The U.S. Housing Market Crash Is Officially Here

The US housing market is in real trouble. | Source: AP Photo/Matt Rourke

The US housing market has been losing its wheels despite the Federal Reserve’s rate cuts, and the severity of the problem came to the fore when the Commerce Department released its latest data.

More signs that the US housing market is in trouble

Sales of new single-family homes in the US fell in September by 0.7 percent to 701,000 units. The August reading also witnessed a downward revision to 706,000 units as compared to the originally reported 713,000 units.

But what’s alarming is that the monthly price decline was the biggest seen since September 2014 despite tight inventories, a sign that a US housing market crash is here. The median price of a new house slid 8.8 percent year over year in September to $299,400. The month-over-month decline came in at 7.9 percent.

The drop in home prices seems a tad surprising given the tight inventory available on the market. The National Association of Realtors (NAR) recently reported that in September, there were just 4.1 months of existing home inventory. This was lower than the 4.4 months of inventory that was available a year ago and far lower than the ideal inventory level of 6 to 7 months.

The NAR report also revealed that sales of existing homes in the US were down 2.2 percent in September to 5.38 million units. Economists anticipated a 0.7 percent decline to 5.45 million units.

https://twitter.com/USHousingReport/status/1186656897836945415

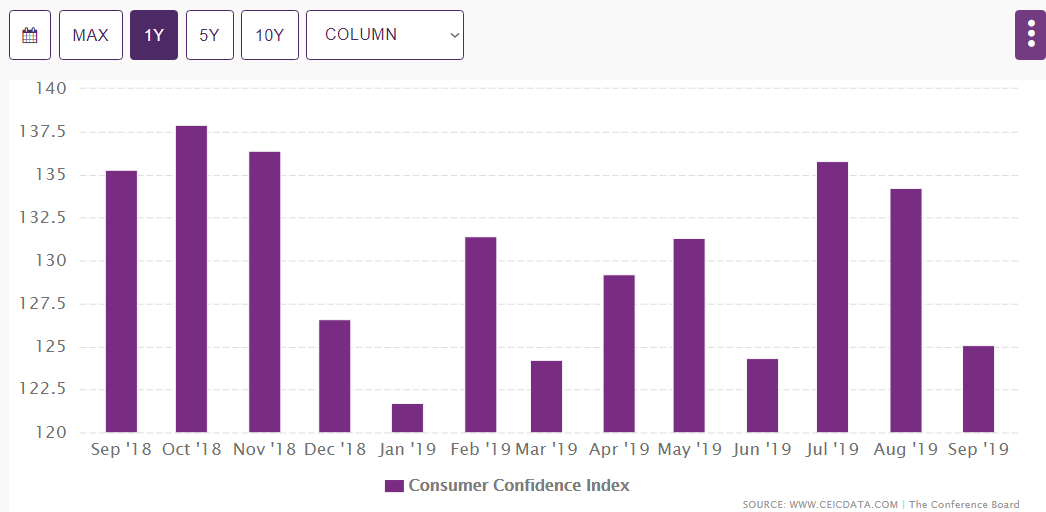

The Commerce Department data says that new home inventory slid 0.6 percent in September to 321,000 units, and it would take 5.5 months to clear this inventory at the current pace. Still, prices crashed as flailing consumer confidence seems to have struck the US housing market.

What gives?

Just last month, Nobel-prize winning economist Robert Shiller predicted that home prices are headed for a crash.

His prophecy stands true now, and it is not surprising to see why.

Fannie Mae had recently reported that the Home Purchase Sentiment Index for September had slid 2.3 points, as Americans became more concerned about the security of their jobs. The US-China trade war has led to a manufacturing slowdown while hiring growth is also losing momentum.

With the probability of a recession looming large, consumers can be expected to play it safe and not go for big-ticket purchases. That’s bad news for the US housing market.

What’s more, there was a sharp fall in US housing starts last month. This indicates that the US housing market inventory could get tighter. But as we have just seen, tighter inventories don’t guarantee higher prices anymore.

Builders will be forced to lower prices in order to entice tight-fisted consumers and clear off their inventories – but they already seem to be doing that as the sharp fall in the price of new homes indicates. If that’s indeed the case, then we shouldn’t be in denial and accept the fact that the US housing market crash has officially arrived.