The Simple Reasons Why the Bitcoin Price Will Never Go to Zero

There's a simple reason why the bitcoin price can never go to zero. There will always be someone who refuses to sell. | Source: Shutterstock

By CCN.com: This publication recently covered a talk at Davos in which Jeff Schumacher claims the Bitcoin price is on the way to zero. In this article, we discuss two simple reasons why this is an impossibility.

As CCN.com’s Christina Comben writes:

Schumacher is a top investor and relative veteran in the space. He told an open-mouthed CNBC panel that he believed bitcoin has no value and that it was useless as a currency. Instead, he’s far more interested in blockchain technology.

Schumacher gave an opinion we haven’t heard in a while, the “based on nothing” argument.

I do believe it will go to zero. I think it’s a great technology but I don’t believe it’s a currency. It’s not based on anything.

Reason #1: True Believers

For the Bitcoin market to completely tank, virtually everyone would have to sell. This is something that has never happened. In fact, it can be safely estimated that less than half of the coins in existence are even available for exchange.

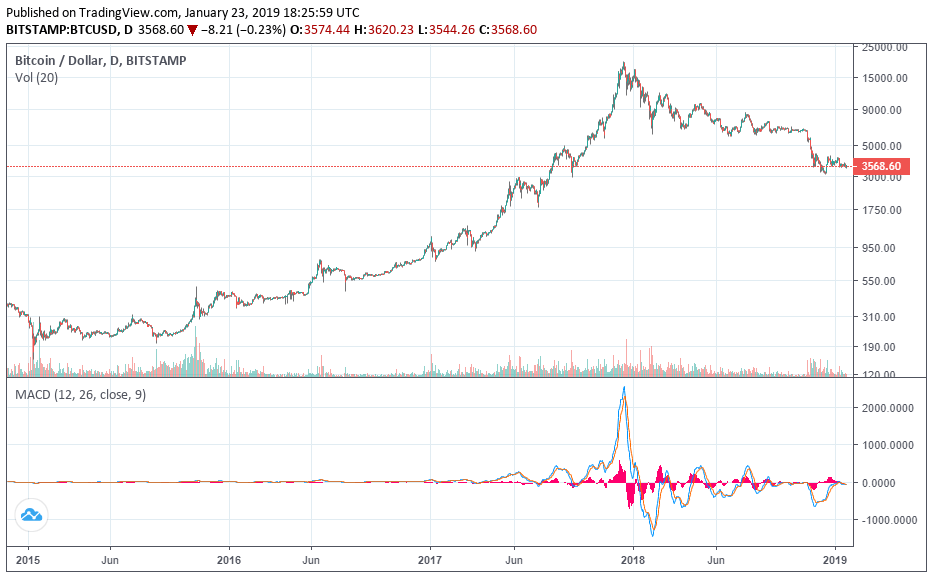

It’s hard to actually pin down how many coins exist on a given exchange, but we know that just over 1 million coins were moved across the blockchain in the last 24 hours. There are a total of just over 17 million coins. Satoshi Nakamoto is said to hold roughly 1 million of them . 21 million will ever exist.

A report from last year by Diar and another by Chainalsysis found that over 55% of the bitcoins in existence have never been sent. 42% of the people who hold more than 200 BTC did not even send an outgoing transaction during the price peak of December 2017, while 27% of those continued to add to their holdings later on.

If “hodlers” were not motivated to sell their coins when the price was massive, why would they suddenly do it when it was cheap? There is an issue of demand, but there’s no evidence that demand for Bitcoin is lacking. Even if it is only a speculative trading instrument, hedge funds and retail investors love it for that reason alone. That it doubles as a usable currency is a side-effect.

Reason #2: Rational Self-Interest

With such a high percentage of coins parked in various wallets and places, a number of cataclysmic events would have to conspire for the price to ever actually reach $0. Such a scenario requires that:

1) Hodlers suddenly have an economic incentive to rid themselves of coins (en masse).

2) Traders become willing to take losses in the thousands per token.

3) All trading bots programmed to buy cheap coins malfunction.

4) The majority of exchanges shut down or are hacked simultaneously.

5) Miners suddenly are willing to give their block rewards away for free.

It is a story of unimaginable entropy. In short, while Schumacher charges that Bitcoin “is not based anything,” this author must conclude that his theory of “zero” isn’t, either.

No one would sell at zero. A high percentage of people currently invested bought in higher than $1,000. The “buy and hold” strategy continues to reward those who see it through. Schumacher seems to fail to understand that a simple refusal to sell at a certain price makes for a true bottom .

Many early adopters continue to wait for a world where they can simply use the Bitcoin itself, rather than converting it to fiat currency for usage. This world is increasingly developing, but it may be decades before Bitcoin and cryptocurrencies are commonplace, especially outside of the developing world where they offer a superior and much-needed alternative to local cash solutions.

Disclaimer: The views expressed in the article are solely those of the author and do not represent those of, nor should they be attributed to, CCN.com.

Featured Image from Shutterstock. Price Charts from TradingView .