Future Gains! Bitcoin Has Bottomed Out, Says Pantera Capital in a Bold Call

Now’s the time to get long bitcoin, a leading cryptocurrency hedge fund says. Not only is bitcoin out of the doldrums, but it’s onward and upward from here.

This according to Pantera Capital Management, a cryptocurrency hedge fund with $800 million-plus in assets under management, in a letter to investors cited on Bloomberg .

“For those who are new to Pantera who might think a fund manager like Pantera would always be saying ‘Today’s a great day to get long. I rarely have such strong conviction on timing. A wall of institutional money will drive the markets much higher,” according to Pantera’s Dan Morehead and Joey Krug in the note.

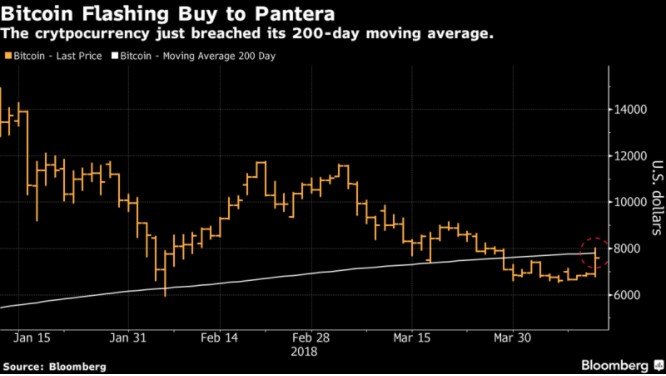

Just look at their track record. Pantera, which first gained exposure to bitcoin in 2014, has only made a trio of buy calls and a single recommendation in the past seven years, as per their note. So they’re not reckless about making these calls in the least. The latest call of a bottom comes on the heels of bitcoin breaching its pivotal 200-day moving average, which reflects the long-term trend.

A rising tide lifts all boats, and the other cryptocurrencies are trading in the green as well. The news couldn’t come too soon after the bitcoin price had been slipping and sliding since a month ago. If Pantera’s right, the storm clouds have cleared and the sun is about to shine on bitcoin investors.

Every bitcoin investor has been wondering what the bottom is during this bear market of 2018, and Pantera said the floor was $6,500. Now that it’s crossed the psychologically important 200-day moving average, and while every day may not be an up day, expect trading above that level for most of the coming year. Not only that, but it’s only a matter of time before bitcoin beats last year’s record price of nearly $20,000.

Worst is Over

Nobody is happier to hear that the worst is over for bitcoin than Pantera, which through year-end 2017 had generated returns of some 25,000% since the fund’s inception. But Pantera like many funds invested in cryptocurrencies has struggled with the bear market, especially in March.

The value of its Digital Asset Fund was nearly halved last month when it lost 45.7% of its value. It was the volatility in the bitcoin price that rocked the fund, “which was the worst in [their] model’s 27-month history,” as per Pantera’s Krug cited in last month’s investor letter.

Krug is no doubt breathing a sigh of relief as all of the crypto community can do now that this technically important level has been achieved.

Featured image from Shutterstock.