U.S. Treasury Yields Fall Ahead of Fed Bombshell

Key members of the Federal Reserve system are coming to terms with cryptocurrencies being part of the future. | Image: REUTERS/Chris Wattie/File Photo

U.S. government debt yields fell on Tuesday, extending their losses for the week as investors assessed mixed messages about the economy heading into the Federal Reserve’s upcoming policy decision.

Treasury Yields Slide

The price of U.S. government bonds rose on Tuesday, pushing yields down. The yield on the benchmark 10-year Treasury fell nearly 5 basis points to a low of 1.79%, according to CNBC data. It was last seen at 1.805%.

The 2-year Treasury bond saw its yield fall to a low of 1.72%, which was also a decline of almost 5 basis points.

Yields on the 30-year Treasury note fell nearly 6 basis points to 2.25%.

Fed Decision Looms

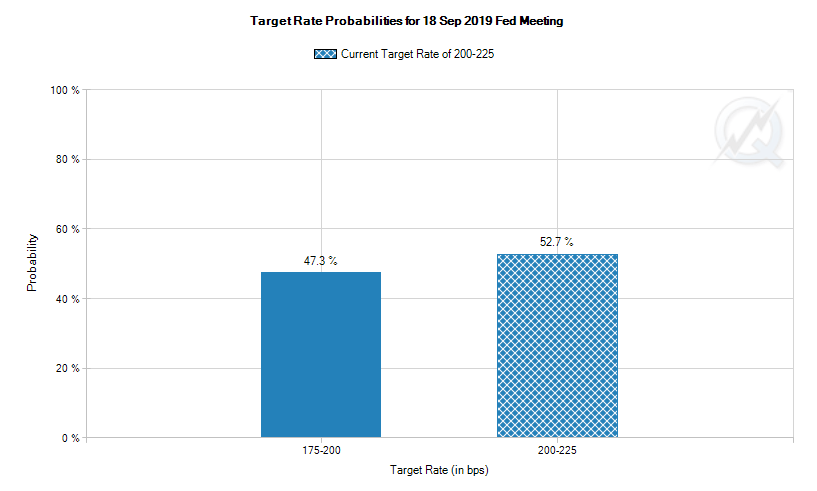

The Federal Reserve will deliver its latest policy verdict on Wednesday amid confusion about which way officials will vote. At last check, the chance of a rate cut on Wednesday is almost 50-50, according to Fed Fund futures prices. Earlier this month, the market had priced in a rate cut with nearly 96% certainty.

At this rate, nobody has a strong grasp on what way the Fed will go, making a split decision like we saw in July extremely likely. At the time, Fed Bank of Boston President Eric Rosengren and Esther George of the Kansas City Fed voted against raising interest rates.

Traders have received conflicting views about the U.S. economy. On the one hand, job creation is slowing and manufacturing appears headed for recession. On the other hand, wages and consumer prices are rising faster than expected.

Although the Fed may not lower interest rates as previously believed, the central bank has already injected billions of dollars into the financial system – the first such intervention since the financial crisis.

The repo rate, which refers to the cost of borrowing cash overnight through repurchasing agreements, surged to as high as 10% on Tuesday, according to the Financial Times. That’s a more than fourfold increase in less than 24 hours.

Citing a senior executive at a major U.S. bank, FT said the rise in the repo rate reflects a sizable disconnect between funding needs and available capital in key segments of the U.S. money market. Repos give companies access to liquidity using government bonds as collateral.

The Fed will deliver its policy verdict Wednesday afternoon at 2:00 p.m. ET. The official statement will be accompanied by updated quarterly projections for GDP, unemployment and inflation.