Joe Biden Could Veto US House Bill Overturning SEC Crypto Rules

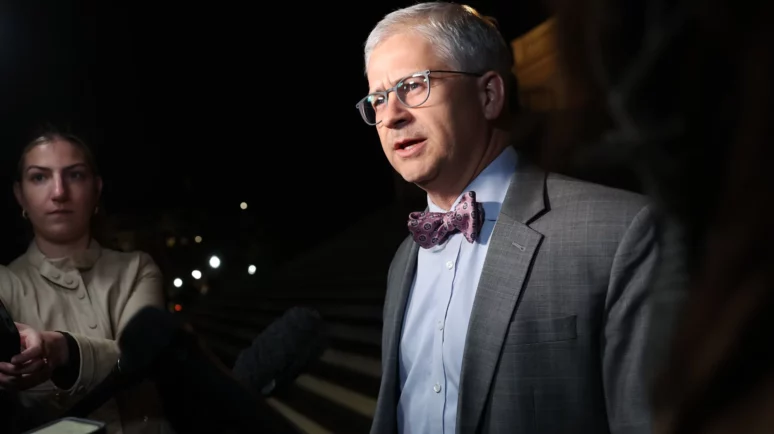

Will Biden veto the SAB121 overturn decision? | Credit: Scott Olson/Getty Images

Key Takeaways

- The US House of Representatives has passed a resolution opposing the SEC’s SAB 121

- Despite this congressional action, the Biden administration may veto the bill.

- Patrick Mchenry and Tom Emmer are among supporters of the resolution to overturn SAB 121.

The United States House of Representatives recently voted to pass H.J. Res 109, a bipartisan bill that overturns the Securities and Exchange Commission’s (SEC) Special Accounting Bulletin 121 (SAB 121) .

However, the Executive branch, including President Joe Biden, oppose this resolution. Biden has even indicated that he would exercise his veto power against the bill.

Bipartisan Support Leads to House Passage Despite Biden Veto Threat

Republican Party Representative Mike Flood, who introduced the resolution, criticized SAB 121 for its unfair treatment of banks wishing to custody crypto, noting that custodial assets are typically considered off-balance sheet.

The bill received notable bipartisan support, with 21 Democratic Party members voting in favor, alongside 207 Republicans. This coalition resulted in the bill passing the House with a total of 228 votes to 182.

Despite the bill’s passage in the House of Representatives, President Biden has stated that he would veto it.

This bulletin had previously required banks to list their customers’ cryptocurrency assets on their balance sheets, a stipulation not applied to traditional assets such as securities.

Will Biden Veto the Decision and When?

In a statement on May 8, the White House expressed strong opposition to efforts by members of the House of Representatives to overturn SAB 121, arguing that doing so would hinder the SEC’s ability to protect investors in crypto-asset markets and to safeguard the broader financial system.

As per the statement :

“Limiting the SEC’s ability to maintain a comprehensive and effective financial regulatory framework for crypto-assets would introduce substantial financial instability and market uncertainty. If the President were presented with H.J. Res. 109, he would veto it.”

Introduced by the SEC in March 2022, SAB 121 establishes accounting guidelines for institutions that custody crypto assets. The guidelines are structured in such a way that they virtually prevent banks from holding crypto assets for clients. U.S. lawmakers and SEC Commissioner Hester Peirce have criticized SAB 121, arguing that it deters regulated banks from serving as crypto custodians and imposes a different set of rules on crypto holdings compared to other assets.

In response, the House Financial Services Committee (HFSC) stated on May 8 that by overturning SAB 121 through the bipartisan resolution, they aim to protect consumers by removing barriers that currently prevent highly regulated financial institutions and firms from acting as custodians of digital assets.

McHenry Backs Resolution Against SAB 121, Slams SEC Overreach

Patrick McHenry, the Chairman of the House Financial Services Committee, supported the resolution to overturn SAB 121, which he described as “one of the most glaring examples” of overreach by the SEC under the leadership of Gary Gensler. McHenry criticized the SEC for bypassing the usual public comment and rulemaking procedures mandated by the Administrative Procedure Act (APA) by categorizing the requirements as mere staff guidance.

He said:

“If you want American assets to be protected, they should be held in custody, not on the bank’s balance sheet. […] And finally, if you want to send a message that rogue regulators cannot circumvent Congress in our well-established rule-making process, vote yes.”

He further argued that SAB 121 imposes excessive costs on banks looking to provide custody services for customer crypto assets and warned that fewer banks participating in crypto custody could increase the vulnerability of user assets.

Representative Tom Emmer also expressed support for the resolution.