UK House Price Crash: Will Prospect of Interest Rate Cuts Save Britain’s Fragile Housing Market?

Will UK face a new house market crash as BoE keeps high interest rates?

-

CryptoRipple Price to Pump After Whale Withdraws More Than $10 Million XRP From Binance?6 days ago

-

CryptoSolana Price Slides 10%, But Pantera Capital Purchases Locked SOL, Bullish Wave Count Remains Intact6 days ago

-

CryptoBinance Faces Spotlight as Ripple Proposes $10 Million Settlement Fee in XRP vs SEC CaseMarch 18, 2024 3:29 PM

-

Projected US Interest Rates in Five Years: Will the Fed Opt For No Cut In 2024?March 18, 2024 3:29 PM

The UK housing market has long been characterized by its resilience and ever-upward trajectory. However, in recent times, a question has emerged: will the surging tide of British house prices encounter a long-anticipated reckoning?

This inquiry takes center stage as rising interest rates threaten to alter the landscape of Britain’s housing market, potentially delivering the long-dreaded blow to its seemingly buoyant nature.

For years, the UK’s housing market seemed impervious to the headwinds that affected various sectors of the economy. Even as global financial crises unfolded and uncertainties loomed, property prices in Britain continued to soar. Yet, a new chapter may be unfolding.

As the Bank of England (BoE) adjusts interest rates in response to economic conditions, the once-calm waters of the housing market have started to ripple with questions and concerns.

What Is a House Price Crash?

A house price crash, often known as a housing market crash, is a term that can evoke anxiety among homeowners, potential buyers, and economists. Fundamentally, a house price crash represents a substantial and abrupt decline in the prices of residential real estate, particularly within the housing market. It marks the point where the seemingly relentless increase in property values abruptly halts and takes a sharp, often painful turn downward.

During a house price crash, homeowners typically encounter challenging circumstances. The value of their most significant asset, their home, diminishes, making it difficult to sell or refinance. Those who purchased their homes at the market’s peak, they may find themselves in a state of negative equity, owing more on their mortgage than their home’s current value.

For potential buyers, a house price crash can present a mixed picture. On one hand, it makes homes more affordable. However, it can also serve as an indicator of economic instability and the possibility of stricter lending standards, which can complicate the home-buying process.

In summary, a house price crash is a pivotal event within the real estate market, with far-reaching economic and social implications. It signifies a significant and sudden drop in home values, influenced by various factors. Understanding the causes and consequences of such a crash is vital for both current homeowners and those aspiring to enter the property market.

What Causes a Property Market to Crash?

The property market, often considered a pillar of stability in the economy, can sometimes experience dramatic downturns, leading to a property market crash. Such crashes can have profound effects on homeowners, investors, and the broader economy. But what are the factors that can cause a property market to crash?

Economic Downturns

One of the primary triggers of a property market crash is an economic recession. During economic downturns, people tend to have less money to spend, leading to a decline in the demand for properties. As unemployment rises and consumer confidence wanes, homebuyers become scarce, and sellers may lower their prices to attract buyers.

