Op-Ed: Will Crypto Miners Abandon Craig Wright’s Bitcoin Cash Fork?

Source: nChain/YouTube

BitMEX’s head of research , Jonathan Bier, gave a statement to Bloomberg this week that will soon be proven true or false. In regards to how the upcoming Bitcoin Cash fork would play out, Bier said that he believes that the important divide between the economic majority and the mining majority will sort itself out in rapid fashion.

“The chain will split in two, but the economy will support ABC and reject SV (Satoshi’s Vision). SV will have a low price and miners will leave it in a few weeks. That is my prediction.”

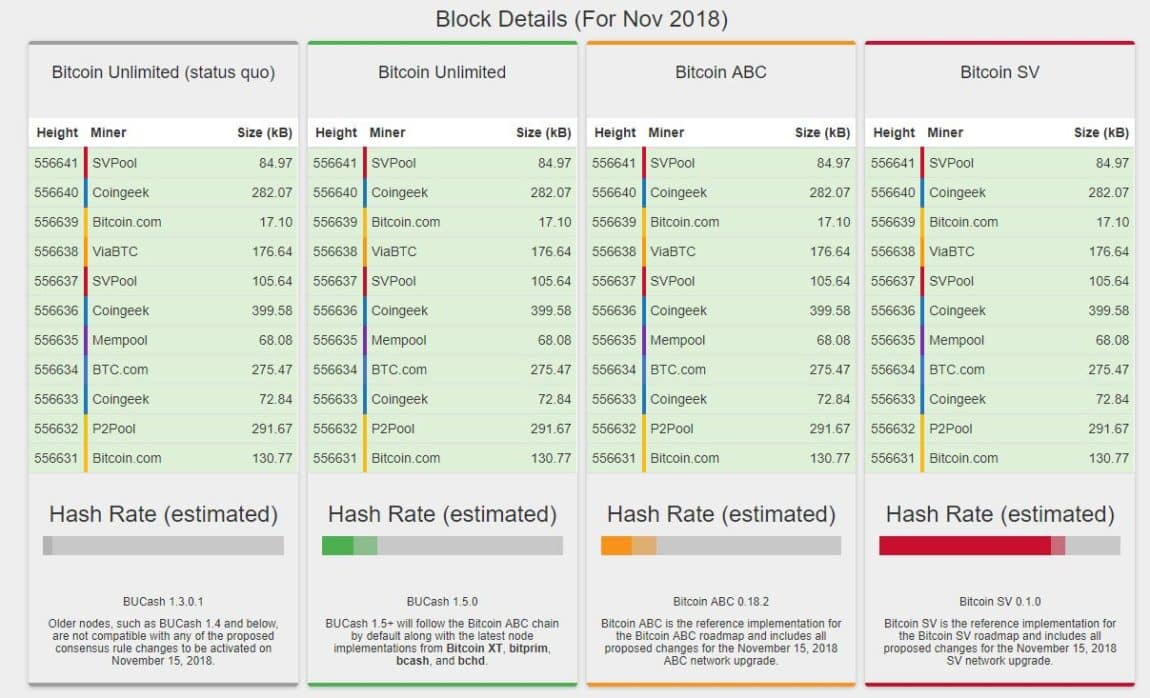

As head of research, Bier would have played an important role in the roll-out of the new fork monitoring tool that Bitmex has sponsored.

A Theory with Legs

Bier’s prediction is based on the reality of the situation rather than personal feelings regarding the technicalities of the upcoming hard fork. It is an informed and wizened view. The economic majority in a cryptocurrency is, in real terms, as important as the mining majority. There are a lot of reasons for this, not the least of which is the cost of the hardware involved in mining cryptocurrencies.

Miners take financial risks on hardware with the reasonable expectation that they will be able to earn a return. If one or the other chain is better equipped to service that result, then that will become the preferred chain of miners, and if they are within a few dozen dollars of each other in unit price, this preference can fluctuate algorithmically in ways that can have a dramatically negative effect on everyday users as difficulties rise and fall and make block times irregular.

Demonstration of this principle is not hard to find. There are many orders of magnitude more miners, pools, mining pools, and so forth contributing to the difficulty of the Bitcoin network than Bitcoin Cash’s current network as a whole. Yet, Bitcoin Cash itself (owing in large part to its architecture being almost identical to that of Bitcoin’s, with some important differences) likely has as much of a lead on the majority of other altcoins.

Some exchanges have decided in advance that they will not list Bitcoin SV at all, but they are just a few of hundreds of places that people transact in BCH. Multiple major exchanges have already made pairs including both versions of Bitcoin Cash, enabling traders to engage in pre-fork futures trading.

Other Possibilities

While Bier’s informed opinion on the matter represents one likely outcome – that Bitcoin SV loses both economic and mining support in that order and in a short span of time – there are others.

As noted in the Bloomberg article, Calvin Ayre and other wealthy individuals – some of whom, like Ayre, own a lot of cryptos as well as mining hardware – have skin in this game. They could conceivably, by themselves and at a loss (although not in their rational self-interest), prop the SV price up for a time.

The likelihood that Ayre’s planned appeals to Bitcoin exchanges — to only list his version of Bitcoin Cash — are successful feels, well, very small. Purely to stimulate trading of the SV coin (or any trading at all) on their exchange(s) and encourage deposits, some exchanges might well list SV exclusively. It would alienate some users, but the 80/20 rule applies: 20 percent of customers make up 80 percent of many business models. In this case, some small exchanges might want that 20 percent to become SV diehards or just people looking to dump their SV coins, or some combination of both. But anything approaching a volume or economic majority? Forget about it.

A scenario that feels likely to this reporter is that both chains live on indefinitely. Whether or not either token enjoys a bullish token price across exchanges, it’s hard to imagine Craig Wright or Calvin Ayre coming back into the fold at this point, nor Roger Ver and Jihan Wu welcoming them back if they decided to do so. CoinGeek by itself has the capability to prop up the SV blockchain, and its media efforts have the capability to continually attract new users and widen the base. (Bitcoin ABC has the same capabilities utilizing a wider array of resources – Jihan Wu, Roger Ver, the coterie of major exchanges which have come out in definitive support of ABC.)

Ayre, Wright, and their sizable number of supporters seem to share a very specific vision for cryptocurrency, and it seems that only complete capitulation of their peers would be enough for them to call it quits this far in. A whole generation of Bitcoin mining hardware is soon to be obsolete with next-generation miners coming online, and this soon-to-be-resold hardware has a convenient retirement plan: mine on one or all of the latter-day Bitcoin blockchains. Effectively, a dedication or rededication of any significant amount of hash power from unexpected sources to either chain would change outcomes significantly, and this possibility relies very much, of course, on the market performance of either.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.

Featured Image from nChain/YouTube