FTX Bankruptcy Claims Rise to 93%, Market Sentiment Improves

Bankman Fried's FTX claim value soars. | Credit: Michael M. Santiago/Getty Images

Key Takeaways

- The value of FTX bankruptcy claims has skyrocketed in recent months.

- FTX bankruptcy claims market has emerged, with companies specializing in distressed assets actively purchasing them.

- Million-dollar claims have recently traded, indicating creditor movement.

- FTX’s ongoing liquidation efforts are increasing their cash holdings.

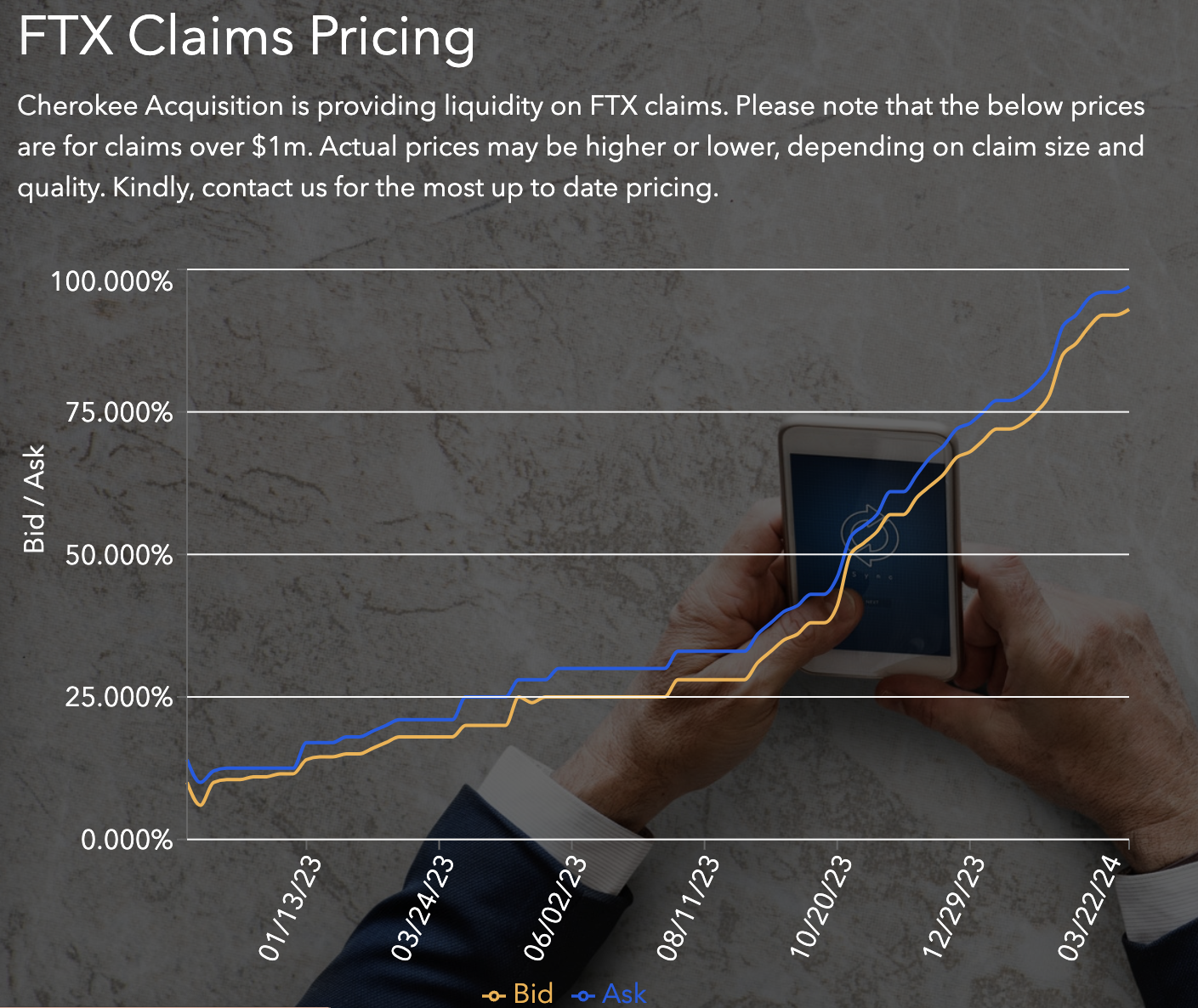

Six months ago, companies specializing in buying distressed businesses and their debts were actively purchasing FTX bankruptcy claims valued at millions, proposing $0.33 for every dollar of the claim.

Now, however, the value of these claims has gone up, with buyers now willing to pay $0.93 on the dollar for each claim.

FTX Debts Soar, Claims Now Worth 93% Despite Company Collapse

In September 2023, a report covered the flow of investments into markets for bankruptcy claims, with a special emphasis on claims related to the collapsed FTX.

The report said that companies including Diameter Capital Partners, Attestor Capital, and Silver Point Capital started acquiring FTX claims at the outset of 2023.