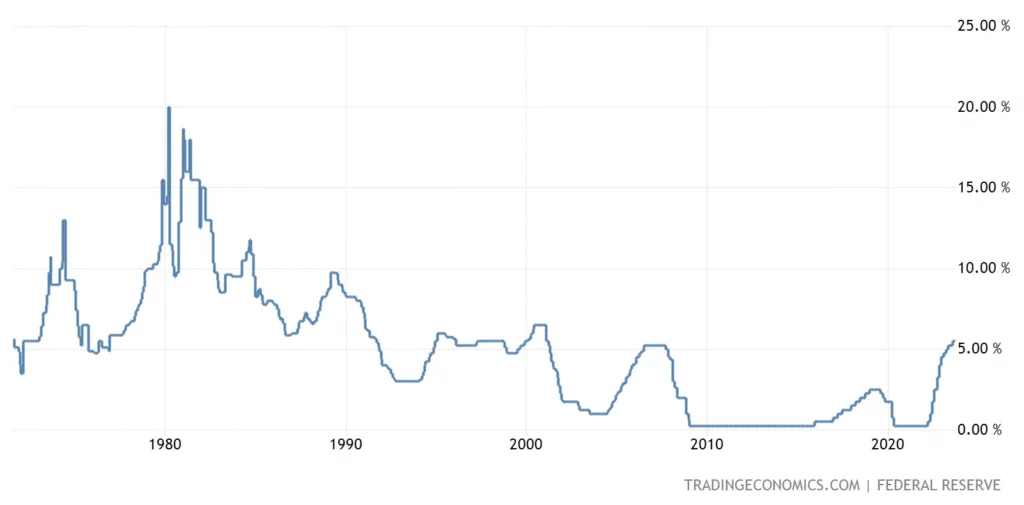

Interest Rate Hikes

Central banks control interest rates to manage inflation and economic growth. When interest rates rise, borrowing becomes more expensive. This can lead to reduced demand for homes, particularly in areas where mortgages are the primary means of home purchase. Higher interest rates can also put pressure on homeowners with adjustable-rate mortgages.

Speculative Bubbles

Property markets can experience speculative bubbles, where prices rise significantly above their intrinsic values. This can be fueled by speculative buying, often with the expectation of quick profits. When the bubble bursts, property prices can fall dramatically, leaving investors and speculators with significant losses.

Tightened Lending Standards

Financial institutions often tighten lending standards in response to economic conditions or regulatory changes. When lending standards become more stringent, it can be harder for buyers to secure mortgages, leading to a decline in demand and, subsequently, property prices.

Overbuilding

An excess of new construction projects can lead to an oversupply of properties. This can happen when developers overestimate demand or when there’s a sudden shift in market conditions. An oversupply can put downward pressure on property prices as sellers compete for a limited pool of buyers.

Natural Disasters and Local Factors

Local conditions, such as natural disasters or job market fluctuations, can impact property markets. For instance, an area prone to natural disasters like hurricanes or earthquakes may experience property market crashes due to the destruction of properties and a decrease in demand.

Global Economic Crises

Major global economic crises, like the 2008 financial crisis, can have a substantial impact on property markets. These crises can lead to widespread economic uncertainty, job losses, and a lack of confidence in the property market.

How Much Does an Average UK House Cost?

Robust sales of larger homes have propelled house prices to their highest point in a year, according to figures from Rightmove. The Rightmove house price index revealed a notable increase in the average asking price of properties entering the market in April, rising by 1.1% or £4,207 month-on-month, reaching £372,324.

This places prices just £570 shy of the record set in May 2023. The annual rate of price growth now stands at 1.7%, marking the highest level in the past 12 months.

Rightmove attributed much of this growth to the segment of larger, more expensive homes, which are experiencing their most robust price growth at the beginning of the year since 2014.

Despite this overall positive trend, the market demonstrates varying speeds, with prices and activity increasing more gradually in sectors relying heavily on mortgages, such as first-time buyers and second-steppers.

Based on @rightmove House Price Index. Sellers misinterpret a 13% increase in sales and renewed buyer interest, up 8% on last year, by applying an average 1.5% increase on newly marketed asking prices in March 2024.

Optimism is highest amongst those with bigger properties, who… pic.twitter.com/hFoNxSg3wH

— Emma Fildes (@emmafildes) March 18, 2024

The influx of new sellers entering the market has surged by 12% compared to the same period last year, while the number of sales being agreed has risen by 13%, indicating a rebound in both seller and buyer activity.

Rightmove identified a window of opportunity for potential movers, noting that distractions such as a busy summer of sporting events and the likelihood of a General Election may create additional challenges.

Highlighting the surge in Spring buyer and seller activity this year, March 28 witnessed the highest number of new sellers entering the market in a single day so far in 2024. This marked the third-largest figure since August 2020, with many sellers eager to capture buyer attention over the Easter weekend.

Nationwide Figures For April

UK house price growth decelerated last month, as indicated by data released Wednesday, May 1, 2024, by Nationwide, coinciding with a rise in longer-term interest rates.

In April, UK house prices saw a modest year-on-year increase of 0.6%, marking a slowdown from the robust 1.6% surge observed in March.

On a monthly basis, house prices experienced a slight decline of 0.4%, following a 0.2% decrease in March compared to February.

Nationwide analyst Robert Gardner commented on the findings: “UK house prices fell by 0.4% in April, adjusting for seasonal effects. Consequently, the annual rate of house price growth slowed to 0.6% in April, down from 1.6% the previous month.”

