The US Housing Market Could Crash, Warns Nobel Laureate Shiller

Dr. Robert J. Shiller, 2013 Nobel Laureate for Economic Sciences, listens during a Nobel Laureate Symposium at the Embassy of Sweden November 19, 2013 in Washington, DC. Nine people from the United States were honored this year with the Nobel Prize in the fields of medicine, chemistry and economic sciences. AFP PHOTO/Brendan SMIALOWSKI

Nobel laureate Robert Shiller predicts that the US housing market is on the verge of crumbling. The American economist was speaking to Bloomberg Television when he said :

“It would suggest declining home prices in the near future,” Shiller, who teaches at Yale University, told Bloomberg Television on Thursday. “I wouldn’t be at all surprised if house prices started falling.”

Shiller’s grim view on the housing market shouldn’t scare you, yet

Shiller’s warning comes amidst emerging signs of a slowdown in the housing market. The S&P CoreLogic Case-Shiller index — which reflects the value of residential real estate across 20 major metropolitan areas in the US — slowed down for the 15th consecutive month in June.

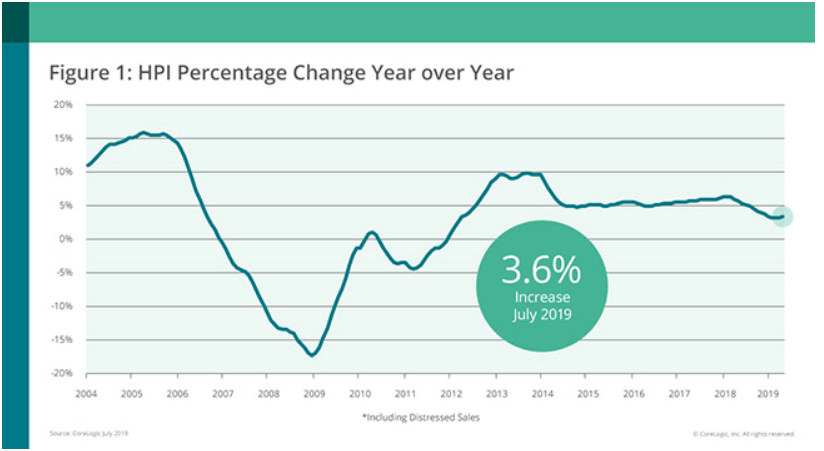

Bulls would argue that the index increased 2.1 percent year over year in June, but the trend clearly indicates that the housing market is losing steam. But real estate data firm CoreLogic’s latest Home Price Index (HPI) report differs with Shiller’s view.

CoreLogic says that home prices increased 3.6 percent year over year in July, while the month-over-month increase came in at 0.5 percent. The month-over-month growth for August is expected to fall to 0.4 percent, but CoreLogic remains confident that the housing market will eventually pick up the pace.

The firm forecasts that annual home price growth has the potential to reach 5.4 percent in July 2020 on the back of low interest rates and increasing income levels. According to Dr. Frank Nothaft, the chief economist at CoreLogic:

“Sales of new and existing homes this July were up from a year ago, supported by low mortgage rates and rising family income.

“With the for-sale inventory remaining low in many markets, the pick-up in buying has nudged price growth up. If low interest rates and rising income continue, then we expect home-price growth will strengthen over the coming year.”

Don’t ignore these warning signs

CoreLogic’s forecast of a pick up in the housing market makes sense considering that the 30-year fixed mortgage rate of 3.87% is now at its lowest levels since November 2016. Also, consumer confidence in the US seems to be holding strong despite the trade war.

The consumer confidence index in the US stood at 135.1 in August. This was a negligible drop from the reading of 135.8 in July, but well ahead of the 129.5 reading that analysts were expecting. So a combination of low interest rates and booming consumer confidence should ideally lead to stronger housing demand and push prices higher.

But a closer look at some other readings suggests that is not the case.

The Mortgage Banker’s Association reports that mortgage application volumes dropped 3.1 percent last week despite the positives outlined above. Also, refinance applications were down for the second straight week, suggesting that consumers might be pulling back given the macroeconomic situation.

Data from the National Association of Home Builders suggests that only 12 percent of the adults surveyed in the second quarter plan to buy a home in the next year, down from 14 percent a year ago. Real estate brokerage firm Redfin reports that the supply of new homes for sale fell 1 percent annually in the second quarter, marking the first annual decline in six years.

So there’s a possibility that the tight macroeconomic situation could force consumers to pull back from purchasing a new home, especially considering that there are signs of a potential recession. If that’s the case, then Shiller’s prophecy that the housing market will decline could turn out to be true.