The Bitcoin Price Is Having the Time of Its Life (And It Owes It All to BIP 91)

The crypto comeback has been in full swing this week, as both the bitcoin price and ethereum price have increased by more than 30%.

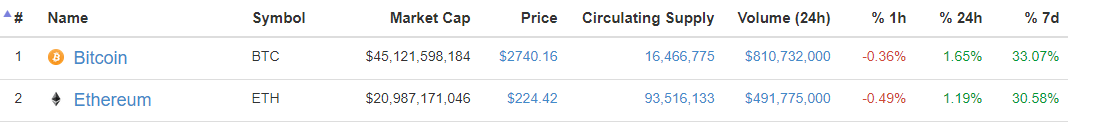

Just a week ago, the total value of all cryptocurrencies was $68 billion. Now, bitcoin and ethereum alone boast a combined market cap of $66 billion. At present, the total crypto market cap is $95 billion.

The next test will be whether the crypto market cap can burst through the $100 billion threshold for the first time since June 26.

Bitcoin Price Soars Following Segwit Lock-In

The bitcoin price spent the majority of July in decline due to investor fears regarding the August 1 scaling deadline and the potential bitcoin blockchain split. It reached a low point on July 16, falling below $1,900 for the first time since May.

The bitcoin price reversed course once it became clear that BIP 91 was going to receive the necessary support to lock-in. In the past week, the bitcoin price has climbed a staggering 33%, peaking at $2,860 on July 20 before settling down to its current value of $2,740. Bitcoin now has a market cap of more than $45 billion.

Nevertheless, bitcoin is not out of the woods yet, because BIP 91 does not completely guarantee the activation of Segwit. Developer Peter Todd recently said there was a 25% chance Segwit will not be activated. Since then, however, hashing support for Segwit has reached 95%, suggesting that the next phase of Segwit integration will proceed smoothly.

Ethereum Market Cap Climbs Past $20 Billion

For the most part, the ethereum price has kept pace with bitcoin. Since July 17 – when the ethereum price bottomed out at $160 – it has risen 31% to its present value of $224. Significantly, this rapid climb has occurred even as the Ethereum community is dealing with the fallout from the $32 million Parity wallet hack. Ethereum now has a market cap of $21 billion.

Crypto Comeback Leaves Two Altcoins in the Dust

The crypto comeback brought most altcoins gains of at least 10%. The Ripple price rose 25% to $0.194, increasing its market cap to $7.4 billion. The NEM price surged by 55% to $0.169, enabling NEM to vault over Dash and Ethereum Classic to assume fifth-place in the market cap rankings.

The Dash price rose 42% to $204, bringing its market cap to $1.5 billion. It successfully supplanted Ethereum Classic in the rankings, but it could not keep up with NEM’s rapid advance. The IOTA price rose a relatively-mundane 12% to $0.265, while Monero and EOS each rose by more than 30%.

Although most coins saw dramatic increases, none rose as much as 10th-ranked Stratis. The Stratis price shot up by more than 88% to $6, putting its market cap just under $600 million.

However, this week’s bull run has left two major coins behind: Litecoin and Ethereum Classic. The Litecoin price saw a modest 5% gain, raising its price to $44. However, it has experienced a steady decline against bitcoin during that timeframe. On July 17, Litecoin was trading at 0.02 BTC; now, it is valued at only .016 BTC. This represents a 22% decline.

Ethereum Classic shares a similar plight. The Ethereum Classic price has risen 8% this week to almost $16, but its bitcoin trading pair has dipped by 20% – from 0.0069 BTC last week to 0.0057 BTC on July 24.

Consequently, Ethereum Classic has dropped from fifth to seventh in the market cap rankings.

Bitcoin Continues to Dominate Market Cap

Bitcoin managed to maintain a 47% market cap share during this week’s market recovery. Ethereum currently controls 22% of the market cap, while Ripple has seen its share fall back below 8%.

Featured image from Shutterstock.