Peter Schiff vs Raoul Pal — Bitcoin Price to $1 Million?

Raoul Pal and Peter Schiff's discussion illuminated contrasting views on Bitcoin. | Credit: Veronica Cestari, CCN

Key Takeaways

- Raoul Pal and Peter Schiff’s discussion illuminated contrasting views on Bitcoin.

- They discussed AI, policy, and tech reshaping the economy.

- Schiff highlighted Bitcoin’s speculative nature and questioned its sustainability

- Pal remained hopeful about blockchain technology’s role in fostering trust and digital currency adoption despite market volatility.

In a recent episode of the Impact Theory podcast, listeners were treated to a discussion that delved into finance and digital currencies.

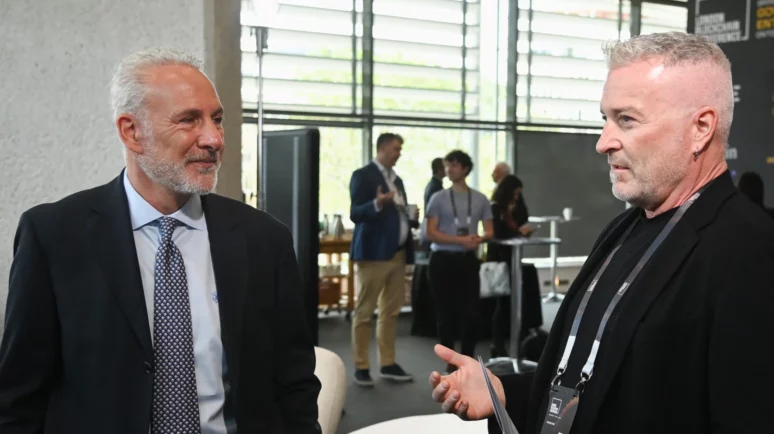

Economists and investment experts Raoul Pal and Peter Schiff engaged in a head-to-head discussion . The pair discussed Bitcoin, the state of the economy, and the prospective future of financial systems.

Financial Titans Clash: Raoul Pal and Peter Schiff Debate Bitcoin

Raoul Pal, a former hedge fund manager who retired at 36, was matched against Peter Schiff, a Wall Street veteran known for his accurate predictions regarding market performance.

The conversation covered a wide array of topics, reflecting on the fundamental debate over value versus price, the ominous possibility of a currency collapse, and Bitcoin’s enticing allure compared to the traditional gold standard.

Discussions also ventured into how the upcoming 2024 election could influence market dynamics, the potential of AI to solve economic challenges, and various strategies for preparing for hyperinflation or financial repression. Additionally, the debate touched on the impact of volatile markets on asset values. It also considered the looming issue of national debt and possible hyperinflation, historical instances of financial repression, the innovative potential of blockchain technology, and the uncertain future of Social Security.

Pal Sees Bitcoin’s Future Tied to Adoption, Schiff Stays Skeptical

Pal said he would reconsider his stance if Bitcoin’s network activity and adoption decreased, signaling a loss in value. Schiff remained skeptical. His opinions remain unchanged, despite Bitcoin’s price fluctuations and lack of widespread transactional use.

Pal says a significant decline in Bitcoin’s network activity and interest could signal its failure as a store of value, similar to gold’s challenges in the digital era. He emphasized that if Bitcoin’s usage, transaction volume, and new adopter rates fall persistently, it might indicate inherent issues with the network’s viability, despite increasing adoption during market downturns, which suggests resilience against short-term price fluctuations.

He talked about significant downturns in the cryptocurrency market. Onr downturn prompted him to question whether it signaled a cessation in adoption or was merely a part of the natural business cycle. Despite these substantial losses, Pal remains optimistic about the future, suggesting that the digital and blockchain adoption trends would continue to grow, underscoring his belief in the enduring appeal and utility of digital currencies and blockchain technology in the years ahead.

Schiff, on the other hand, remains skeptical about Bitcoin’s practical use and widespread adoption, despite its price fluctuation from a few dollars to $60,000. He notes minimal real-world transaction use within his business and recalls the fade of initial corporate interest in Bitcoin transactions.

Bitcoin: Trust Machine or Speculative Bubble? Experts Clash on Future Value

Schiff contrasted Bitcoin’s volatility and speculative nature with its initial promise of banking system independence and privacy. Dan Tapiero’s view of Bitcoin as a “security truth machine” and a solution to trust issues in financial systems offers a different perspective, however.

Schiff highlighted the speculative nature of Bitcoin, expressing concern over its volatility and questioning the sustainability of its value. He pointed out the possibility of Bitcoin’s price fluctuating significantly, noting that it could rise from $60,000 to $100,000, $1 million, or fall to $10,000 or lower.

He noted the uncertainty of Bitcoin’s future performance despite its history of recovery. it with speculative investments in gold stocks, which he considers based on their perceived undervaluation.

Schiff Critiques Gov’s Money Creation, Pal Ponders Gold and AI’s Role

Peter Schiff criticized the government’s method of indirectly taking money from its citizens by creating money out of thin air, which he equated to a form of taxation that reduces purchasing power.

He said:

“Instead of taking your money by taxing you openly and directly or even indirectly through a sales tax, [the government] surreptitiously robs you of your purchasing power by just creating money out of thin air, usually with a complicit central bank.”

Raoul Pal talked about the diminishing performance of gold against the backdrop of global currency debasement.

Schiff also expressed skepticism towards Bitcoin as an alternative to traditional currencies. Meanwhile, Pal questioned the future economic value in a world increasingly dominated by AI and automation.

Pal said:

“What’s harder is to say, what the hell does an economy mean after 2030, when you’ve got endless AI and robots and AGI? What what value do you provide in that world?”