U.S. Stock Market Rally Has a Chilling Resemblance to the Great Depression

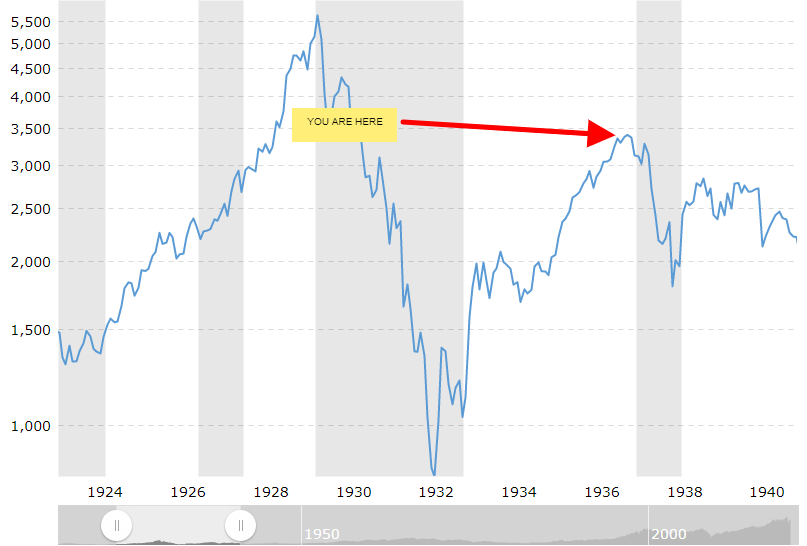

The S&P 500's chart looks like an accelerated version of the 1930s when stocks crashed and recovered over a span of about eight years. | Image: AFP

- There is an uncanny resemblance to U.S. stock markets’ movements in the last few months to what occurred during the Great Depression.

- 1929’s crash was perpetual, taking three years to manifest. After that, the bear market rally lasted for five years.

- We have our version of the situation now, except the Fed’s intervention has made sure that the 1929-32 crash and the 1932-37 rally played out in a matter of weeks.

If history doesn’t repeat itself exactly, it sure does rhyme. The recent U.S. stock market rally bears a striking resemblance to the post-1929 crash rally that lasted until 1937.

If one draws parallels to then and now, we are at the peak of the stock market rally that ended in 1937.

After that, the S&P 500 lost 52% of its value in a bear market that lasted 61 months.

Something similar could be incoming–and it could happen in a flash because of the accelerated timeline.

The Fed Has Sped up the Timeline Multifold This Time

After the crash that ensued back in March, the Federal Reserve did what it does best. It printed more money, which caused a stock market rally to nearly pre-crash levels.

Fascinatingly, the full replay of the 1929-32 crash and the 1932-37 rally unfolded within months.

Considering that, its safe to say that the coming U.S. stock market crash would be just as swift.

After the Next U. S. stock market Crash, We Will Be in Uncharted Territory

If the flash crash does arrive, it would be impossible to guess what follows next. Will the U.S. dollar lose its status as the world’s reserve currency like sterling did in 1945? Time will tell.

For now, it looks like the Fed will do whatever it takes to avoid a 1929-style collapse. The dollar’s shortage has already raised some eyebrows.

If the dollar keeps getting stronger, countries could ask to devalue it.

We could have our version of the Plaza Accord. Today, countries worldwide have racked up tremendous amounts of dollar-denominated debt.

Whatever ensues will be like nothing encountered before because central banks have never pumped so much stimulus. We would be in uncharted territory.

The coming months could have an answer for us.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com and should not be considered investment or trading advice from CCN.com.