There’s a 72% Chance That We’re Nearing a Major Stock Market Correction

All signs point to a looming selloff in the stock market. | Source: AP Photo/Richard Drew

- The S&P 500’s trading range suggests a drop on the horizon.

- There are plenty of sell-side triggers coming up.

- The market lacks commitment, and that means one misstep could set off an avalanche of selling.

The debate over whether or not the U.S. stock market will be able to continue with its impressive rally raged on last week.

Bulls rejoiced with positive vaccine news and Federal Reserve Chair Jerome Powell’s promise to do what it takes to support the U.S. economy. But some analysts are sounding the alarm that a stock market selloff is coming.

History Says Stock Market Slump is Next

One such bear is Sundial Capital Research analyst Jason Goepfert. He says history tells us there’s a good chance the market is about to move lower — a 72% chance to be exact.

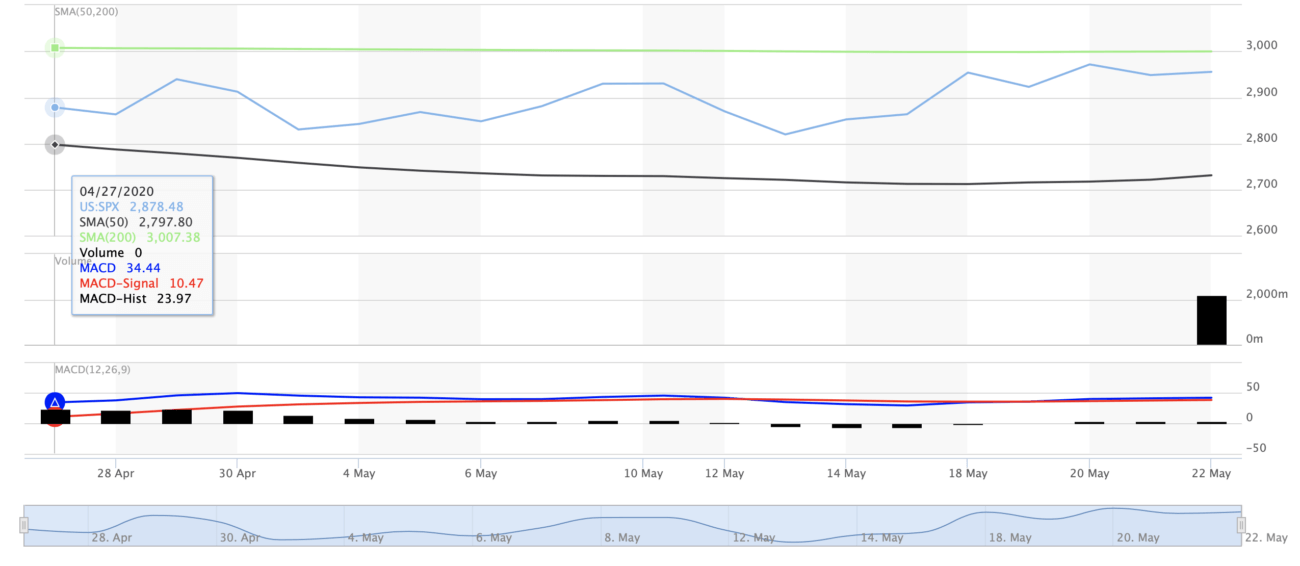

He pointed out that this marks the 30th time the S&P 500 has been trapped between its 50-day moving average (roughly 2730) and its 200-day moving average (3000) for more than 20 days in a row. When that’s happened in the past, the index almost always goes lower. Even if the S&P 500 bucks the trend and breaks above the 200-day moving average, it typically offers up an average decline of 12.7% over the next six months.

The trouble is basically that buyers haven’t shown enough oomph to make any progress lately. When that happens during down trending markets like we’ve been in, with a protracted stretch near but below the 200-day average, it has indicated larger problems and that has almost always meant further weakness ahead

The lesson? Buying into the stock market now means you’re going against all odds. That’s not a bet I’d take even with Powell backing me up.

