This Billionaire Is Buying the Stock Market Bloodbath While You Panic

Dallas Mavericks' billionaire owner Mark Cuban is buying the dip, big-time. | Source: AP Photo/Evan Vucci

- Stocks continue to plunge at the fastest rate in history.

- But smart investors are looking for discounted assets among all the panic.

- Billionaire Mark Cuban is buying the S&P 500 on every down day right now.

The U.S. stock market took another brutal dive on Wednesday, but one billionaire isn’t fazed. As panic consumes Wall Street, Mark Cuban is patiently buying while there’s blood in the streets .

I’ve been putting in 1% [to] 1.5% to work on every down day

Every time the stock market takes another 5% fall like today, the Dallas Mavericks owner is buying a little more.

Buy stocks when there’s blood in the street

It takes guts to be a contrarian investor and buy while everyone else is panicking. But if you’re a long-term investor, it’s a historically successful strategy. As Mark Hulbert of Hulbert Ratings put it :

When valuations become attractive enough, courageous contrarian-minded investors will step up to the plate and start buying.

That’s exactly what Mark Cuban is doing right now. He thinks the market will eventually turn around and today’s heavily discounted prices will reap a profit.

I’ll dip my toe in the water, hoping that two years from now, this will all be a nightmare we put behind us and the market will be much higher.

What’s Mark Cuban buying?

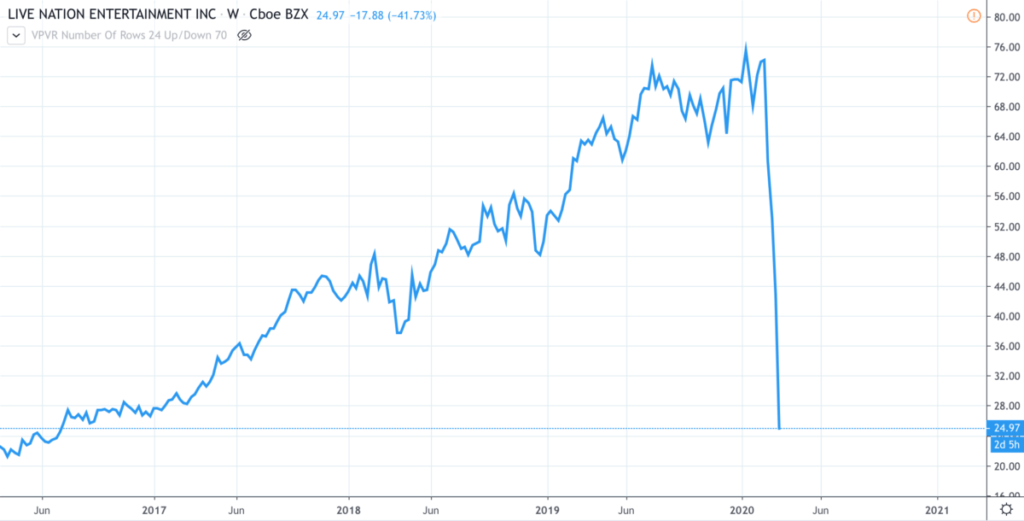

The billionaire investor is keeping it simple, using a small amount of capital to buy the SPY – an exchange-traded fund that tracks the S&P 500. He’s also buying Live Nation shares, which have been decimated in the coronavirus panic.

Live Nation stock is down 66% since the highs of February. Cuban is betting the live events industry will recover and thrive when life returns to normal.

Is the stock market bottoming out?

Like most investors, Mark Cuban isn’t ready to call a bottom yet. But he thinks the stock market is starting to settle into a pattern.

It looks like we’re starting to get into a trading range. You know, up 5%, down 5%, up 5%, down 5%. And I’m not quite sure why.

It might be a sign that some sense of normalcy has returned to the volatile markets. Cuban isn’t the only one looking for opportunity in this selloff. Kristina Hooper, chief global market strategist at Invesco is already eyeing up US tech stocks as their value comes down.

In the U.S., tech stocks look particularly attractive because of their growth potential over the longer run.

For the outside looking in, the stock markets are in panic mode. But the seasoned investors are doing what they always do: looking for discounted assets for the long-term.