UK house prices fell 0.4% in April compared to March, according to our monthly House Price Index, though prices were 0.6% higher than April last year.

Read more: https://t.co/9iTacvWS0h pic.twitter.com/ppECgIp8QQ

— Nationwide (@AskNationwide) May 1, 2024

Gardner attributed the deceleration in price growth to ongoing affordability challenges, particularly with the recent increase in longer-term interest rates, which have reversed the sharp decline witnessed around the turn of the year. Despite this moderation, house prices remain approximately 4% below the all-time highs reached in the summer of 2022, factoring in seasonal adjustments.

Nationwide highlighted research conducted by data firm Censuswide on its behalf, revealing that nearly half of prospective first-time buyers have postponed their property plans over the past year. Among this group, the primary reason cited for delaying their purchase is the perceived high prices of houses (53%). Additionally, 41% identified higher mortgage costs as a significant barrier preventing them from entering the market.

Mortgage Lending Set To Fall In 2024

Mortgage lending is anticipated to decline in the coming year, with an expected rise in arrears and repossessions, as outlined by UK Finance , a trade association for the UK banking and finance industry. Despite ongoing challenges in the mortgage market, UK Finance suggests that the primary affordability pressures are currently reaching their peak.ù

While the easing of financial strains may take time, improvement is projected in 2025. UK Finance predicts a decrease in lending for house purchases to £120 billion in 2024, down from £130 billion in 2023. External remortgaging activity is expected to decrease to £60 billion from £65 billion, and the value of internal product transfers is forecasted to fall from £219 billion to £202 billion in 2024.

The report emphasizes that various factors are mitigating payment issues, ensuring that over 99% of the 10.8 million mortgages in the UK are currently not in arrears.

Can the UK Government Stop a House Price Crash?

The prospect of a house price crash in the UK raises concerns not only for homeowners but also for various industries that rely on a vibrant property market. According to Heather Powell, head of property and a partner at the tax and advisory firm Blick Rothenberg, there’s a need for government intervention to prevent further price declines and safeguard the market.

Powell emphasizes the importance of implementing schemes to reinvigorate the property market, stating, “The continuing decline in residential property sales highlights the sluggish pace of recovery for industries tied to a healthy property market. The government must take action promptly to reenergize this essential aspect of the UK economy.”

She advocates for a regime that encourages first-time buyers without inflating property prices. She suggests that incentives like ‘Help to Buy,’ tailored to regional price ceilings, could be beneficial. Such measures can unlock the capital generated by a thriving property market, contributing to the broader economic recovery.

What Is The Help to Buy Scheme?

The ‘Help to Buy’ scheme, initiated in 2013 to aid aspiring homeowners, ceased accepting new applicants in October 2022 and is yet to be replaced by the government.

Powell also highlights the ripple effect of the property downturn, affecting industries beyond homeowners.

Estate agents, removal companies, decorators, carpet and furniture stores, and many other businesses dependent on the property market have witnessed declining sales in 2023. Their forecasts for the next six months remain bleak. And this raises concerns about the impact on tax revenues and government funds.

Property sales figures for the year ending July 31, 2023, show a significant drop compared to the preceding years. This situation not only affects households but also impedes the overall recovery of the UK economy.

The issue extends to the difficulty homeowners face in selling their properties and starting anew due to limited demand. First-time buyers also struggle to accumulate sufficient deposits, leaving a void in the market.

In summary, the potential for a house price crash in the UK is a multifaceted challenge with broader economic implications. Government intervention and carefully designed schemes are crucial to address the issue and protect both homeowners and the industries connected to the property market.

When Will UK Interest Rates Stop Rising?

The Bank of England‘s recent moves on interest rates have been closely monitored, with forecasts suggesting a significant reduction in the base rate to approximately 3% by late 2025. This would mark a substantial decline from the current 5.25%. But it still represents a rise-and-fall pattern of interest rates that could be likened to a rocket and a feather.

Since December 2021, the Bank of England has consistently increased the base rate over 14 consecutive adjustments. Market expectations regarding where the base rate will ultimately peak have been ever-shifting, influenced by incoming economic data and factors such as inflation, wage growth, and unemployment.

Currently, market sentiment suggests that the base rate may have reached its peak at 5.25%. However, Paul Dales, Chief UK Economist at Capital Economics, presents three reasons for cautious optimism.