Irrational Trading Among Investors

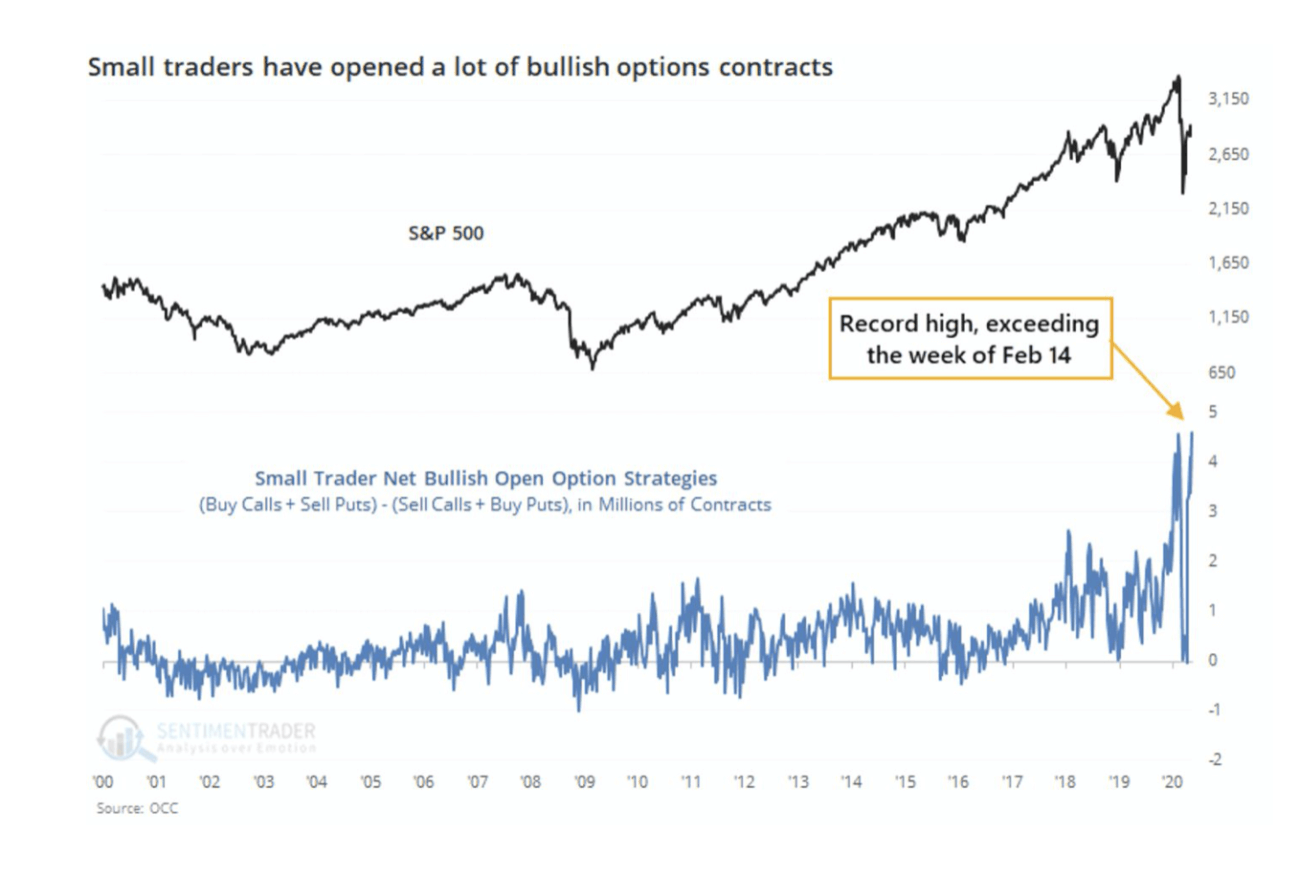

For those who insist that ‘this time it’s different,’ there are mountains of evidence suggesting investors have become irrational in their trading. Perhaps the most telling signal is the fact that small-time options traders have started to make big bets on future market gains. Goepfert says that’s one of the biggest red flags in today’s market.

When we look at a group of traders who tend to be wrong at emotional extremes, the warning sign is clear. There is no data we follow that is more worrying than this.

Stocks said to benefit from a future in quarantine, like remote workspace applications and e-commerce plays, have been rising exponentially.

Meanwhile, those hurt by COVID-19 are still underperforming. That’s clear when you look at Cornell Captial’s Quarantine Index versus its Anti-Quarantine Index. Each basket of stocks is performing in a way that indicates the coronavirus pandemic will continue to weigh significantly on U.S. businesses for the foreseeable future.

Stocks are now trading back where they were last summer when Donald Trump’s trade war with China was driving the stock market. Not only is the market contending with the headwinds from the pandemic, but the U.S.’s relationship with China is in an even more precarious position than it was back then.

Sell-Side Trigger Warning

All signs point to an overbought stock market that lacks commitment. That’s why the upcoming weeks are so dangerous. It seems the market is still being driven by coronavirus-related news. Vaccines are the top priority as that appears to be the only iron-clad solution to a return to normalcy.

But what happens when some of these candidates start to admit failure? This weekend the much-celebrated Oxford University Covid-19 vaccine trials saw some of that hope dashed. It turns out there’s only a 50% chance that the drug will pan out .

Plus, the rising tension between the U.S. and China is becoming impossible to ignore. While China is supposedly committed to making the Phase 1 trade agreement work, both sides are starting to take increasingly venomous shots at each other.

Finally, there’s the looming deadline for the end of the government’s stimulus. Unemployment benefits are still padded with extra Covid-19 relief, but those funds will dry up in July, further exposing how badly the lockdowns have hit U.S. workers.

Any or all of those events have the potential to trigger a stock market skid due to the level of commitment in today’s buyers.

Disclaimer: This article represents the author’s opinion and should not be considered investment advice from CCN.com.