Ethereum Close To Million Validators But ETH Price Action Remains Undecisive

ETH 2.0 nears 1 million validators but its price direction remains unclear.

Key Takeaways

- Ethereum nears 1 million validators, showcasing network strength.

- ETH’s price fluctuates, challenging $3,000 after recent recovery.

- Validator interest spikes, with a significant queue awaiting entry.

As Ethereum 2.0 approaches a landmark with nearly one million validators, its network strength is undeniable. Yet, despite this remarkable growth in network participation, Ethereum’s price remains in the thought spot.

One Million Validator Milestone

The Ethereum network is nearing a significant milestone with almost one million validators participating, according to Beacon Chain and Ethereum’s Validator Queue data, which reports an active validator count of 979,686.

These validators have staked over 31.34 million ETH, representing about 26% of Ethereum’s total circulating supply.

This achievement comes at a time of heightened interest in validation, with a record queue of over 10,000 validators, equivalent to more than 320,000 ETH or approximately $1.1 billion, waiting to join the network. This backlog is expected to be processed within the next week, underscoring the vibrant and growing commitment to Ethereum’s future.

Ethereum (ETH) Price Analysis

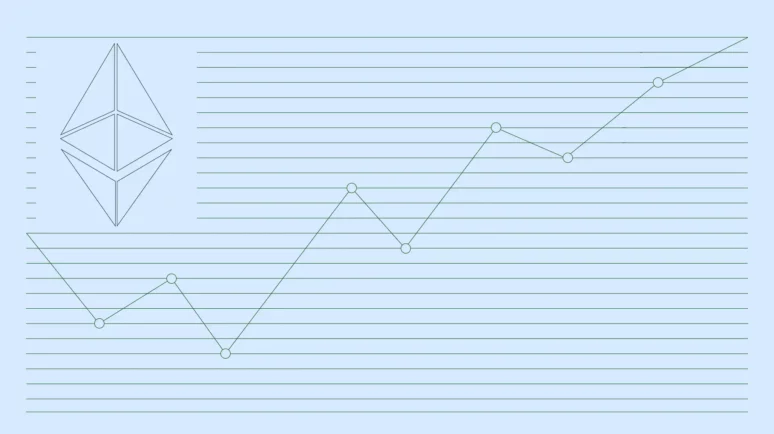

On March 11, Ethereum surpassed the $4,000 threshold, briefly touching near $4,100, signaling what could be the zenith of its recent ascent. However, it has since begun a descent, dropping to a low of $3,062 on March 20. A recovery followed, with the price of ETH reaching $3,680 at its highest point on March 26.

Ethereum’s price currently interacts with the 0.618 Fibonacci retracement level, a typical reversal point for corrective waves. Among other things, this is one of the signs of a potentially more significant descending move. Still, a confirmation will come in the form of a rejection, potentially driving Ethereum’s price below the $3,000 mark.

Alternatively, the recovery from March 20 could continue, signaling another upward climb, if it manages to go above the 0.618 resistance at $3,660. In that case, we could see a new all-time high by the end of its completion.

We are leaning toward the bearish outlook, but the confirmation will come shortly. If the price makes a downturn, a bearish scenario will be in play, while if it continues moving up above 0.786 at $3,844, we would receive a definitive sign.

Disclaimers

Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.