First, anticipated Ofgem utility price cap reductions and other positive factors could push CPI inflation down to about 4.6% in October. Second, the service CPI inflation rebound is considered temporary. Third, slowing average earnings growth suggests wage growth, a key domestic price pressure indicator, may have peaked.

Nevertheless, Dales cautions that the UK’s inflation issue is unlikely to resolve swiftly. The labor market’s relaxation has been gradual, and high inflation expectations persist. Consequently, the decrease in core inflation and wage growth is expected to be gradual rather than sudden.

While it is doubtful that the Bank of England will further increase interest rates, it might not be in a position to reduce interest rates until late in 2024.

Would a Stamp Duty Cut Keep Property Prices Rising?

The property market, especially in the United Kingdom, has been a subject of intense interest and debate in recent years. The interplay of various factors, including demand, supply, and government policies, greatly influences property prices. One such policy that has been considered a powerful lever in influencing property market dynamics is the stamp duty.

Stamp duty is a variable tax on UK property purchases. Governments have occasionally introduced temporary reductions or exemptions in response to economic challenges or to boost the property market. The question that often arises is whether such cuts can effectively keep property prices on an upward trajectory.

To understand this, it’s essential to consider the dynamics at play:

Demand and Affordability

Reducing or exempting stamp duty can make properties more affordable, particularly for first-time buyers and those looking to move up the property ladder. This can increase demand, putting upward pressure on prices, especially in the lower to middle segments of the market.

Market Sentiment

Positive news of a stamp duty cut can boost market sentiment, leading to increased buyer confidence. This sentiment can translate into a flurry of property transactions, further stimulating price growth.

Regional Variances

Property markets in the UK vary by region, and the impact of a stamp duty cut can differ significantly. In regions where affordability is a key issue, a cut can be more influential in driving up prices.

Short-Term vs. Long-Term Effects

Stamp duty cuts often have a more pronounced effect in the short term, creating a surge in transactions. Whether this leads to a sustained increase in property prices in the long term depends on various factors, including economic stability, job growth, and housing supply.

Fiscal Policy

The effectiveness of stamp duty cuts in sustaining price growth can also depend on broader fiscal policies and economic conditions. An isolated tax cut may not be enough to counteract the impact of a broader economic downturn.

It’s worth noting that while a stamp duty cut can influence property prices, it is not a standalone solution. Property markets are multifaceted, and their trajectories are influenced by various internal and external factors. Additionally, stamp duty cuts can have implications for government revenues, which may affect funding for public services.

In conclusion, a stamp duty cut can certainly provide a short-term boost to property prices and market activity, particularly in regions where affordability is a concern. However, its ability to keep property prices rising over the long term depends on a complex interplay of factors. Sustainable price growth typically requires a supportive economic environment, adequate housing supply, and measures to address broader affordability issues.

Analysts View

Sarah Coles, Senior Personal Finance Analyst at Hargreaves Lansdown , highlighted the potential risks associated with stimulating housing market demand through measures like stamp duty cuts.

Coles points out that such incentives could drive up house prices. This may happen especially in a market already grappling with tight housing supply and increasing mortgage payments due to rising interest rates. She draws parallels with past experiences, where stamp duty holidays effectively boosted demand, potentially leading to price increases.

Coles highlights that tax cuts, though generally favored by buyers, won’t solve the current property market challenges.

To address these issues effectively, a comprehensive approach is needed. Simply boosting demand without addressing supply constraints may lead to more buyers vying for limited housing stock, potentially driving prices up. This phenomenon was observed during the stamp duty holiday prompted by the COVID-19 pandemic.

Richard Fearon, Chief Executive of Leeds Building Society , echoed the concern about the consequences of using tax cuts to boost demand. He suggests that a more sustainable solution lies in investing in building an adequate supply of houses, rather than relying on widespread stamp duty reductions. Fearon argues that such tax-driven strategies may inflate house prices, exacerbating the challenges faced by first-time buyers.

He pointed out that governments have historically favored quick-fix demand-boosting measures over addressing the structural issues within the housing market. The focus should be on ensuring a balanced supply of properties to achieve more lasting and equitable growth.

In summary, the experts raised concerns about the potential pitfalls of demand-stimulating measures like stamp duty cuts. They stress the need for a comprehensive approach that addresses both supply and demand issues within the property market to promote sustainable growth.

