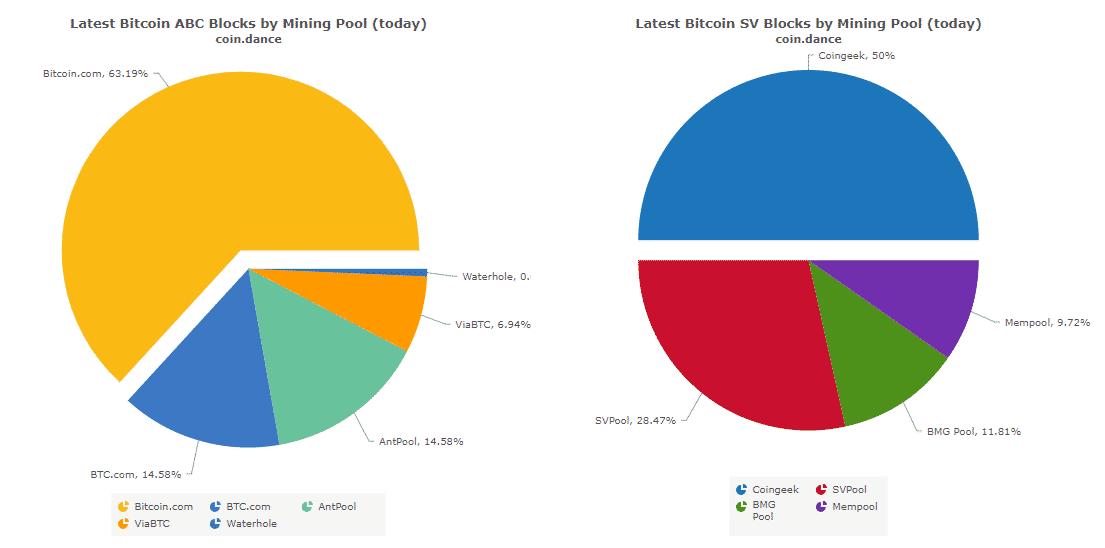

Notably, both BCHABC and BSV are characterized by alarming hash power centralization, with each network featuring a single mining pool accounting for a majority of blocks mined since the fork. On BSV, this is CoinGeek, who currently has 50 percent of the network’s mining power, while Bitcoin.com accounts for a full 63 percent on BCHABC (though the Bitcoin.com pool website indicates that its hash rate, which ballooned to 4EH/s at various points following the fork, is now back down to around normal levels at 122PH/s as of the time of writing).

Both Sides are Mining at a Loss

According to BitMEX Research, BSV miners are losing at least $280,000 per day relative to the value of the coins — and likely more — which will put pressure on profit-motivated miners to cut their losses and switch to BCHABC or BTC.

“Even if the SV mining collation do catch up with ABC or if they manage to do hostile chain re-orgs, its highly unlikely BCash ABC users & investors will ever switch to follow SV. ABC users just need to be patient & wait it out. @CalvinAyre & the SV miners will eventually give up,” the firm wrote on Twitter, doubling down on BitMEX Research’s Jonathan Bier’s pre-fork prediction that miners would ultimately abandon the BSV fork.

That said, BCHABC is currently even more expensive to mine since it has almost twice the difficulty of BSV.

Crucially, though, neither mining group has the ability to sell their coins until exchanges begin taking BCH deposits. Thus, all BCH miners are currently mining at a loss, with the expectation that their support for one chain or the other will consolidate support behind that network and allow its coins to return to the pre-fork value of bitcoin cash.

Consequently, the question is not currently which chain is more profitable to mine in the short-term so much as it is, in the mid-term, which chain is more likely to survive the other, win the BCH ticker symbol, and attract buy support on exchanges. By these metrics, BSV currently seems like the riskier gamble.

Market Has Consistently Favored BCHABC

Virtually every cryptocurrency exchange froze bitcoin cash trading ahead of the fork, and no major platform has reopened unified BCH markets, nor will they do so until there is apparent consensus behind one chain or the other.

However, several exchanges have allowed traders who are already holding BCH on their platforms to “split” their coins into BCHABC and BSV “futures” that are tradeable but not currently withdrawable.

Aside from a temporary reversal a day before the fork, BCHABC consistently traded at a significant premium to BSV in the days preceding the fork and the hours since. As of the time of writing, BCHABC was trading at around $285, down from a 24-hour high of $341. BSV, meanwhile, had stabilized around $104 after briefly dipping as low as $69.

