Jupiter Price Prediction 2024: Will Solana-based DEX Token Regain Investors Attention?

What's ahead for Jupiter?

Key Takeaways

- Jupiter’s token JUP debuted on January 31.

- It fell a bit after its launch.

- One price prediction says it may reach $3.29 next year.

Jupiter , the leading liquidity aggregator driving a significant portion of Solana’s decentralized exchange activity, introduced its native JUP token on January 31.

This token launch, accompanied by a community airdrop, follows a series of successful Solana ecosystem airdrops that contributed to a bullish trend toward the end of 2023. While Solana ‘s price saw stabilization amidst recent attention on the approval of bitcoin ETFs in the US, Jupiter’s debut marks a significant milestone for the ecosystem.

Having pioneered as Solana’s premier on-chain swap aggregator since its launch in October 2021, Jupiter optimizes DeFi transactions by minimizing slippage and ensuring swift execution through the aggregation of liquidity from various decentralized exchanges.

While the aggregator itself operates free of charge, Jupiter implements fees on dollar-cost averaging (DCA) orders, perpetual swaps, and limit orders executed on its exchange platform. This fee structure supports the sustainable growth and development of the ecosystem while providing users with unparalleled liquidity and transaction efficiency.

Jupiter did not immediately respond to a request for comment

But what is Jupiter (JUP)? How does Jupiter work? Let’s see what we can find out, and also take a look at some of the Jupiter price predictions that were being made as of March 28, 2024.

Jupiter Price Prediction

Let’s examine some of the Jupiter price predictions being made on February 2, 2024. It is crucial to bear in mind that price forecasts, particularly for a potentially volatile asset like cryptocurrency, often turn out to be inaccurate. Additionally, please remember that many long-term crypto price predictions are generated using algorithms, which means they can change at any time.

Being so young – it was launched only on January 31, 2024 – it is still hard to find price predictions for this token.

| 2024 | 2025 | 2026 | |

|---|---|---|---|

| Prediction #1 | $2.84 | $3.29 | $9.69 |

| Prediction #2 | $0.00481 | $3.12 | $19.07 |

| Prediction #3 | $2.14 | $3.12 | $19.07 |

First, CoinCodex had a short-term Jupiter price prediction that suggested the token would go to $1.707067 by April 4 before rising further to $4.33 by April 27. The site’s technical analysis was bullish, with eight indicators sending encouraging signals and none making bearish ones.

Jupiter Price Prediction for 2024

DigitalCoinPrice said that Jupiter would reach $2.84 this year. Changelly thought the token would trade at $0.00481. PricePrediction.net expects it at $2.14.

Jupiter Price Prediction for 2025

Moving on, both Changelly and PricePrediction.net thought Jupiter would trade at $3.12 in 2025. DigitalCoinPrice had the token coming in at $3.29 that year.

Jupiter Price Prediction for 2030

Looking at a more long-term Jupiter price prediction, Changelly said the token would hit $19.07 in 2030 and the same did PricePrediction.net. DigitalCoinPrice made a JUP price prediction that had it trade at $9.69 at the start of the next decade.

Google BardAI Price Prediction for Jupiter (as of March 28)

Google’s BardAI platform gave the following price prediction for Jupiter on March 28. Please remember that the exact price prediction of an asset or cryptocurrency in the future is nearly impossible to achieve. Additionally, artificial intelligence price predictions are predicated on past performances and are in no way entirely accurate.

Short Term (Next 3 months)

- Expected Price: $3.75

- Reasons:

- Overall crypto market sentiment: The price of JUP is likely to be influenced by the broader trends in the cryptocurrency market.

- Adoption and usage of the Jupiter platform: If the Jupiter platform gains more users and adoption, it could lead to increased demand for JUP tokens, potentially pushing the price up.

- Developments on the Jupiter platform: New features, partnerships, and other developments on the platform could also impact the price of JUP.

- Regulatory landscape: Changes in regulations surrounding cryptocurrencies could also affect the price of JUP.

Medium Term (Next 6 months)

- Expected Price: $4.39

- Reasons:

- Overall market sentiment: The general sentiment towards the cryptocurrency market can significantly impact individual coin prices.

- News and events: Specific news or events related to JUP or the wider crypto space can cause price fluctuations.

- Technical analysis: Analyzing historical price charts and technical indicators can suggest potential future trends, but it’s not a guarantee.

Long Term (Next 5 years)

- Expected Price: $27.50

- Reasons:

- Overall cryptocurrency market trends: The performance of Bitcoin and other major cryptocurrencies can significantly impact JUP’s price.

- Developments within the Jupiter project: The success of the project’s roadmap and adoption of its technology can positively affect the price.

- Regulatory changes: Government regulations on cryptocurrencies can create uncertainty and impact prices.

- Unexpected events: Unforeseen events like hacks or major economic shifts can drastically alter the market.

Recent Updates from Jupiter

Jupiter said it has funded 10M USDC and 100M JUP into a DAO wallet. This operational budget provides the DAO the capability to fund the ideas with USDC and have the JUP allocation for long term incentive alignment with J.U.P Catributors.

