Apple, Facebook and Netflix Poised to Take Out All-Time Highs

With the trade war between the U.S. and China thawing, tech giants Apple, Facebook, and Netflix could reach their all-time highs. | Source: (i) Shutterstock (ii) REUTERS/Dado Ruvic/Illustration/File Photo (iii) Shutterstock; Edited by CCN.com

With the trade war between the U.S. and China thawing, investor sentiment swung from jittery to optimistic very quickly. The trade truce pushed U.S. markets higher as the dreaded 25 percent tariff on Chinese goods was put on hold. The surprising decision provided investors some relief and gave equities a much-needed boost. As stocks regain bullish momentum, three Nasdaq names are looking to make headlines. Apple, Facebook, and Netflix are likely to take out all-time highs.

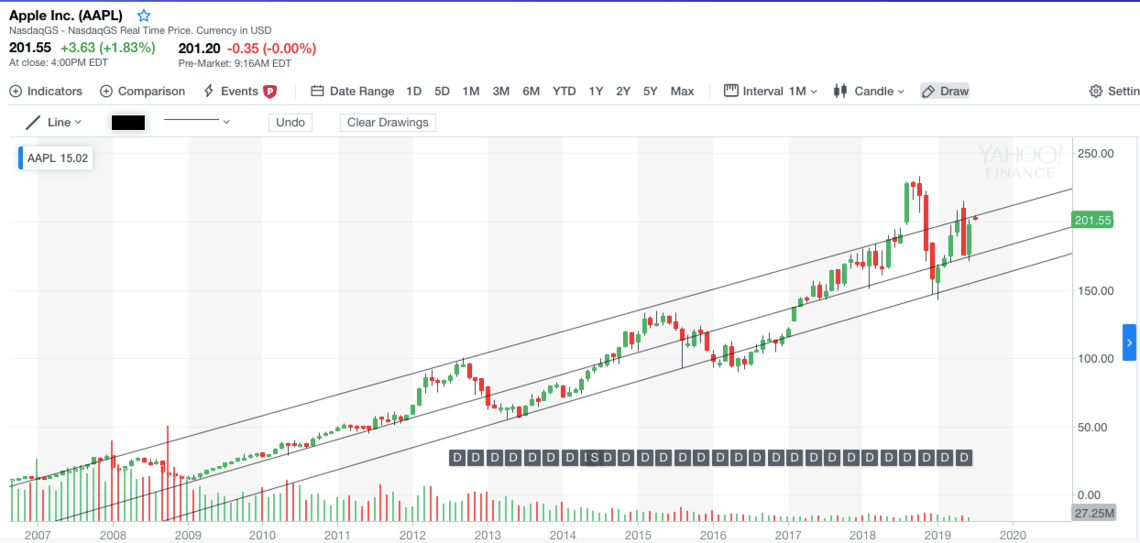

Apple’s Decade-Long Uptrend Remains Strong

Apple (AAPL) has been in a strong uptrend for over 10 years now. That trend was in peril when the equity dropped to as low as $142 in January. However, the tech giant managed to bounce and it’s stock closed the month strong. With the uptrend still intact, Apple now looks to print a fresh all-time high.

A look at the monthly chart shows that the stock is trading within an ascending channel. It is touching the resistance of the channel at $200, which means that a retracement to the midpoint of the channel at $190 is likely.

Nevertheless, AAPL remains bullish as long as it trades within the channel. It could crawl above the midpoint. In addition, it has a good chance of taking out its all-time high of $233.47 within six months.

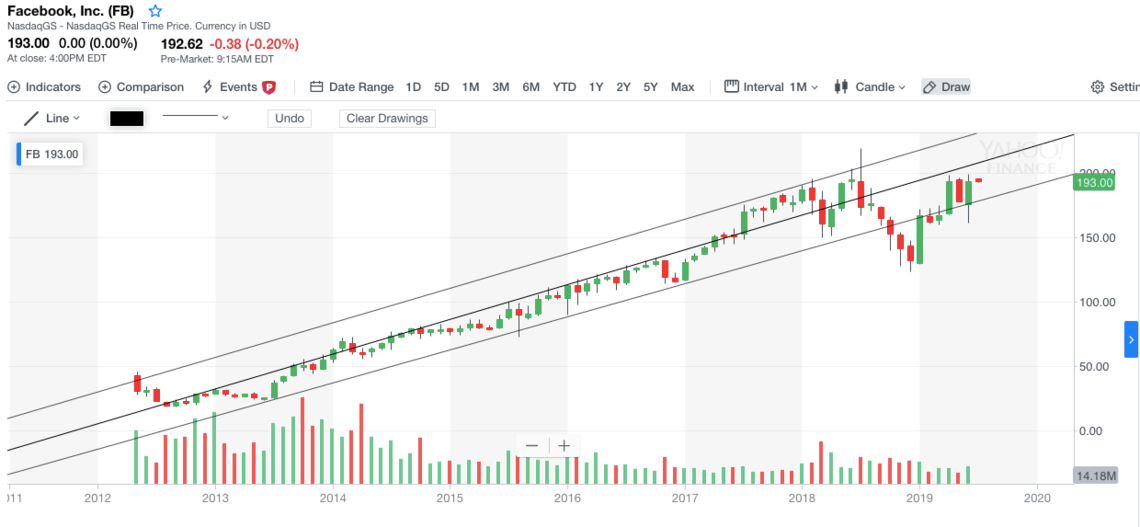

Facebook Bounces Strong to Recover Its Bullish Tone

Facebook (FB) is also trading in an uptrend channel. However, the social media titan breached the diagonal support of the channel after news of the Cambridge Analytica scandal hit media outlets. The company’s stock tanked as it dropped to $123.02 in December 2018. At that point, the security lost over 43 percent of its value from the all-time high of $218.62.

Nevertheless, bulls pushed back hard. They managed to recover the diagonal support of the channel in April 2019 when the stock climbed as high as $198.48. More importantly, bulls successfully retested the support last month.

As FB is back trading within the channel, bulls could drive the price of the stock above $218.62.

Netflix Looks Ready to Pull Off a Shocking Breakout Rally

Netflix (NFLX) is one of the most bullish Nasdaq stocks. It posted an all-time high of $423.21 in June 2018. From that point, the stock went into a downward spiral as it lost over 45 percent of its value when it plunged to $231.23 in December 2018.

Fortunately, bulls regained their composure and swiftly brought the price back above the diagonal support. Now, the stock of the on-demand streaming company is looking to launch a massive rally.

A look at the weekly chart shows that Netflix is ready to break out from an inverse head-and-shoulders pattern. A strong move above $375 would signal the trend reversal.

Based on the height of the pattern, the breakout could catapult the stock to as high as $510 to post a fresh all-time high in less than six months.

Bottom Line on Apple, Facebook, and Netflix

The trade war truce has given U.S. equities a healthy boost. Nasdaq stocks including AAPL, FB, and NFLX are among the primary beneficiaries. These stocks are inching closer to printing new all-time highs.

According to this assessment, Apple stock would be a good buy at the midpoint of the channel around $190. For FB, the buy area appears to be at $185, which is near the diagonal support of the channel. Lastly, Netflix could be a good buy after it breaches resistance of $375. Under current conditions, buying relatively high and selling higher seems like a solid strategy.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.