‘Nuclear Option’: ABC Dev Won’t Rule out Changing Bitcoin Cash PoW Algorithm

Was Amaury Sechet serious when he claimed to be the person who created Bitcoin? | Source: CoinGeek/YouTube

The Bitcoin Cash civil war is just days away from culminating in a contentious blockchain split, and the lead developer of the faction with the minority hashrate has advised that the development community should “get a patch ready” in case they need to pursue an emergency hard fork to change the cryptocurrency’s Proof-of-Work (PoW) algorithm.

Bitcoin ABC Dev. Open to ‘Nuclear Option’

Writing on Twitter, Bitcoin ABC lead developer and self-described Bitcoin Cash “benevolent dictator” Amaury Séchet said that activating an emergency fork to alter the Bitcoin Cash hashing algorithm would be a “nuclear option” but that developers should keep it on the table in case their version of Bitcoin Cash (BCHSV) suffers an attack from miners backing Bitcoin SV (BCHSV), the BCH version promoted by Craig Wright and billionaire Calvin Ayre.

“You should get a patch ready. It’s better to be ready and not need it than to need it and not be ready,” Séchet said when asked whether he supported a PoW change. “Changing PoW is somewhat of a nuclear option so I’d be reluctant to use it. But it always has been considered the option of last resort in case a large portion of miner become hostile, so we should be ready.”

Craig Wright-Backed SV Boasts Dominant Hashrate

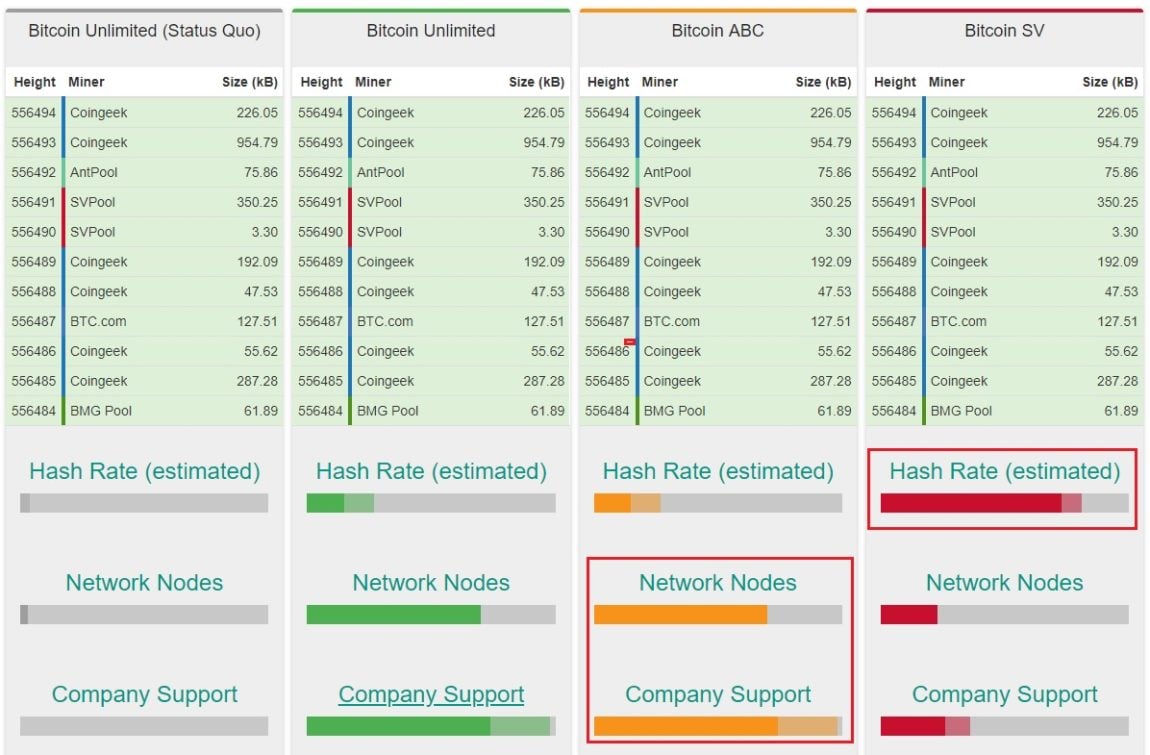

Ready indeed, because despite strong community and business support, the hashrate has — at least in the days leading up to the fork — largely rallied behind BCHSV. The SV camp appears to possess the dominant hashrate, with Coin Dance estimating that ~75 to 80 percent of miners are signaling for SV compared to just ~15 to 27 percent for ABC.

Craig Wright, who as recently as this month claimed in an email that he was Bitcoin creator Satoshi Nakamoto, has threatened that SV miners will use their massive hash power to attack the BCHABC blockchain, and he is not the only SV backer to issue this warning.

Last week, Bitcoin Cash startup and BCHSV supporter CashPay Solutions opened a mining pool — SharkPool — whose sole purpose is to attack altcoins and BCH forks that it considers illegitimate — including BCHABC.

“SharkPool considers all alterations to the original Bitcoin design a threat, this includes a potential ABC chain if they choose to not capitulate in time and accept the SV ruleset prior to the hard fork,” co-founder Ari Kuqi told CCN.com in an emailed statement. “ABC has been hinting at a possible PoW change and accepting minority hash; this doesn’t change anything. There will be no splits of Bitcoin and the leeched value in the shape of alts and forks will be brought back.”

“You either build on Bitcoin or you use a central database,” he added.

Nodes, Businesses Back ABC

At present, Bitcoin Cash is mined using SHA256, the same hashing algorithm used on Bitcoin and a variety of other cryptocurrency networks. SHA256 has long been ASIC-compatible, so aside from the odd cryptojacking-related botnet, BCH can only be mined profitably using these specialized mining devices, which achieved enhanced efficiency by sacrificing versatility.

Altering the BCHABC hashing algorithm would represent a major shift for the cryptocurrency network, as it would prevent SHA256 ASIC owners from mining BCHABC blockchain. But, while that would prevent ABC supporters from mining BCHABC with their current hardware, it would also secure the network against an attack from the SV camp — at least in the near-term.

BCHABC appears to have more on-the-ground support, which is why some have suggested a PoW change to immunize the cryptocurrency against malicious miners who support the other chain. BCH node operators are more than three times as likely to run the Bitcoin ABC client than Bitcoin SV, and 98 percent of BCH-integrated companies have signaled that they are prepared to support the BCHABC network — just 36 percent of companies have said the same for BCHSV.

Perhaps more tellingly, traders have consistently priced BCHABC tokens far above BCHSV ones on exchanges that allow users to exchange physical bitcoin cash for pre-fork “futures” tokens. On Poloniex, the first crypto exchange to offer pre-fork BCH trading, BCHABC is currently trading at $393 while BCHSV is priced at $129.

Backers believe that, while a drastic measure, altering the cryptocurrency’s PoW algorithm could secure BCHABC the opportunity to leverage its community and business support to cement its status as the “real” Bitcoin Cash network, even without majority miner support.

Featured Image from CoinGeek/YouTube