Windstream Bankruptcy Fleeces Investors But Shouldn’t Harm Customers

Internet provider Windstream has gone bankrupt. Luckily, customers should not face too many disruptions. | Source: Shutterstock

Windstream Holdings, Inc. (NASDAQ: WIN) has officially filed for Chapter 11 bankruptcy and restructuring following the February 15th, 2019 decision of Judge Jesse Furman in favor of Aurelius Capital Management LP. So what happens next?

Windstream has described this bankruptcy filing as a proactive step toward allowing WIN to continue business and improve their operations in the coming days.

According to Tony Thomas, President and Chief Executive Officer of Windstream:

“Taking this proactive step will ensure that Windstream has access to the capital and resources we need to continue building on Windstream’s strong operational momentum while we engage in constructive discussions with our creditors regarding the terms of a consensual plan of reorganization. We acted decisively to secure the long-term financial stability of Windstream, and we are confident that, upon completion of the reorganization process, we will be even better positioned to invest in our business, expand our speed and capabilities for our customers and compete for the long term.”

What Chapter 11 Bankruptcy Means for Windstream

Since Windstream filed for Chapter 11 bankruptcy, it will be allowed to continue its operations as usual while it negotiates with creditors. It will also be required to file the following documents with the court:

- schedules of assets and liabilities;

- a schedule of current income and expenditures;

- a schedule of executory contracts and unexpired leases;

- and a statement of financial affairs

Company Plans Restructuring

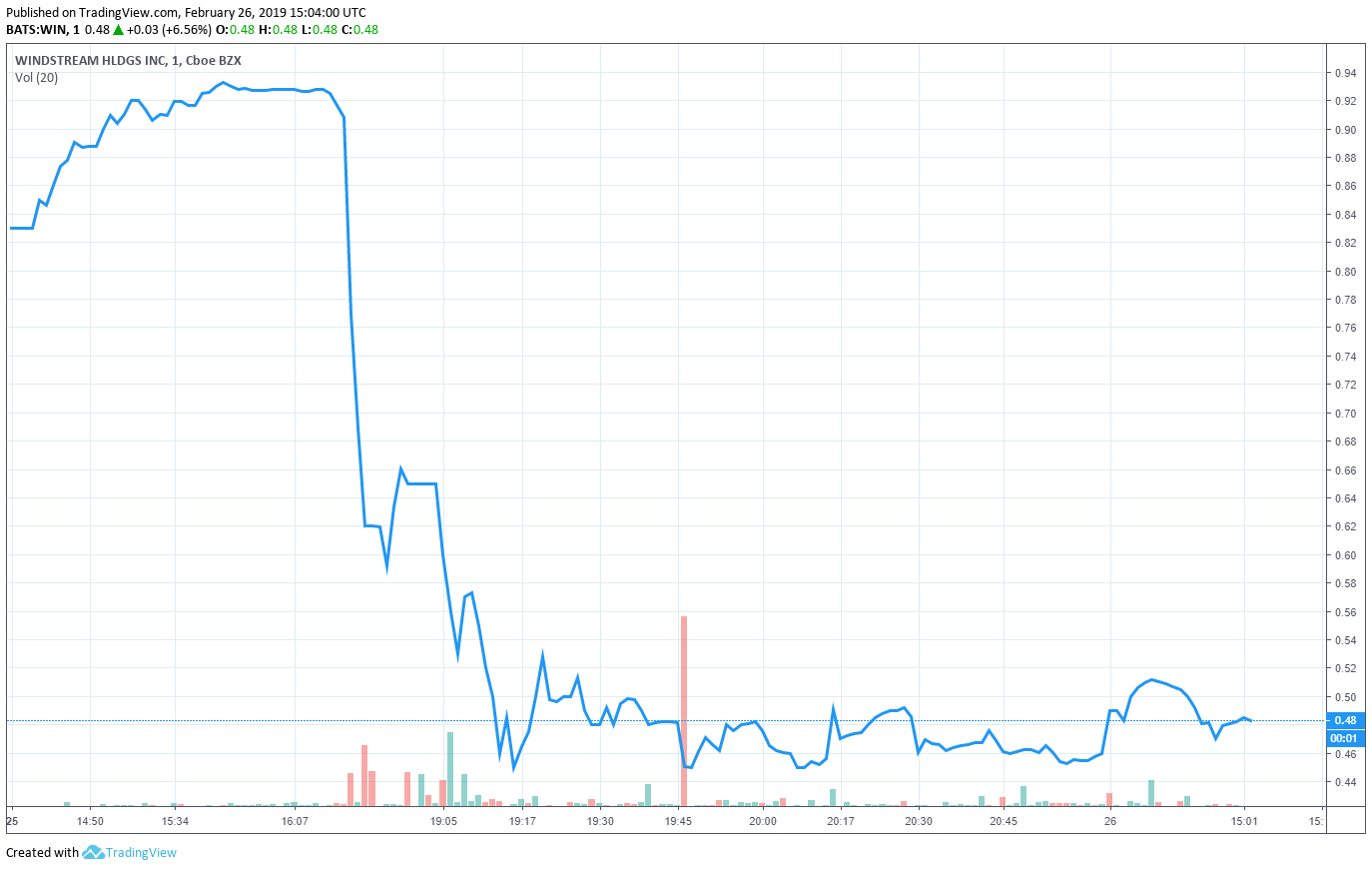

Windstream will be filing an appeal for the decision by Judge Furman in an attempt to retain the $310 million they have been ordered to pay to Aurelius Capital Management LP. Judge Furman ruled this sum be paid for a technical default, allegedly set-off by the Uniti Group (NSDQ:UNIT) spin-out in 2015. WIN shares plunged on the ruling.

Uniti Group provides infrastructure for WIN in the form of fiber optic cabling and tower availability. They possess more than 5 million strand miles of fiber optic cable and over 800 wireless towers.

In a press release on February 19th, 2019 , Kenny Gunderman, President and Chief Executive Officer of Uniti, commented:

“It is our understanding that Windstream intends to take action and pursue all available options. The validity of our master lease agreement with Windstream was not impacted by the ruling, and access to our network remains critical to Windstream’s operations and its ability to serve its customers.”

Citigroup to Provide $1 Billion in Financing

The announced debtor-in-possession financing means that Windstream Holdings will retain its assets and break into a windfall of $1 billion from Citigroup Global Markets if the courts approve their petition. These funds will be added to any debts previously incurred by WIN for repayment at a later date.

WIN will still be expected to pay their debts, in excess of $5.8 billion, but the $1 billion DIP financing will enable them to continue paying suppliers and employees in full to maintain their operations.

What Should Customers Expect?

Bankruptcy sounds scary for customers at first, and Chapter 7 bankruptcy is a frightening concept. Chapter 7 involves assets being sold to pay for the company’s debts, but Chapter 11 will let Windstream continue to operate and expand their service offerings.

At this time, consumers may see light service interruptions or service changes but will likely experience their regular quality of service. In the event that matters grow worse from here, however, customers may experience service difficulty, interruptions, and other negative side-effects. The worst-case scenario would be cancellation of service or company buyout.

Considering WIN’s monopoly of service in some rural areas, cancellation of service or company buyout would be less than ideal but may lead to sale of property to other internet service providers in the future.

While a bankruptcy filing shakes investors and customers alike, Windstream has stated that they have taken the best proactive steps for recovery possible. Customers may experience mild interruptions, but they should generally expect a consistent quality of service if the courts approve the internet provider’s restructuring plans.

Featured Image from Shutterstock. Charts from TradingView.