Jupiter Price History

Now, let’s examine the Jupiter’s price history . While we should never take past performance as an indicator of future results, knowing what the token has achieved can provide us with some very useful context if we want to make or interpret a Jupiter price prediction.

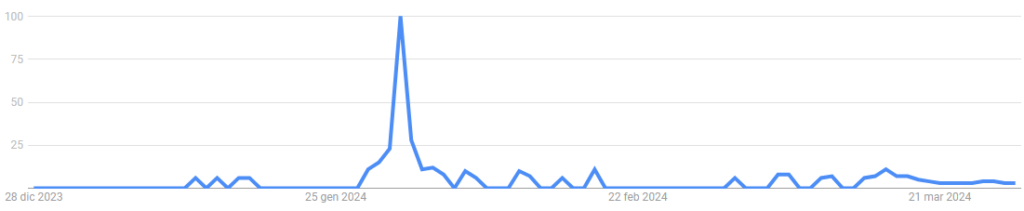

JUP first came onto the open market on January 31, 2024, when it was worth about $0.8546. It went down then, reaching $0.6317 in early February. The coin hit its record high on March 18, 2024, at $1.5521, before retracing a bit. It’s worth $1.31 on March 28, 2024.

Jupiter Price Analysis

JUP rose when it came out, peaking in late January. After it retraced and found support around $0.45 in February, it began its first uptrend, reaching a high of $1.55 on March 16.

From there, the price fell by nearly 30%. This correction is now near completion, with the price approaching $1.30.

We should see a breakout with one more climb in a five-wave uptrend. Our next target is $2. However, should we see it fall, another 30% drop would look likely, bringing JUP to a low of $0.90.

Is Jupiter a Good Investment?

It is hard to say. The token’s price has shot up after its launch, but there may already be signs of a downturn.

On the other hand, there are good reasons for Jupiter’s recent movements, with new developments getting investors attention.

As always with crypto, you will need to make sure you do your own research before deciding whether or not to invest in JUP.

Will Jupiter go up or down?

No one can really tell right now. While the Jupiter crypto price predictions are largely positive, price predictions have a well-earned reputation for being wrong. Keep in mind, too, that prices can, and do, go down as well as up.

Should I invest in Jupiter?

Before you decide whether or not to invest in Jupiter, you will have to do your own research, not only on JUP, but on other coins and tokens such as Ordinals (ORDI). Either way, you will also need to make sure that you never invest more money than you can afford to lose.

Who are the Founders of Jupiter?

Who Owns the Most Jupiter (JUP) Tokens?

On March 28, 2024, one wallet held 40.90% of JUP’ supply.

Richest JUP Wallet Addresses

As of March 28, 2024, the five wallets with the most Xai tokens were

- 26ddLrqXDext6caX1gRxARePN4kzajyGiAUz9JmzmTGQ. This wallet held 4,090,152,115 JUP, or 40.90% of the supply.

- 6G4XDSge4txj5tBkA5gZqefXXE3BRxqA37Yb1pmrHv6N. This wallet held 3,500,000,000 JUP, or 35.00% of the supply.

- 7bEL9XkPGNg7a3oSiUERKsZtFoJMqKh6VhGDCmMCPqdg. This wallet held 650,000,000 JUP, or 6.50% of the supply.

- K6U4dQ8jANMEqQQycXYiDcf3172NGefpQBzdDbavQbA. This wallet held 500,000,000 JUP, or 5.00% of the supply.

- GDijXRGfd1jhk5GkRPp1TDnEH2FfHURSRZeB5um3pUWk. This wallet held 190,039,584 JUP, or 1.90% of the supply.

Fact Box

| Supply and distribution | Figures |

|---|---|

| Maximum supply | 10,000,000,000 |

| Circulating supply (as of March 28, 2024) | 1,350,000,000 (13.50% of maximum supply) |

| Holder distribution | Top 10 holders owned 90% of supply, as of March 28, 2024 |

From the Whitepaper

In its technical documentation, or whitepaper , Jupiter says the progress and innovations at Jupiter can be attributed to three core anchors:

- The JUP Promise: Best Price, Best Token Selection, Best UX. This deceivingly simple and straightforward promise is the driving force behind our obsessive efforts in product innovation. From enhancements in routing algorithms to the integration of new tools, they are all aimed at delivering an exceptional trading experience for both users and developers.

- Maximizing the Potential of Solana’s Technical Capabilities:Much like harnessing the full potential of a high-performance vehicle, we strive to make the most of Solana’s capacity for providing swift and efficient trading experiences. Jupiter has been at the forefront of adopting new Solana features such as lookup tables, priority fees, and token 2022 standards.

- Improving the liquidity landscape in Solana: We are committed to the rapid integration of new liquidity sources and innovative use cases, ensuring the continual growth and competitive edge of the Solana ecosystem.

Jupiter (JUP) Explained

How Jupiter Works

User enters in the amount of tokens they want to trade for. Jupiter calculates out all the possible routes for the token trade. Jupiter fetches the quotes for each of those routes and returns the amount of tokens you will receive per route. This includes all fees.

Jupiter Attention Tracker

FAQs

Disclaimer

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.