You Won’t Believe How Many US Voters Back the ‘Extreme’ 70% Tax Rate in Ocasio-Cortez’s Green New Deal

Alexandria Ocasio-Cortez motioning toward her chief of staff, Saikat Chakrabarti, who was named in a complaint filed with the FEC Monday | Source: AP Photo / Mark Lennihan

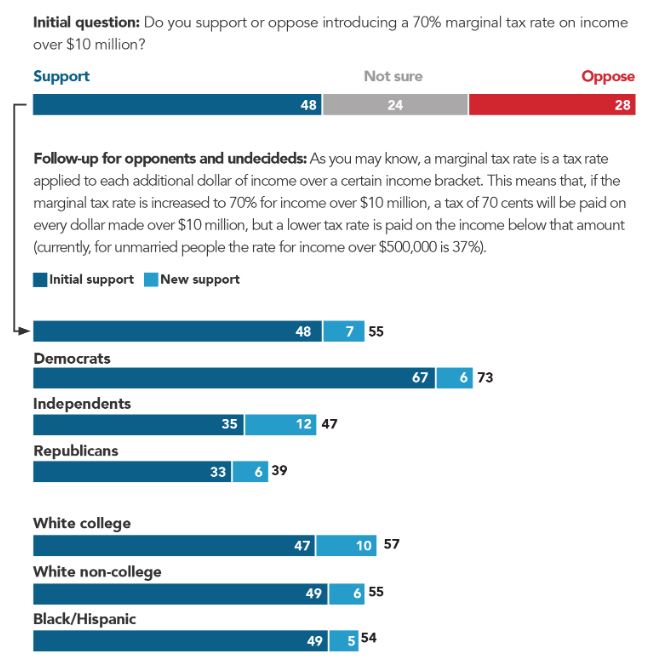

According to data from Navigator Research, a recent poll concluded that almost half of Americans support a 70% marginal tax on income earned above $10 million. Without explanation, 48% of people polled favored the proposition from the Green New Deal. An additional 7% were in favor after learning the meaning of “marginal tax rate.”

One of several ideas floated by openly socialist US House Representative Alexandria Ocasio-Cortez (D-NY), the proposal has been shrugged off by Bill Gates as “extreme.” The legendary technocrat also points out that the system would undoubtedly “start to create tax dodging and disincentives, and an incentive to have the income show up in other countries and things.”

39% of Republicans Support 70% Tax Rate (?)

The poll calls into question the composition of political parties in post-Trump America, where numerous “populists” have flooded into the Republican ranks and indubitably confused pollsters. Of the people who identified as Republicans, the allegedly conservative party in the United States, 39% supported the government taking 70 cents of dollar # 10,000,001.

Nearly half of independents, and – unsurprisingly – more than 70% of Democrats also supported the proposal.

As Business Insider notes, America has not always been competitive where income taxes are concerned.

At the height of the Great Depression in 1935, people earning more than $5 million a year paid 79% . By 1978, anyone making a little over $100,000 paid 70% . Taxes were drastically reduced and simplified throughout the 1980s, raised again during the 1990s, and reduced again under George W. Bush.

Looking at the numbers , it’s hard to argue that the government doesn’t need to get its revenue up. In this reporter’s unpopular opinion, the national debt is our only true nationwide crisis. It threatens every aspect of our society, from security to the long-term stability of our children. And any representative who doesn’t seek to address it is a bad one, on up to the last 5 presidents including Donald Trump – as well as upstart politicians like Alexandria Ocasio-Cortez

Did You Tell Them About Alexandria Ocasio-Cortez’s Other Ideas?

I single out Ocasio-Cortez because her tax rate hike is just one aspect of her so-called Green New Deal. She wants to raise taxes on the wealthy and give tax relief to the working poor. Apparently, a fair percentage of Republicans agree with this strategy. She also wants to spend many billions on things like expanding healthcare and free education as well as “job guarantees.”

Income tax makes up less than half of federal revenue. Corporate taxes don’t add much more. A serious policy would ask, “cui bono?” Personal income tax is almost criminal in the eyes of anyone who respects our constitution. But taxing companies who use our public resources and our citizens in the pursuit of insane profits is both a legitimate and effective strategy.

You set the bar a lot higher, but you create dozens of ways that corporations can bring their taxes down.

The Road to Hell is Paved With Good Intentions [and the Green New Deal]

Those ways shouldn’t be something simple like “charitable donations.” They should be more complex and targeted at specific societal ills.

For example: if Walmart brings most or all of its employees out of poverty, the government splits the welfare savings with them. Companies who pay wages that keep people from qualifying for welfare should pay less tax, plain and simple. Policy proposals like that make a lot more sense. Then companies who don’t care about their taxes will pay them, while wide-ranging economic effects will be induced by the actions of the rest.

Again, like Bill Gates says, a simplistic strategy of going after people’s personal incomes isn’t going to yield significant results. It’s possible to generate more revenue while stimulating businesses to act in “socially responsible” ways.

Some people will tell you that money is the root of all evil. In this author’s opinion, these are the people who’ve never worked their fingers to the bone for something.

Too often, the conversation around taxation leaves out the fact that the government does very little real good with the money it extracts. Serious conservatives would do well to promote a policy of paying off the debt and eradicating all excess institutions – a “reboot,” if you will.

Everyone agrees that the government needs its checkbook balanced. That’s not a question. But increasing the income tax while simultaneously increasing expenditures does the exact opposite.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.

Alexandria Ocasio-Cortez Image from AP Photo / Mark Lennihan