3 Ways Bitcoin Is Quietly Growing Stronger – Every Single Day

The bitcoin price has been on a roller coaster. Despite the volatilty, the cryptocurrency is quietly growing stronger every single day. | Source: Shutterstock

Many people believe that bitcoin will eventually fail because it is not backed by anything. What they don’t understand is that the cryptocurrency is backed by two precious resources: miner hash power and developer hours.

Hash power has exponentially risen over the years while the number of developers working on bitcoin has remained healthy despite the cryptocurrency’s drop in value. In addition to that, economic activity has steadily grown.

These metrics tell us that the cryptocurrency has been making significant fundamental advancements regardless of daily price action.

1. Mining Hash Power Sets Fresh All-Time Highs

Hash power is an important metric that gives us an excellent indication of bitcoin’s long-term value.

Rising hash power tells us that there are more miners joining the network, and existing miners are putting in more mining capacity. This is a bullish sign because miners contribute resources such as mining equipment and electricity. They’re investing because they want to secure the network and believe bitcoin will rise in value over time.

On September 8, bitcoin’s hash rate printed a new all-time high above 94 quintillion hashes per second.

2. Active Developers Per Month Has Remained Steady

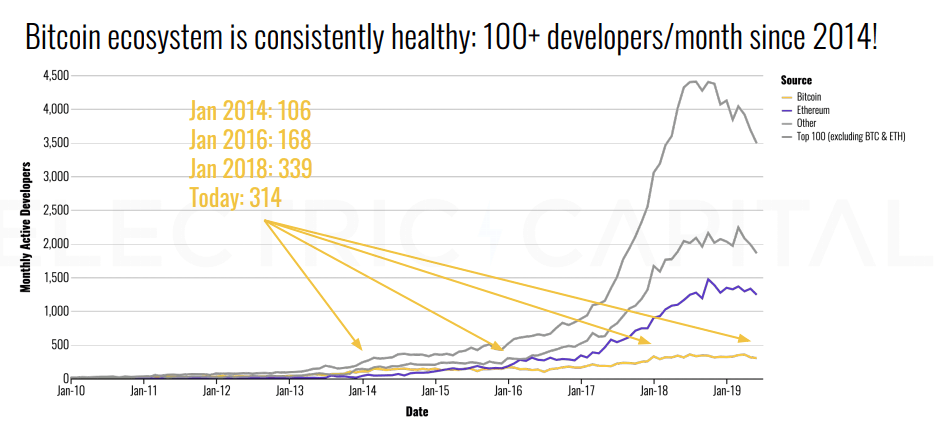

Despite the drop in value from the all-time high near $20,000, bitcoin’s developer ecosystem continues to be healthy. An Electric Capital report revealed that the number of active bitcoin developers per month has risen from 106 in January 2014 to 314 in January 2019.

These developers are responsible for network improvements that help maintain security, reduce transaction fees, and boost bitcoin’s capacity.

3. Bitcoin’s ‘Outputs Per Day’ Metric Is Growing Strong

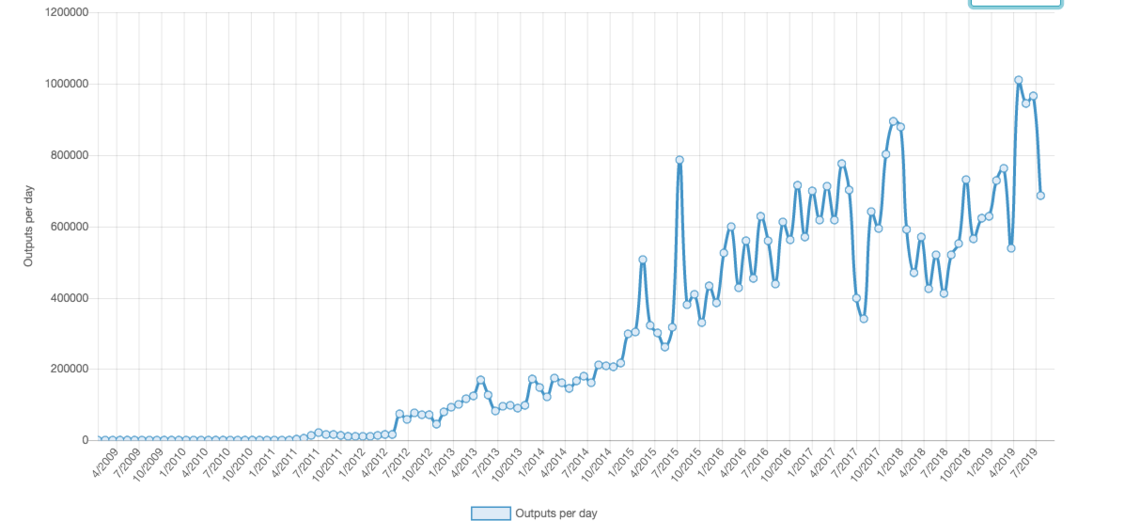

Instead of looking at transactions per day, experts see outputs per day as a more reliable indicator of overall economic activity. That’s because batching enables users to send multiple transactions in one output. Therefore, the transactions per day metric does not paint a complete picture of economic activity.

BTC’s “outputs per day” figure set an all-time high above 1 million in April 2019. That number dropped in July but still remains significant at nearly 700,000 outputs per day.

Gold Investment Platform Executive: Bitcoin to Be a ‘Safe Haven’ in the Midst of Brexit

In addition, the co-founder of MarketOrders, Sukhi Jutla, spoke to CCN.com and shared her bullish view on bitcoin. On top of strengthening fundamentals, the current economic environment in Europe appears to favor the cryptocurrency. She said:

“Expect Brexit to heighten the ‘digital gold’ appeal of bitcoin and cause the price of this crypto to increase and be seen as a safe haven amongst this turbulence.”

Bitcoin exhibited certain qualities of digital gold earlier this year when it traded in lockstep with bullion 58% of the time over a three-month stretch.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.