Importantly, though, the majority of BCH investors have not yet claimed their post-fork coins. A certain percentage will decline to split their coins in the short-term altogether, either because they plan to hold funds on both chains, do not think it is worth their time to sell the coins on the other chain, or are not comfortable with the technical process that splitting coins involves.

However, there is also likely a significant number of BCH holders who want to sell the coins on the losing chain before they become valueless but wanted to wait until after the fork to see which network had the upper hand. Of these cautious would-be sellers, most would be holding funds in user-controlled wallets or on exchanges that have not opened BCHABC/BSV trading.

Once major exchanges begin to reenable BCH deposits and open post-fork markets, one would expect to see a mad rush to sell funds on the chain viewed as less viable. Once again, at the current state of play, this would not bode well for BSV, which is not to say that conditions could not shift in the interim.

What BCH Partisans are Saying

Taking the above factors into consideration, proponents of Bitcoin ABC have largely declared victory, increasingly believing that an SV-led attack on BCHABC is unlikely to succeed.

Moreover, they claim that since hash rate was the metric by which SV proponents argued that the outcome of the fork should be judged, BCHABC has beaten BSV at its own game.

Bitcoin SV, however, has refused to concede that it has lost the hash war. Backers allege that ABC has used rented hash power to give its blockchain an early lead and that this will not be sustainable over the long-term.

Craig Wright, for example, has taken to referring to the battle as a “marathon” in which ABC sprinters will quickly find themselves winded.

“In our hash competition, we have seen the ABC team bring on their strongest sprinters. We are just at the trials and not yet on the finals to Marathon and they have made a remarkable burst to do a 9.9 second 100m (unfortunately in the wrong direction),” he tweeted Friday morning.

Calvin Ayre, meanwhile, said in a statement provided to CCN.com that the outcome of the fork will be decided over the course of many weeks — not one or two days — and made the dubious prediction that Bitmain will bankrupt itself trying to defeat BSV.

“CoinGeek and nChain are in this battle for the long haul. We will mine BCH and fight as long as it takes to protect the original Bitcoin from Bitmain, Jihan Wu, and their Bitcoin ABC development group who all want to change BCH into some alt-coin Wormhole token technology. Roger Ver’s company Bitcoin.com is subsidizing hash for only 24 hours, taken from his own customers. As for Bitmain, to keep up with us in this hash war, Bitmain will have to spend millions of dollars a day from its investors’ money and shareholder assets, while also trying to raise more investor money for its shaky IPO. This will bleed Bitmain’s cash and cryptocurrency reserves, because we are prepared to fight for months and months. If I were a shareholder or investor in Bitmain, I’d be asking why Jihan Wu is spending all your money to control BCH when Bitmain’s business supports multiple cryptocurrencies.”

Ayre also accused Bitcoin.com of “cheating” by using “transient hash” to manipulate the market and Roger Ver of launching a DDoS attack against the CoinGeek website.

How Does the BCH Hard Fork Affect Bitcoin?

Many cryptocurrency investors have wondered how the Bitcoin Cash hard fork will affect other projects, particularly its older sibling, Bitcoin (BTC). The good news is that, practically speaking, the fork has no effect on BTC, other than perhaps making it even less likely that Bitcoin Cash — already the minority fork and now itself splintering into competing versions — will overtake BTC and claim the “Bitcoin” mantle.

That said, the cryptocurrency market endured a steep decline in the days immediately preceding the BCH hard fork, leading many analysts to connect the sell-off with investor uncertainty surrounding the fork.

Some, such as hedge fund manager and CNBC commentator Brian Kelly, speculated that the bitcoin price had declined ahead of the fork since traders were nervous that bitcoin mining giant Bitmain would shift so much hash power from BTC to BCH that it would disrupt the ability of the BTC network to continue producing blocks at regular intervals. He predicted that the move would be short-lived.

Mati Greenspan, a senior market analyst at eToro, provided similar commentary, stating that concern over the BTC hash rate coupled with bearish technical factors had driven the bitcoin price decline. Noting that the fork was “something of a soap opera,” he said that it could cause some investors to become disillusioned with BCH altogether.

“Amid this saga, the hard fork may also drive a number of investors away from Bitcoin Cash altogether, into the arms of its parent asset, Bitcoin,” Greenspan said in remarks shared with CCN.com. “We can only hope for a swift resolution to the drama.”

Featured Image from Shutterstock