The Dow Is Plummeting & the IMF Warns This Is ‘Humanity’s Darkest Hour’

Stock market sentiment soured after the International Monetary Fund (IMF) warned that the coronavirus pandemic is "humanity's darkest hour." | Source: Eduardo Munoz Alvarez/Getty Images/AFP

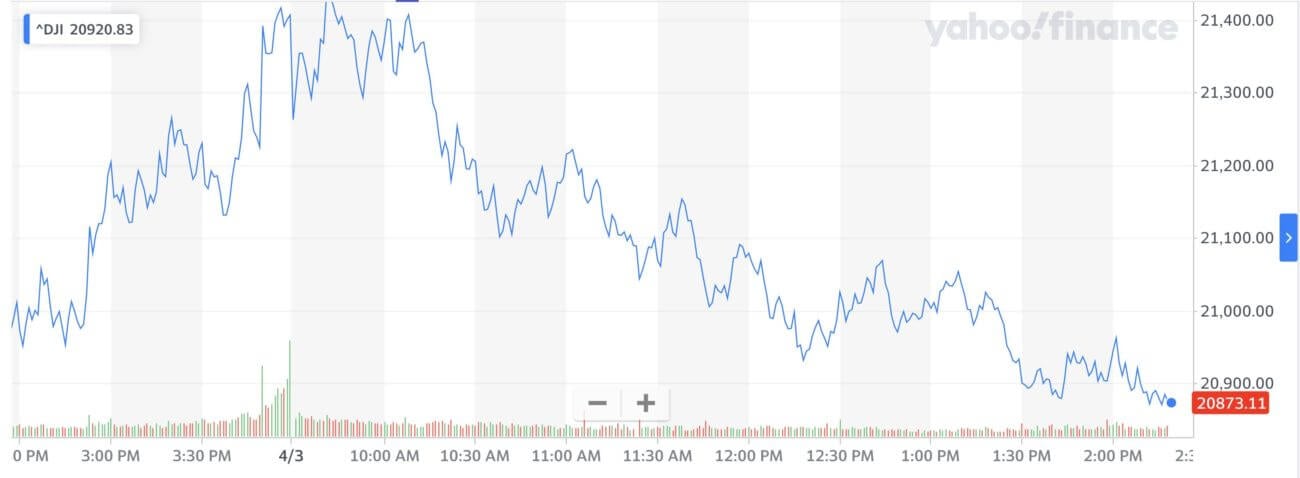

- The Dow Jones careened lower on Friday as the stock market recoiled from a horrific jobs report.

- Nordea warns the government’s Paycheck Protection Program won’t stop April’s unemployment report from getting even worse.

- IMF Managing Director Kristalina Georgieva said the coronavirus pandemic is “humanity’s darkest hour.”

A horrendous U.S. jobs report pummeled the Dow Jones Industrial Average (DJIA) on Friday, and stock market sentiment soured after the International Monetary Fund warned that the coronavirus pandemic is “humanity’s darkest hour.”

Unemployment is quickly spiraling higher, and problems with the government’s Paycheck Protection Program are only making the situation worse – creating new headaches for Dow bulls.

Dow Falls as Coronavirus Ravages U.S. Labor Market

There was a remarkable symmetry in the sell-off among the three most prominent U.S. stock market indices :

- The Dow fell 394.39 points or 1.84% to 21,019.05.

- The S&P 500 dropped 1.98% to 2,476.80.

- The Nasdaq slid 2.05% to 7,333.89.

Volatility continued to rule the commodity sector, and reports of an emergency OPEC meeting provided a strong push for oil prices. U.S. crude rallied 13% to trade above $28.50 per barrel, and Brent rose a stunning 14% to clear the $34 level.

Safe-haven asset gold rallied 0.5% to $1,646 despite a surge in the dollar, while silver fell 1.2% to $14.50.

Risk-off conditions continue to hit bond yields hard. The yield on the 10-year U.S. Treasury note dove below 0.59%.

The U.S. jobs report was considerably worse than economists had anticipated. Non-farm payrolls dove more by more than 700,000 jobs – a full 600,000 worse than the consensus forecast – and unemployment spiked to 4.4%.

There was a narrow 0.4% bounce in hourly earnings, but this is likely anomalous due to mass lay-offs in the low-wage retail and service sectors.

Unfortunately, this week’s jobless claims report reveals that conditions are only going to get worse. Economists at Nordea anticipate that the unemployment rate is set to triple

The risk is, therefore clearly leaned towards higher unemployment rates. Our projections though fit relatively nicely with Kaplan and Mester’s recent comments that the unemployment rate may peak in the low-to-mid teens, while they are far from Bullard’s horror scenario of 30% (in comparison, unemployment reached 25% during the Great Depression).

The government’s much-vaunted loan stimulus package aims to arrest this trend by helping small businesses make payroll during the economic shutdown.

Unfortunately for Dow Jones bulls, early indications are that the program is suffering a chaotic roll-out. Many small business owners have taken to Twitter to voice their frustration at Bank of America – the first major lender to begin accepting Paycheck Protection Program applications.

To BoA’s credit, they are at least trying to roll-out the program to some customers. JPMorgan Chase and Wells Fargo have yet to open their web portals .

IMF Director Calls for Unity During’ Humanity’s Darkest Hour’

https://www.youtube.com/watch?v=ScGVIoBX8_M

With the global number of confirmed coronavirus cases now above 1 million , the United States accounts for more than 258,000 of those infections.

As New York and the United Kingdom recorded their deadliest-ever days, IMF Managing Director Kristalina Georgieva sounded the alarm on the threat that the world economy faces during “humanity’s darkest hour” (video above):

Never in the history of the IMF have we witnessed the world economy come to a standstill. This is in my lifetime, humanity’s darkest hour, a big threat to the whole world, and it requires for us to stand us, be united.

Investors evidently did not respond positively to one of the world’s most prominent economists using such apocalyptic language.

Dow 30 Stocks: Raytheon Technologies Debuts, 3M Fights Back Against Trump

Another rough day in the Dow 30 saw the index’s most heavily weighted stock, Apple, dip 1.6% to $241 after news broke it wasn’t planning to reopen its stores until May at the earliest .

After being attacked by Donald Trump on Twitter for shipping respirators to Latin America and Canada, 3M hit back against the president’s invocation of the Defense Production Act to force them to halt exports. MMM fell 2.6%.

Strong demand for 3M’s N95 masks appears to be keeping a floor under the company’s share price despite the assault from the White House.

Raytheon Company completed its merger with United Technologies , and Raytheon Technologies Corporation debuted in the Dow Jones under the RTX ticker symbol.

The only two DJIA stocks firmly in the green were Pfizer and Boeing, moving 2.2% and 3.1% higher, respectively.