Dogecoin Price Mirrors Pre-Bull Market — Is DOGE Going Parabolic?

Dogecoin shows positives fundamentals with analyst predict a parabolic rise.

, Key Takeaways

- Dogecoin recent activity mirrors past bull runs, with some analysts forecasting a potential potential surge.

- Transaction fees and active addresses indicate growing blockchain interest.

- DOGE’s price recovery suggests a bullish phase may be starting.

According to crypto analyst Ali Martinez , a respected figure in crypto trading, Dogecoin‘s current price movement is reminiscent of its past bull runs, notably those in 2017 and 2021.

Martinez’s analysis, shared in a post on February 26, suggests Dogecoin might experience a significant surge. He pointed to the possibility of a parabolic increase for DOGE starting in around April, potentially elevating its value to $1.70, followed by a rise to $3.50 and possibly higher.

Past performance does not guarantee future results, but DOGE has been known for its stratospheric rise over the years. Will it be the case this time as well?

Dogecoin Fundamentals

The total amount paid in fees to use the blockchain has increased. We saw a peak on February 10 when it reached 442,000 DOGE but fell to 58,000 on February 18. A new uptrend started and the figure now near 200,000 DOGE, having seen a 30-day change of 359.51%.

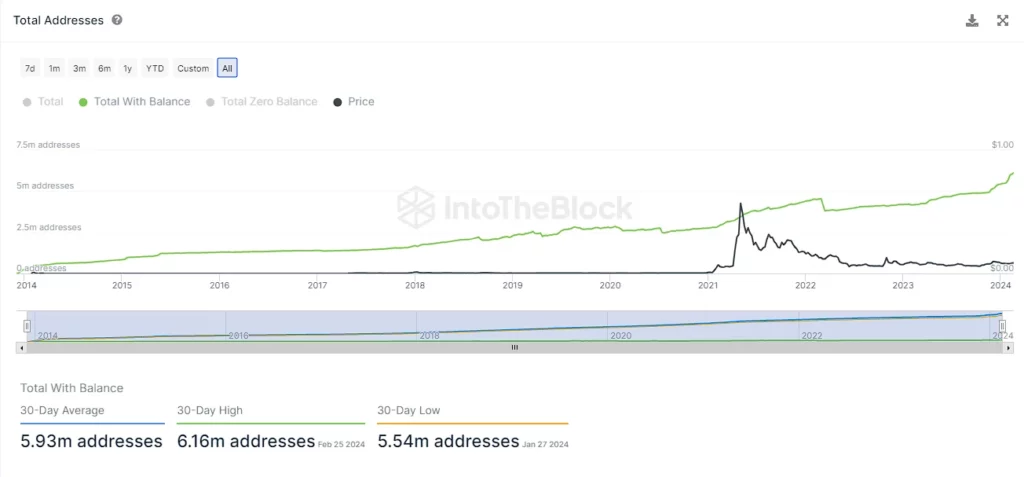

A notable rise in new and active addresses was seen on February 2. This peak was the highest ever, with the number of active addressees reaching 324,000, and there were also 268,000 new addresses.

This is further substantiated by the total number of addresses recorded, which reached an all-time high of 6.12 million.

These metrics point to a fundamental solid picture for Dogecoin, indicating that the the interest in this blockchain increased over time.

Dogecoin Price Analysis

After consolidating above its horizontal support of $0.058, the price of DOGE finally started to increase again from mid-October. A a recovery of 82% stopped at the $0.10 zone, causing a downturn.

This $0.10 resistance is the upper level from the more extensive consolidation range. Therefore, its breakout could signal the starting bull phase. On the pullback, Dogecoin found support at 0.618 Fibonacci retracement, a typical ending point for corrective wave 2.

Dogecoin made a minor rise from a low of $0.076 on January 22, but that could become a more significant uptrend. If DOGE continues moving up and surpasses its previous high of $0.10, it will most likely develop its third wave of a new five-wave impulse to the upside.

Our next target is $0.16, where the 1.618 Fibonacci extension level overlaps with the horizontal resistance, further validating the target. If, following this, Dogecoin continues rising after a consolidated correction exceeding $0.12, we could see a higher high of nearly $0.20.

Forming this five-wave pattern, DOGE would show that it did start a new bullish phase after being in a bear market from its all-time high of $0.75 in May 2021. Will Dogecoin go parabolic into a new one? We will need to wait and see, but the first outlined structure will indicate that DOGE started to attempt it.

Disclaimers

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.