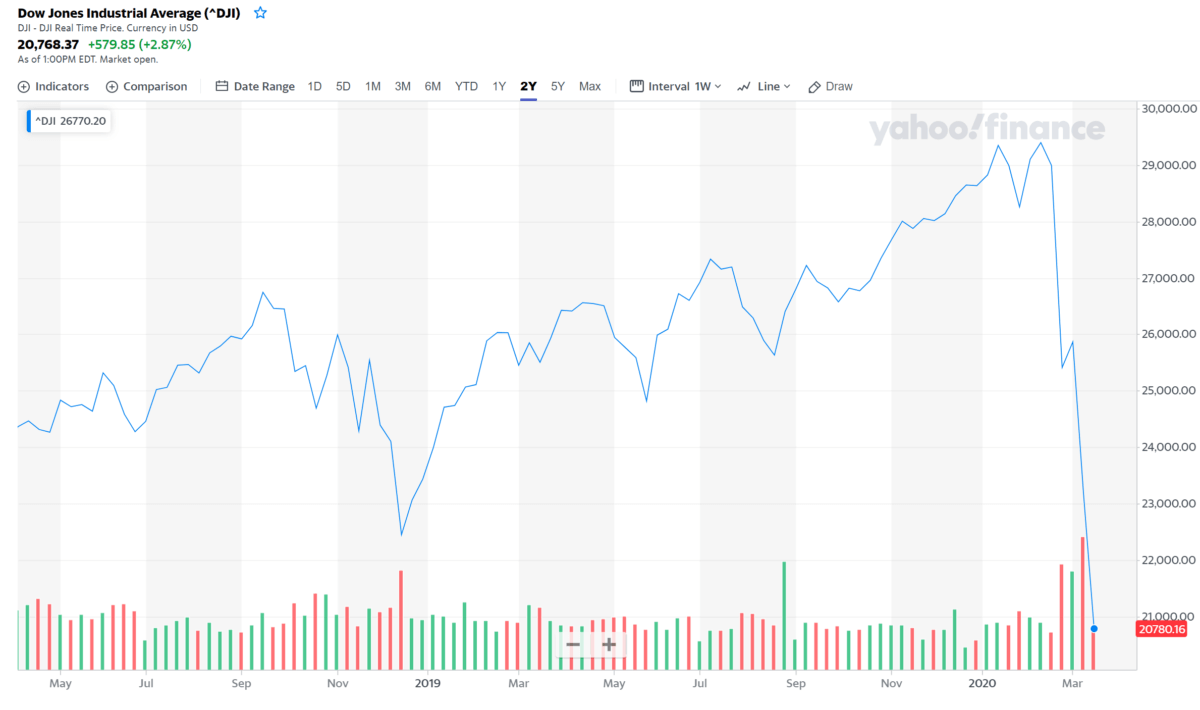

Trump Stimulus Won’t Save the Dow Jones From Crashing Below 20,000

For the Dow, Tuesday's dip below 20,000 could be just the beginning. | Source: Nicholas Kamm / AFP

- The Fed and Trump administration are running out of ideas to save the Dow Jones from a bigger downtrend.

- Analyst Gina Sanchez says no stimulus package will save the markets in the near-term.

- Only progress in containing the coronavirus pandemic will alleviate pressure from the stock market.

The Dow Jones Industrial Average (DJIA) briefly dropped below 20,000 on Tuesday for the first time in nearly three years.

The Trump administration’s latest stimulus package proposal rescued the stock market, at least temporarily.

But according to Chantico Global founder Gina Sanchez, no fiscal policy or stimulus package – not from Trump, and not from the Federal Reserve – will save the Dow Jones from suffering an even more devastating crash.

Only one thing will save the Dow

The Dow Jones began to see heightened levels of institutional sell-off after the World Health Organization (WHO) declared the coronavirus outbreak a global pandemic.

The number of confirmed U.S. coronavirus cases officially stands at 4,226 , and several states risk succumbing to Italy-style outbreaks.

Against that backdrop, Chantico Global’s Sanchez warns that no amount of stimulus will rescue the stock market from this panic-driven sell-off. Only actual progress in containing the virus can do that.

So as the Fed slashes interest rates to zero and the Trump administration scrambles to send cash payments to Americans, Sanchez expects them to have a minimal impact on the Dow Jones.

She said on Squawk Box Asia:

This isn’t a monetary crisis. So, bringing in a monetary tool—while it can’t hurt—can’t necessarily help. What we need to hear is that the virus is contained and no amount of fiscal stimulus will help that.

She further warned that the U.S. may start to see a no-end-in-sight scenario where the effect of coronavirus containment policies on the economy and the Dow Jones will impose dire consequences down the line.

The strategist explained:

The element of slowing the spread or stopping the spread or creating containment is one element, but the reality is that the policies we are instituting in order to do that are basically causing an economic lockdown. And that in itself will have a significant effect that could be more than just short-term.

The Fed’s hands are tied, and Trump’s are too

Digital currency theorist Andreas Antonopoulos suggested that the Fed and the U.S. government had four options left in their arsenal to prop up the markets.

The first option – a 0% benchmark interest rate and quantitative easing – has already been pursued. The three remaining options are:

- Negative interest rates and currency controls

- cash limits and helicopter money

- cash ban

The federal government has made clear that at least some of those options are on the table. U.S. Treasury Secretary Steven Mnuchin pitched an $850 billion stimulus package to send every American adult cash as quickly as possible.

Yet even greater panic could ensue if the distribution of checks, withdrawal limits, and Fed maneuvers fail to stabilize the stock market.

For the Dow, Tuesday’s dip below 20,000 could be just the beginning.

Disclaimer: This article represents the author’s opinion and should not be considered investment or trading advice from CCN.com.