Where Will There Be a UK House Price Crash?

This year, house price declines initially hit the South of England. But,now, higher interest rates are affecting other regions too. In the current landscape, house prices are experiencing declines in all areas of England. The East of England and the South East have witnessed the most significant price falls over the past year, registering -2.4% and -2.2%, respectively. The North East Yorkshire and the Humber are marginally in negative growth at -0.1%.

In a notable shift, house prices in Wales have recorded an annual decrease of 0.2% for the first time. They increased by 0.1% just in the previous month. In Cardiff, house prices have seen a year-on-year decline of 0.2%, matching the rate observed in the preceding month.

Among major UK cities, Bournemouth, Cambridge, and Southampton have experienced the most substantial house price drops, with declines of -2.6%, -2.3%, and -2.0%, respectively.

FAQs

What impact do interest rates have on UK house prices?

Affordability, mortgage costs, investment costs, consumer confidence, marke liquidity, investor behavior, economic conditions and general debt levels are all factors affected by interest rates and that, in turn, affect house markets. Interest rates directly affect affordability and the cost of borrowing, influencing demand and market liquidity. Additionally, interest rates indirectly influence consumer confidence, investor behavior, and overall economic conditions, all of which can contribute to fluctuations in property prices.

Will UK house prices fall in 2024?

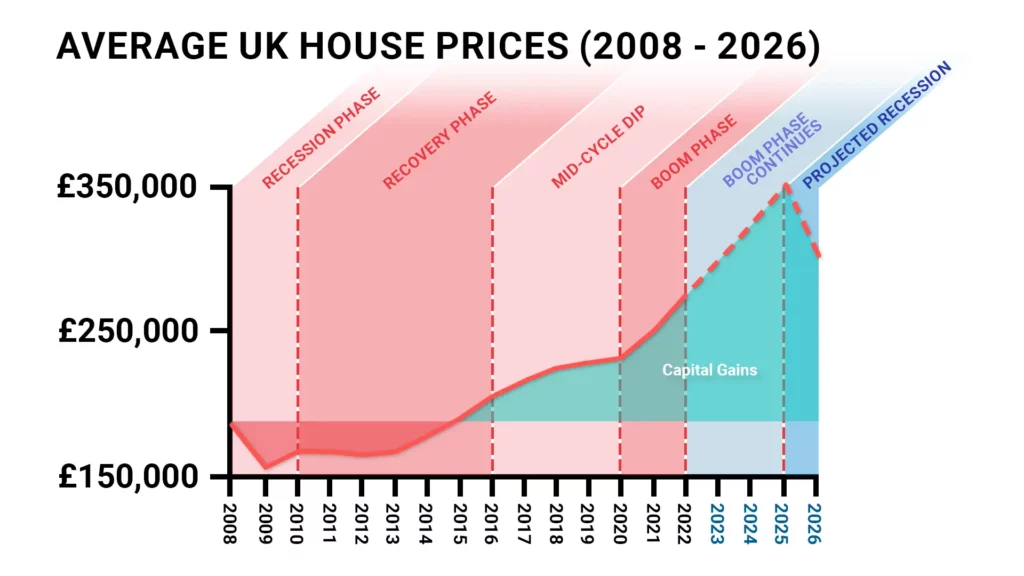

By the end of 2023, house prices are expected to have fallen by 5% over the course of the year, with a further anticipated decrease of 2.4% in 2024, according to a Lloyds Banking forecast. These projections suggest a total 11% decline in property prices from their peak in the previous year. Santander, another major financial institution, is predicting a larger drop in UK house prices for the entirety of 2023, estimating a decline of approximately 7%, followed by a more modest 2% fall in 2024.

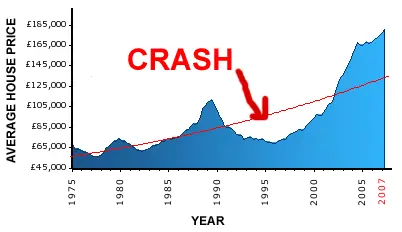

When was the last property price crash?

The last UK property price crash was during the Great Financial Crisis in 2008-2009, when the average prices in the UK fell by 15.6% between February 2008 and February 2009.

Giuseppe Ciccomascolo