U.S. Taxpayers Can Receive Federal or State Tax Refunds in Bitcoin

By CCN.com: U.S. taxpayers can receive all or part of their federal and state tax refunds in bitcoin. This is being made possible through a collaboration between blockchain payments processor BitPay and Refundo, a provider of tax-related financial products.

In a statement , Refundo says its CoinRT product is especially useful for low-income communities that don’t have checking accounts and often resort to paying high check-cashing fees.

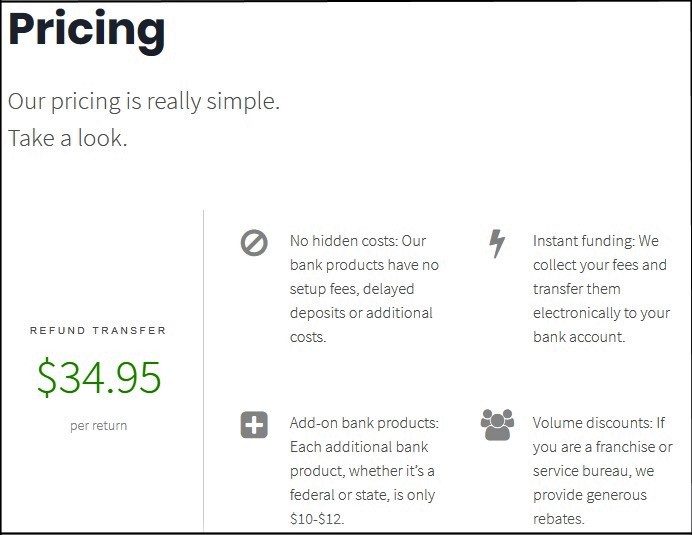

That said, Refundo’s CoinRT service is not free. CoinRT costs $34.95 per refund transfer, and that doesn’t include BitPay’s 1% service fee.

Refundo focuses on low-income communities

Refundo specializes in serving low-income communities. Refundo CEO Roger Chinchilla says these communities often send money abroad, so the integration of bitcoin can streamline both their tax refunds and their international remittances.

“Bitcoin provides transactional transparency, as every transaction is verified, recorded and stored on the blockchain. The transaction itself contains no sensitive personal information.”

“Refundo offers several options to help taxpayers receive their tax refunds safer, faster and more conveniently. Adding bitcoin was a natural fit for our customers, who often do not have traditional checking accounts, pay high check-cashing fees, and regularly send money internationally.”

EY rolls out cryptocurrency tax tools

On an institutional level, Big Four accounting firm Ernst & Young (EY) recently introduced a crypto tax tool specifically for its clients who invest in digital currencies.

A month later, EY followed up by launching the second generation of its EY Blockchain Analyzer. The tool will help clients who hold or trade cryptocurrencies by automatically calculating their capital gains and losses.

Taxes may be boring, but they’re a part of everyone’s lives. So the slow integration of crypto into something that everyone has to do lends some legitimacy to an industry that’s still struggling for mainstream acceptance.

BitPay CEO expects mass adoption in 3-5 years

As CCN.com reported, BitPay CEO Stephan Pair says he believes that mass crypto adoption is less than five years away.

“I used to say 10 years. But now I think it’s more like three to five years until you can go into a restaurant, a retail establishment, and everybody’s going to expect that the store will be able to accept a blockchain payment.”

When asked if SEC approval of a bitcoin ETF would speed up mass adoption, Pair says the ETF is not the end-all, be-all. However, Pair says a bitcoin ETF would push the bitcoin price higher.

Stephen Pair also remarked that the bitcoin price doesn’t reflect its “actual utility,” but stems from speculation over its future adoption.

“A very big component of the [bitcoin] price is certainly speculation. It’s investors that are speculating on the future usage and adoption of this technology. I’m sure a small component of that price is the actual utility.”