Berkshire’s Rumored $5 Billion Trade Is Classic Warren Buffett

If it’s true that Buffett has been buying back shares, it’s the right move. | Source: AP Photo/Nati Harnik

- Based on SEC filings, Warren Buffett may have bought back $5 billion in Berkshire Hathaway shares.

- We’ll know for sure in August when the company reports second-quarter results.

- A stock buyback would be a classic Buffett move.

Warren Buffett isn’t just a great investor. He’s intimately connected with “the powers that be.”

As such, he’s often managed to work out exemptions from the Securities and Exchange Commission (SEC) on the timely disclosure of his deals. Rather than report within a few days, Berkshire Hathaway has until the end of the quarter.

He appears to be taking advantage of his longer window to sneakily buy back shares of Berkshire Hathaway stock (NYSE: BRK.A).

Warren Buffett May Have Tipped His Hand to a $5 Billion Stock Buyback

The (alleged) move was first revealed in the Rational Walk blog. Based on a few calculations involving Buffett’s ownership stake and Berkshire’s outstanding share count, there appears to be around $5 billion that’s unaccounted for.

The most reasonable explanation for where those “missing” shares went is that they were retired via a share buyback.

In the past, Buffett has said he would be willing to buy back shares, provided they traded at a compelling discount to the market. He initially set a metric of 1.1 times the company’s book value, subsequently raised it to 1.2, and ultimately revised it to the vaguely-defined “below intrinsic value .”

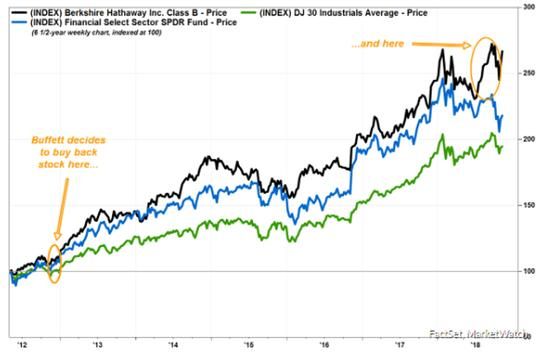

This strict policy has resulted in a few small buybacks over the years, most notably in 2012 and 2018.

With a cash hoard of over $130 billion, using $5 billion to buy back shares would admittedly qualify as a small trade for Buffett. That doesn’t mean it’s not significant.

A larger buyback could be in the picture if markets sell off again and Berkshire stock goes along for the ride. Warren Buffett’s small moves this year suggest he’s bracing for another drop.

The Responsible Way to Buy Back Shares

If it’s true that Buffett has been buying back shares, it’s the right move. When the stock market plunged earlier this year, shares of Berkshire dropped below the 1.2 times book value metric.

Berkshire stock has been underperforming on the market upswing. And that’s as Buffett’s top stock holding, Apple (Nasdaq: AAPL), has surged to over 40% of the company’s investment portfolio.

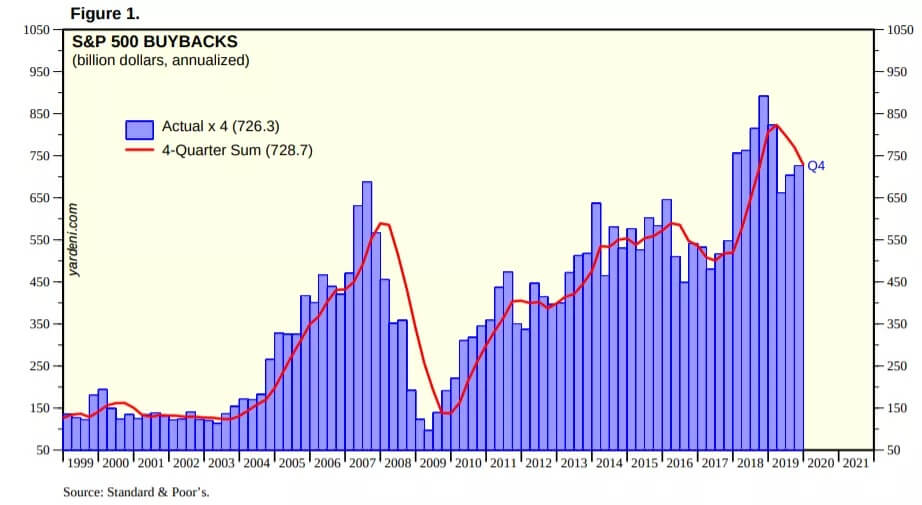

By comparison, most companies executing share buybacks have done so indiscriminately. They’ve repurchased their stock with little concern for value or price – often buying at all-time highs.

At their peak, corporate buyback totals exceeded dividend payments:

A shocking number of companies buying back shares went into debt to do so , hollowing out their balance sheets and leaving them unprepared for a crisis.

That’s why so many corporations have suspended buyback operations this year to preserve cash flow . And it’s become politically toxic for any company getting government support or laying off workers to be seen buying back shares.

That only leaves a handful of high-profile companies that can still buy back shares. Berkshire is one of them.

We still don’t know with absolute certainty if Berkshire repurchased the “missing” $5 billion worth of shares. If it did, the firm waited for a reasonably attractive valuation – and a time when the worst of the pandemic uncertainty had passed.

That’s classic Warren Buffett.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. The author is long BRK-B shares.