Tesla’s Stock Crashes as Wall Street Predicts Armageddon

Tesla's stock hit a fresh 52-week low, falling 6% today on news that Elon Musk is cutting prices on some of the company's older model cars. | Source: Shutterstock

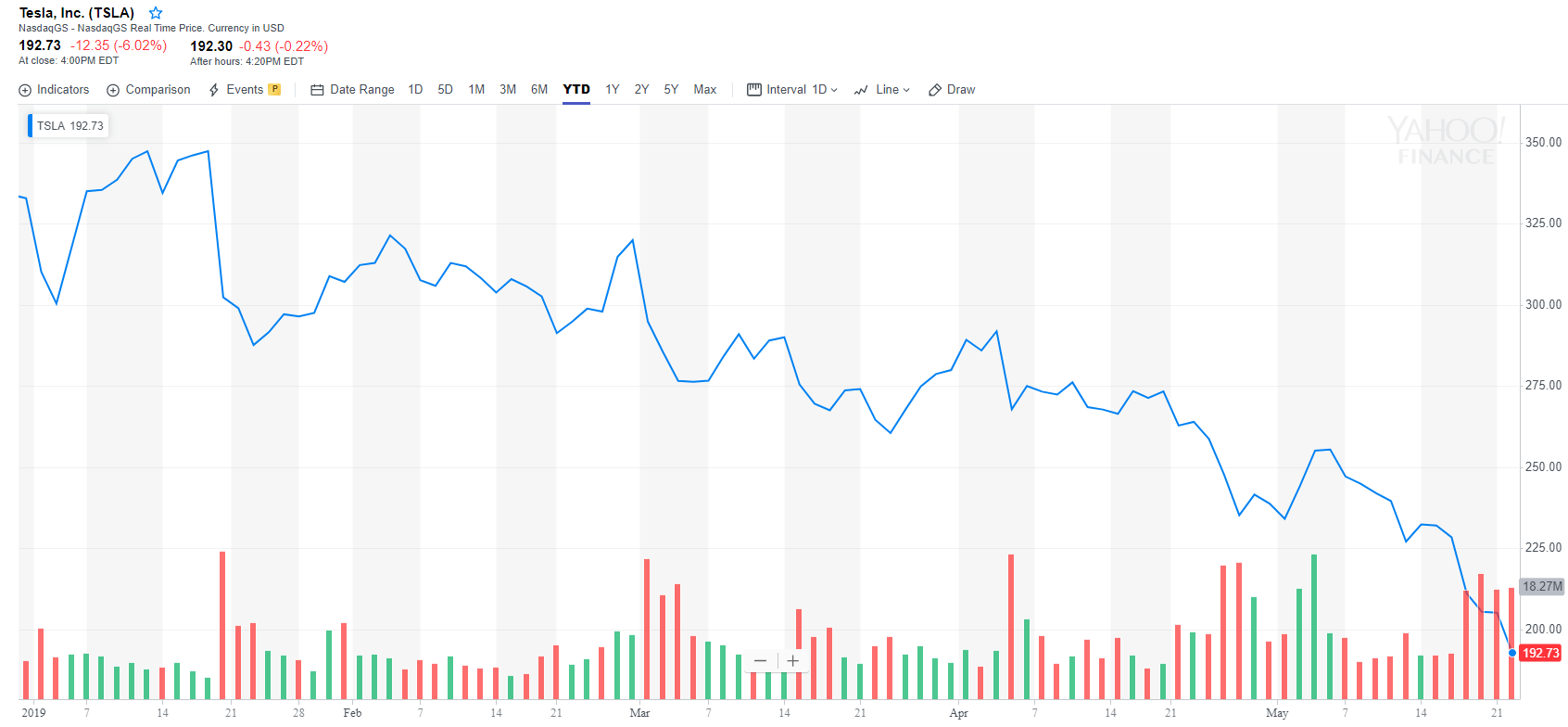

By CCN.com: Tesla’s stock is down another 6% today, the sixth consecutive session TSLA shares have fallen. It is now down 40% year-to-date.

Tesla Car Price and Stock Price Are Both Falling

Tesla’s stock is getting hammered today because of the company’s announcement that it is cutting prices on older model S and X vehicles. Merrill Lynch put out a note expressing concern that sales on those models have peaked and are losing market share to its own Model 3.

Analysts are starting to get a clue that Tesla’s stock has always been a sucker’s bet, with Morgan Stanley lowering its worst-case scenario price target to $10:

“Our revised bear case assumes Tesla misses our current Chinese volume forecast by roughly half to account for the highly volatile trade situation in the region, particularly around areas of technology, which we believe run a high and increasing risk of government/regulatory attention.”

Citi lowered its Tesla stock price target to $36:

“The recent capital raise was a positive step but won’t necessarily get the balance sheet out of the woods if Tesla cannot achieve FCF targets. So the recent reported internal memo, which seemingly called into question prior guidance, didn’t help the risk/reward calculus. The implications can be serious, since an automaker’s balance sheet is always subject to the confidence “spiral” risk.”

The Tesla Honeymoon Is Over

Tesla’s stock had defied gravity for years even as problems with its cars mounted. From cars spontaneously bursting into flames to auto-driver crashes to production delays and shortages of parts, Tesla and Elon Musk managed to paper over all of these problems.

Yet things finally took a turn when Tesla’s cash burn caught up with it, forcing the company to draw down additional funding a few weeks ago after reporting a disastrous loss of $702 million in the first quarter. This loss came on the back of a 30% decline in quarterly deliveries of vehicles over the previous quarter.

Some of this decline is the result of the $7,500 tax credit being cut in half, once again proving that rent-seeking Elon Musk built his empire on the backs of government subsidies.

Consumer Reports Eviscerated Elon Musk

Then, a high-profile scolding from Consumer Reports, which slammed Elon Musk and Tesla for putting investors over safety, appeared to stick:

“We’ve heard promises of self-driving vehicles being just around the corner from Tesla before. Claims about the company’s driving automation systems and safety are not backed up by the data, and it seems today’s presentations had more to do with investors than consumers’ safety.”

Elon Musk has been able to sweep all of Tesla’s problems under the rug with the help of bullish water carriers who insisted that TSLA should be valued as a tech stock and not as a manufacturer with endless problems.

Tesla Competition Is Also Heating Up

It’s not just internal problems that have been dogging Elon Musk. The rest of the auto world is the shark chasing his tail, as companies like BMW continue to pursue their own electric vehicles.

It appears that Wall Street is finally awakening to the scam that Tesla stock is and that Elon Musk is no longer the Teflon chief.