TikTok Ban: What Does This Mean for Meta?

A possible TikTok ban in the US may push sales on Meta social platforms, in a market valued more than several billions dollar. l Credit: Alex Wong/Getty Images

Key Takeaways

- A possible US ban might jeopardize TikTok’s goal of reaching $20 billion in annual sales.

- Meta – Facebook and Instagram’s owner – could be a major beneficiary if TikTok exits the US market.

- The US ban and social brands’ hesitance on social commerce create uncertainties in this evolving space.

TikTok’s ambition to achieve a $20 billion annual gross merchandise value faces jeopardy due to a potential ban in the US, a significant source of its traffic. In such a scenario, Meta stands to gain, given that ByteDance’s app has already captured a portion of the virtual market.

The fate of TikTok remains uncertain in the US, with another lawsuit pending in Europe. However, the competition between ByteDance and the owner of Facebook appears to revolve around online sales, signaling the battleground for dominance in this space.

The Market Figures

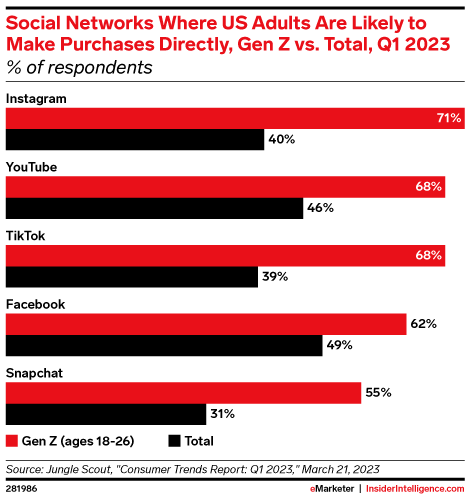

According to Statista , Facebook and Instagram currently hold the top positions in the global ranking of preferred social networks for purchases, with 27% and 20% of total digital buyers, respectively. TikTok and YouTube follow closely, tied at 8% in 2023, with WhatsApp, also under Meta, at 7%.

In a bid to capitalize on its growing popularity, ByteDance launched an international shopping platform in the West in 2021, selecting the United Kingdom as its initial foreign market to replicate the success of Douyin, TikTok’s Chinese counterpart, which generated up to $10 billion in annual sales since its 2017 launch.

Despite a slow start in the UK, TikTok has revamped its Western business model by introducing new features, including Trendy Beat , launched in June 2023 in the UK. This feature allows users to purchase items featured in viral videos produced by a Singapore-based company owned by ByteDance. This move marks a significant shift in TikTok’s e-commerce strategy, posing a threat to Amazon, Shein, and Temu.

With a user base of 23 million and over 1.5 million registered businesses in the UK, TikTok is estimated to generate sales of $20 million per quarter.

But e-commerce also debuted in the United States in September, presenting a promising market. However, this growth potential faces uncertainty due to a new bill proposed by US legislators, aiming to pressure Bytedance to divest its application to continue operating in the country six months before the proposed social media bans take effect.

A Chance For Meta?

Recently, US Congressmen passed a bill urging ByteDance to divest its micro-video application to a non-Chinese entity within six months, under threat of being banned from the country. While the measure awaits approval from the Senate and President Biden, its potential implications are significant, especially given ByteDance’s recent foray into e-commerce in the US. Bytedance’s e-commerce had already amassed $16 billion in annual sales just a few months after its American debut.

If the ban doesn’t materialize, eMarketer forecasts a continued positive trajectory for TikTok, estimating 40.7 million buyers for 2024. In comparison, Facebook and Instagram are projected to lead with 64.4 and 48.8 million buyers, respectively.

Notably, TikTok outpaced both Meta and Pinterest in net customer gains in 2023. PwC Luxury & Fashion revealed that the US social shopping market comprises 33.3 million social buyers and 250,000 registered companies, primarily focused on beauty and fashion.

But Instagram, a flagship under the Meta umbrella, is still at the top among most-used apps. In 2023, Instagram claimed the title of the world’s most downloaded app, surpassing TikTok. Sensor Tower data revealed a 20% increase in Instagram downloads globally, totaling 767 million, compared to TikTok’s 4% growth.

A contributing factor to Instagram’s success is its adoption of the Reels feature, which mirrors TikTok’s format and has proven to be a major hit. However, this – and the US ban – may not suffice, as Meta must prioritize innovation in 2024.

Innovation Can Be The Key

According to recent research from Forrester, 68% of US teenagers use TikTok weekly, surpassing all other platforms. To effectively target this demographic, Meta must enhance its innovation efforts and accelerate the development of features that resonate with younger audiences.

So, we’d expect a significant push from Meta this year, particularly with new product updates leveraging artificial intelligence (AI) technology, aimed at impressing and retaining TikTok users.

“Nevertheless, any potential TikTok ban in the US could prompt lawmakers to scrutinize Meta’s dominance in the social media landscape, raising concerns about competition and user privacy,” Forrester researchers said.

This could result in increased regulatory actions or antitrust investigations. And it would pose a dual challenge for Meta: either solidifying its position as a monopoly or facing stricter regulation.

Furthermore, the proposed bill represents the most significant threat to TikTok’s presence in the US market to date. The implications span geopolitics and domestic regulation. The outcome of this legislation will have far-reaching consequences.

This Won’t Be Smooth Sailing for Meta

Firstly, the approval of the US ban by the Senate and President Biden is uncertain. Secondly, the potential acquirer of TikTok remains unclear. And it’s not sure whether ByteDance is compelled to sell the app. However, there are additional uncertainties to consider.

A potential TikTok ban could reshape the social media landscape, favoring Meta’s dominance and impacting ad pricing. Facebook and Instagram could benefit from reduced competition, experiencing increased ad revenues and CPMs.

Advertisers targeting TikTok’s audience may shift to Facebook and Instagram, boosting demand for ad space and potentially raising CPMs.

Moreover, the absence of TikTok could attract more content creators and influencers to Meta’s platforms, enhancing user engagement and advertiser appeal.

However, several factors could temper these benefits. Firstly, user and advertiser migration may not be seamless, as preferences may not align perfectly with Facebook and Instagram’s features. Increased regulatory scrutiny could arise, focusing on competition and monopolistic practices in the tech industry, and other platforms may emerge to fill the void, diminishing the advantages for Meta.