Roku Shares in Free Fall as FedEx Stock Steadies After Wednesday Rout

It's the era of the streaming wars and Roku shares are taking a beating | Source: REUTERS/Brendan McDermid/File Photo

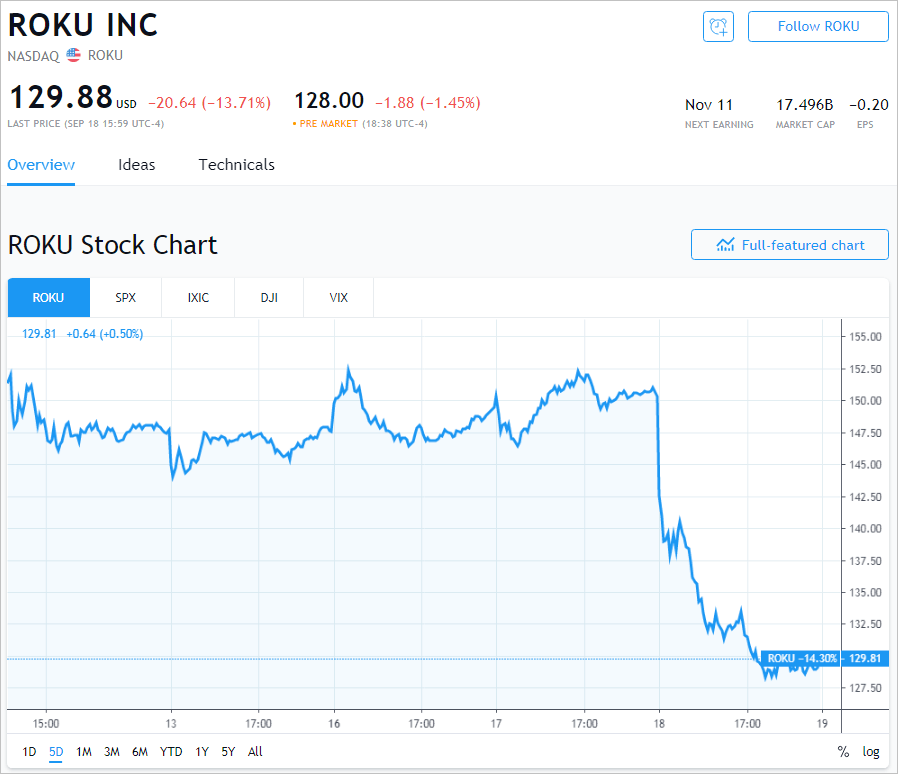

The shares of streaming devices manufacturer and online media content aggregator Roku continue to tumble in the pre-market hours after they slid by over 13% on Wednesday. On the other hand, Fedex which was another big loser on Wednesday after falling by 12.92% seemed to have contained the bleeding in Thursday’s pre-market hours.

Comcast Lands Severe Blow

Roku’s tumble followed a move by telecommunications conglomerate Comcast to introduce a service that will directly compete with the streaming devices maker. After closing Tuesday at slightly over $150 per share, the stock Roku tumbled by 13.71% on Wednesday to end the day at below $130 per share.

In the Comcast move, the telecommunications conglomerate aimed directly at the core of Roku’s business – its streaming boxes. Specifically, Comcast will turn a paid-for streaming box known as Xfinity Flex into a free product to subscribers of its Xfinity Internet-only service.

Previously, Comcast charged $5 per month for the streaming box which allows users to stream content from a sea of apps and platforms including Amazon Prime Video, YouTube and Netflix. Unlike Roku’s, Comcast’s stock, on the other hand, barely moved on Wednesday and closed the day slightly higher after appreciating by 0.58%.

Despite the drop, Roku is still nearly three times its price in January. Since the year started the stock has climbed by 294%. It now has a market cap of $17.5 billion.

Fedex delivers the bad news

Fedex’s drop of nearly 13% on Wednesday came after its first-quarter earnings missed market expectations and Wall Street analysts downgraded the stock.

Earlier in the week, the courier services firm had cut its guidance for fiscal 2020 by around 18%. Fedex chairman and CEO, Frederick Smith blamed the pessimistic outlook on decelerating global economic growth and trade tensions:

Our performance continues to be negatively impacted by a weakening global macro environment driven by increasing trade tensions and policy uncertainty.

This saw the stock fall from slightly above $173 to around $150, a 12.92% drop.