The Stock Market Flashed a Catastrophic Warning, But No One’s Listening

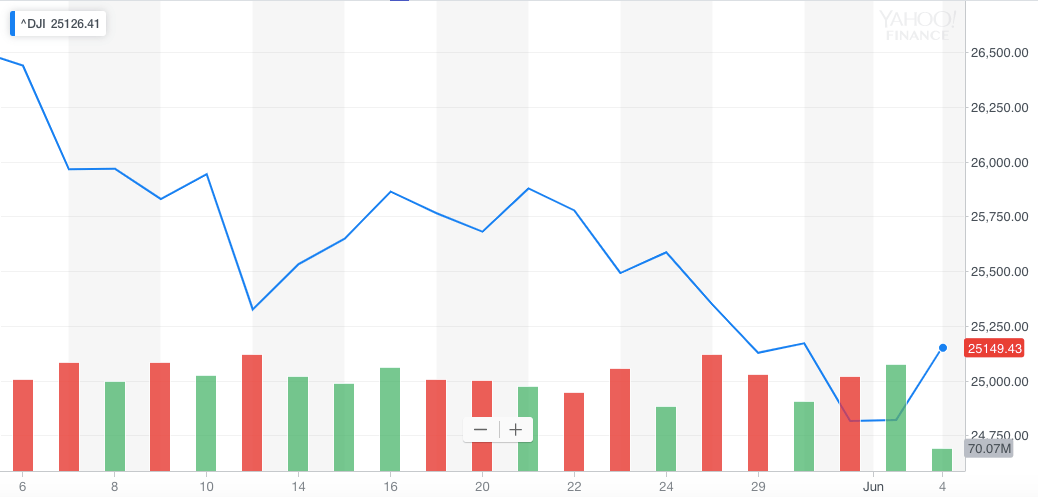

The Dow suffered a vicious 750 point crash as the German economy teetered on the brink of a devastating recession. | Source: REUTERS/Kai Pfaffenbach

By CCN.com: The U.S. stock market is sounding a catastrophic recession warning. The evidence is flashing in bright colors, and the alarms are absolutely deafening. But no one on Wall Street is listening.

Twice this year, the 3-month (short-term) Treasury yield was greater than the 10-year (long-term) Treasury yield, in what’s known as an inverted yield curve . This indicator is a strongly-correlated precursor to an economic downturn. The longer it lasts, the more likely the recession, Business Insider reports.

Morgan Stanley researchers have found that inversions lasting more than one month have preceded every stock market recession in the last 50 years. The current inversion is currently two weeks old.

3 More Reasons to Be Bearish on the Stock Market

If the two-week inversion isn’t enough to get you worried, there at least three other indicators that paint a bleak picture for the U.S. stock market in the next year or two.

The downward shift of long-term Treasury yields is mainly due to investors’ fear of holding stocks. The Dow is reacting poorly to the potential trade war between the U.S. and China. As talks continue to heat up, businesses and investors are worried that high tariffs will lead to reduced economic growth in the coming years.

We see a similar lack of confidence in the credit market. Lisa Shalett, Morgan Stanley Wealth Management CIO, reports that they’re recording a widening spread between corporate bond yields and Treasury yields. A growing range between the two is another indication that investors feel more risk in corporations.

Finally, Shalett puts the underperformance of growth sector companies as the nail in the stock market coffin:

“Tech leadership is breaking down while defensive sectors like utilities are holding up better. At the same time, small-cap stocks are underperforming large-caps. This rotation in stock sector performance is echoing the yield curve’s message.”

Amazon, Facebook, Google – all three are down double-digit percentages from their previous highs. And, antitrust investigations may keep them contained for a while.

Greedy Investors Don’t Seem to Care

Even though the indicators are pointing towards doom and gloom, investors are buying up shares on any piece of positive news.

Today, the stock market made a massive recovery following an announcement that the Chinese government may reverse it’s previously hostile trade war strategy.

But, it’s uncertain how long that position will last. Just one month ago, President Trump was tweeting threats of massive tariff hikes to Chinese imports.

As long as the inverted yield curve is in play and growth sector stocks keep underperforming, we should remain extremely cautious in this economic landscape.

Click here for a real-time Dow Jones Industrial Average price chart.