In January 2023, the bids for these claims were worth $0.145 per dollar. By September, however, their value reached $0.33 per dollar per claim. Presently, Cherokee Acquisition , the company behind Claims Market, says that bids for these claims have surged to $0.93 on the dollar.

FTX did not immediately respond to a request for comment.

From Pennies to Millions: Creditors Cash Out on Bankruptcy Claims

Significant transactions in the FTX bankruptcy claims market included a $2.34 million claim sold on March 22 and a $3.6 million claim traded on March 19. The FTX bankruptcy docket, which records these transfers and applies a $28 fee to various acquisition firms, notes some transfers with anonymized names.

The movement started to gain momentum shortly after the bankruptcy proceedings kicked off. At that time many creditors initially settled for much less than $0.93 on the dollar. By February 1, claimants began selling their claims at $0.75 on the dollar.

Although not the scenario of receiving crypto payments in-kind that some FTX creditors would prefer, the opportunity to obtain 93% of their claim’s value immediately and to fully extricate themselves from the FTX situation has been seen as advantageous by others. Throughout this process, large corporations specializing in debt acquisition have demonstrated a strong interest in buying these divested claims.

Increased Liquidation Boosts Cash Reserves for Reimbursing Clients

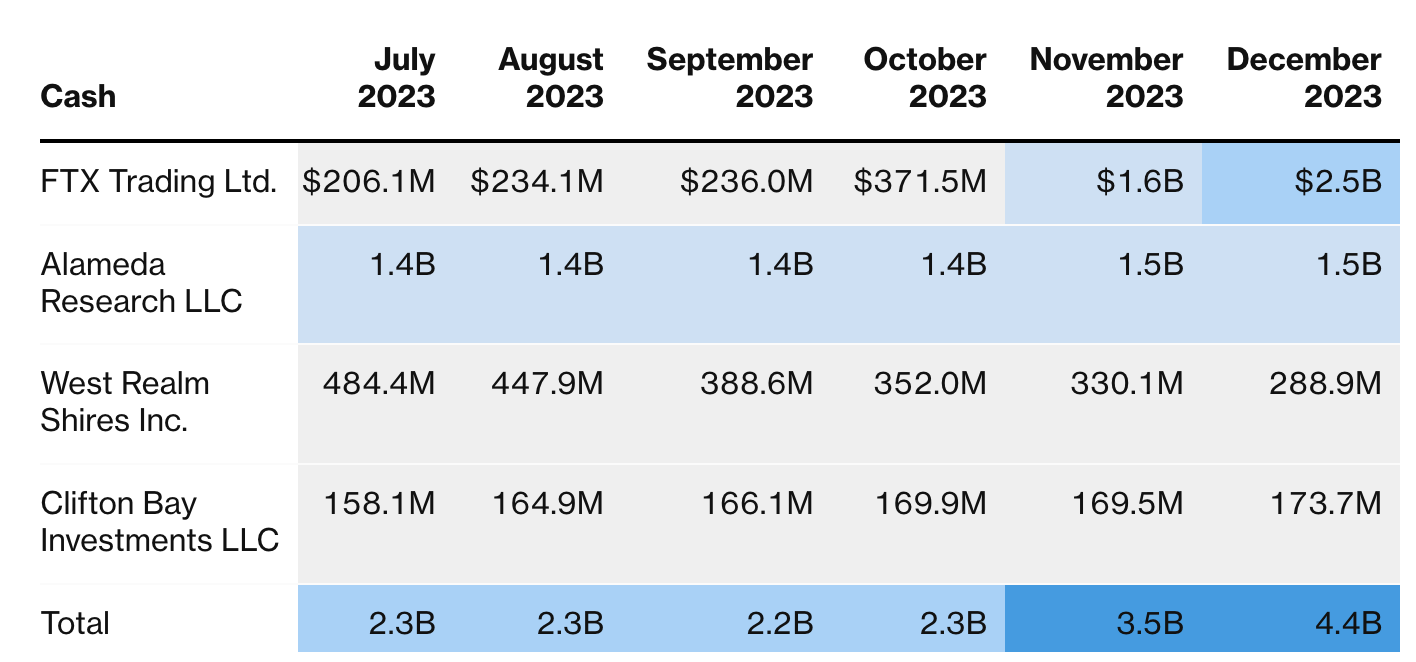

In January, it was disclosed that, as a component of its bankruptcy proceedings, FTX is actively selling off its cryptocurrency assets and gathering cash to repay clients whose assets were frozen following the platform’s collapse in 2022.

The enterprise’s four main subsidiaries, including FTX Trading Ltd. and Alameda Research LLC, have markedly boosted the company’s cash reserves. Based on reports from Chapter 11 monthly operations, these reserves surged to $4.4 billion at the end of 2023. This represented a significant increase from roughly $2.3 billion in late October. It is important to note that the aggregate cash holdings across all FTX’s affiliates are anticipated to be even higher.

More than a year after the FTX debacle, what emerging investment trends are crypto specialists and informed investors observing? Amid apprehension regarding the crypto market’s stability, there appears to be a silver lining for exchanges ready to evolve and adhere to stricter regulatory guidelines.