Here’s Why Trump’s COVID-19 Could Mean a Q4 S&P 500 Recovery

Donald Trump and the First Lady have tested positive for the coronavirus, the President tweeted late Thursday night. | Source: Drew Angerer/Getty Images/AFP

- U.S. President Donald Trump contracted COVID-19, and the markets sold-off immediately thereafter.

- The rising uncertainty in the markets could push the Republicans to reengage in stimulus talks, which might fuel the S&P 500 in Q4.

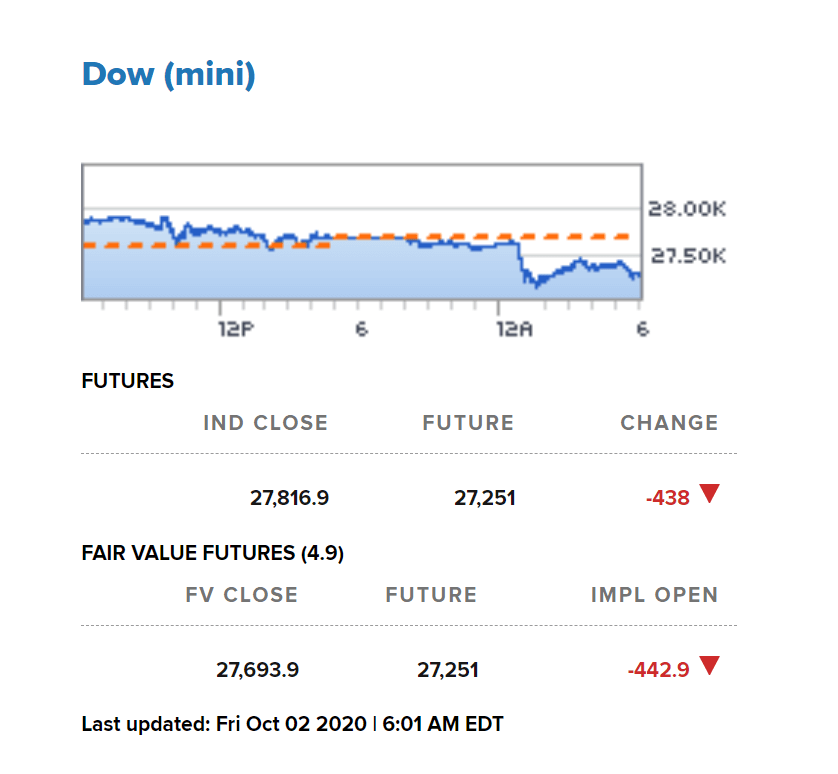

- The stock market in the U.S. and Europe are posting major losses in pre-market trading as the Dow drops 413 points.

U.S. President Donald Trump has contracted COVID-19, the President said on Twitter . While the markets initially reacted negatively, it could potentially lead the S&P 500 recovery in the fourth quarter.

There are three possible catalysts for the S&P 500 in the upcoming months. They are the rising probability of a stimulus package, a rising dollar as a result, and an extended consolidation phase.

Republicans Could Reach For a Stimulus Deal in the Wake of the News

On October 2, House Democrats, led by the Democratic House Speaker Nancy Pelosi, approved a $2.2 trillion stimulus package.

But Republicans and the Trump administration swiftly rejected the proposal , criticizing the politicization of the stimulus.

A stimulus bill would massively benefit the S&P 500 and the Nasdaq Composite, which have struggled since September 2.

Apart from alleviating significant pressure from equities, it would also deliver direct checks to individuals. The last time the government sent direct stimulus checks, the S&P 500 rallied 11% in two months.

Yet, the stimulus package remains far from seeing a consensus between the Democrats and Republicans.

Senate majority leader Mitch McConnel said it is “inappropriate” to many things that don’t directly pertain to stimulating the economy. He said:

“What the Speaker did, even after coming down a full trillion dollars, is throw everything you can imagine into the package, including tax cuts for rich people in California and New York, and free healthcare for illegal immigrants. That sort of thing is not appropriate.”

Kayleigh McEnany, the White House press secretary, condemned Pelosi for “not being serious.” She said if Pelosi “becomes serious,” then the Trump administration would entertain a discussion.

The President’s unexpected contraction of COVID-19, which adds more uncertainty to the election, could lead the Republicans towards the stimulus.

With the election just over a month left, the Trump administration would likely be concerned about the stock market’s performance. The public could gauge the trend of the S&P 500 as the election near s, and that could sway voter confidence.

As such, there is an increased probability that the Republicans could reengage in discussions with the Democrats. When the stimulus gets approved, it will cause the S&P 500 to rally.

The financial markets are reacting strongly to the Trump COVID-19 contraction. Watch the video below:

Stimulus Would Cause the S&P 500, U.S. Dollar, and Economy to Rebound in Tandem

The calls to Republicans to take the stimulus “compromise” are already rising.

Nita Lowey, the House appropriations committee chair, said the “economic catastrophe” has people and businesses crying out for action.

The recent proposal includes direct stimulus checks, emergency jobless benefits, and aid to small businesses. Lowey said:

“The health and economic catastrophe facing our country continues to cry out for urgent action. The American people cannot afford to wait until next year for action, so House Democrats are making good on our offer to compromise.”

A stimulus package approval would likely act as an immediate catalyst for the S&P 500, due to the direct checks. It could cause retail trading activity soaring once again, recovering the appetite for equities.

It would also cause the U.S. dollar to recover along with the economy, making equities more compelling in the near term.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com. Unless otherwise noted, the author has no position in any of the securities mentioned.