Global Power Shift: Germany Tops Japan, UK Crashes – What’s Next?

Germany replaces Japan as third largest economy while the UK slips into recession. What's next for the top world economies?

-

CryptoEthena Price Prediction 2024: ENA Outperforms Market, What Next?6 days ago

-

CryptoCoinbase Lawsuit Unveils Regulatory Dilemma Amidst Record ProfitsYesterday

-

BusinessBitcoin Hong Kong ETFs May Open To Mainland Money as Kraken’s CF Benchmark Predicts $1B AUM by 2024 EndYesterday

-

BitcoinMicroStrategy Orange Could Bring More Than One Billion People Into Financial System ‐ Why Do Bitcoin Maximalists Hate It?5 days ago

Key Takeaways

- Germany surpasses Japan as the world’s third-largest economy.

- UK slips into recession while US maintains lead over China.

- What’s next for the top economies?

The global economic landscape is undergoing a significant shift, with powerhouses changing positions and uncertainties looming on the horizon. Despite positive growth, Germany eclipsed Japan as the world’s third-largest economy. Furthermore, the United Kingdom fell into recession. The only certainty is that the United States and China are going to be on top.

So, what’s going on among big economies? And is the ranking going to change again soon?

Germany Overtakes Japan

Official data revealed that Japan’s economy expanded by 1.9% last year. However, despite this growth, Japan was surpassed by Germany as the world’s third-largest economy. The primary factor behind this shift was a significant depreciation of the yen against the dollar, with the yen experiencing a decline of over 18% between 2022 and 2023, including a seven percent drop last year.

According to government figures, Japan’s nominal gross domestic product (GDP) in dollar terms for 2023 stood at $4.2 trillion, while Germany’s was at $4.5 trillion, as recent data disclosed.

Japan’s currency depreciation was worsened by the Bank of Japan’s unique policy of maintaining negative interest rates, diverging from other major central banks. Both Japan and Germany heavily rely on exports, but Japan faces additional challenges, notably a severe shortage of workers due to a declining population and low birth rates, which is more pronounced compared to Germany.

sorry japan, germany now the world’s 3rd largest economy (because of yen depreciation, not real gdp contraction) pic.twitter.com/EPZ75EFFCO

— ian bremmer (@ianbremmer) February 15, 2024

Projections indicate that India, with its youthful population and strong growth rates, is positioned to surpass both Japan and Germany to become the world’s third-largest economy behind the United States and China later in the decade.

Japan’s economic outlook remains mixed, with recent indicators showing a 0.1% contraction in the last quarter of 2023, falling short of market expectations. This marks the second consecutive quarterly decline in output, underscoring ongoing challenges in Japan’s economic landscape.

UK Falls Into Recession

The UK economy faced a steeper decline than anticipated in the final quarter of last year, officially slipping into a recession, as revealed by data released by the Office for National Statistics.

Gross domestic product in the UK contracted by 0.3% in the three months leading up to December compared to the previous quarter. This figure came below the expected decrease of 0.1% as per consensus estimates reported by FXStreet. This downturn follows a 0.1% decline in the third quarter of 2023.

The term “technical recession” describes a situation where GDP experiences two successive quarterly contractions.

Despite this recent downturn, the ONS noted that throughout 2023, GDP may have seen a marginal increase of 0.1% compared to 2022.

GDP is estimated to have fallen in October to December (Quarter 4):

▪️ services fell (-0.2%)

▪️ construction fell (-1.3%)

▪️ production fell (-1.0%)➡️ https://t.co/gsheUbREuI pic.twitter.com/r7xi4Eokhu

— Office for National Statistics (ONS) (@ONS) February 15, 2024

In addition to the quarterly data, the ONS also disclosed monthly figures for December, along with downward revisions to readings from November and October. December saw a 0.1% monthly decline in GDP, which was a more positive outcome than the 0.2% fall that economists expected. However, these figures also show an impact of revisions to previous monthly data.

November’s GDP growth was downwardly revised from an initially reported 0.3% climb to 0.2%, while October’s GDP contraction was revised to a steeper decline of 0.5% from the previously reported 0.3%.

The services sector, a key component of the UK economy , experienced a 0.1% decline in output in December 2023. Over the three-month period leading up to December 2023, services output fell by 0.2%, according to the ONS.

US And China Still On Top

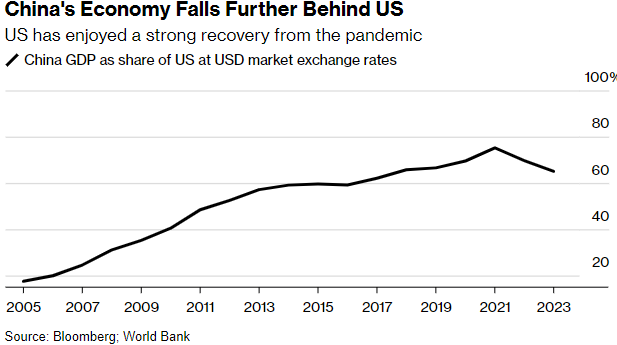

The US and China are still the largest economies in the world. The United States has widened its lead over China in the global economic race, propelled in part by resilient consumers.

In nominal terms, US gross domestic product surged by 6.3% last year, surpassing China‘s 4.6% growth rate. While some of this discrepancy are due to America’s higher inflation rates, the overall performance for 2023 underscores a significant trend: the US economy is emerging from the pandemic era in a stronger position compared to China’s.

Eswar Prasad, a former member of the International Monetary Fund’s China team now at Cornell University, described the shift as “a striking turn of fortunes”. He highlighted the robust performance of the U.S. economy compared to the challenges facing China. And questioned whether China’s GDP will surpass that of the U.S..

Despite expectations for a rapid recovery, China’s economy didn’t rebound as anticipated after Covid-19 lockdowns. Recent GDP data showed the U.S. economy ending the year strongly. It showed a 3.3% real growth rate in the fourth quarter, following a 4.9% expansion in the third quarter. Inflation pressures are easing, nearing the Federal Reserve’s 2% target, easing concerns of a looming recession.

What’s Next?

The Organisation for Economic Cooperation and Development (OECD) upgraded its 2024 global economic growth forecast. It now projects a 2.9% expansion compared to its previous forecast of 2.7% in November. This upward revision primarily stems from a significantly improved outlook for the United States, the world’s largest economy.

In 2023, global growth exhibited unexpected resilience, reaching 3.1%, driven by a faster-than-anticipated decline in inflation and robust growth in the US and emerging markets. This offset slowdowns in European Nations.

However, indicators now suggest a potential moderation in growth. This may be due to higher interest rates impacting credit and housing markets, alongside subdued global trade activity.

Real household income per capita in the #OECD fell by 0.2% in Q3 2023, while real GDP per capita grew by 0.3%.

The decrease in real household income per capita ended four consecutive quarters of growth starting in Q3 2022.

🔗 https://t.co/biy05PYxHc #OECDStats pic.twitter.com/vnJt7H7dx0— OECD Statistics (@OECD_Stat) February 8, 2024

While major economies are experiencing a decline in inflation, the OECD cautioned that it is premature to conclude that underlying price pressures are over.

The OECD also underscored the risks posed by the ongoing conflict between Israel and Hamas in Gaza. As well as the attacks on ships in the Red Sea by Yemeni rebels. These disruptions in Red Sea shipping routes have the potential to escalate consumer prices and pose additional challenges to global economic stability.

Giuseppe Ciccomascolo

Fed’s Monetary Policy Shift: What It Means for Crypto and ETF Approval

Projected US Interest Rates in Five Years: Will the Fed Opt For No Cut In 2024?