American Bitcoin Seizures Near 14 Billion as Congressman John Rose Blasts “Rogue Regulator” Gary Gensler

US Crypto Enforcement | Image: Chip Somodevilla/Getty Images

Key Takeaways

- The US government’s Bitcoin holdings have surged beyond 216K BTC.

- The SEC and chair Gary Gensler is facing criticism for enforcement actions.

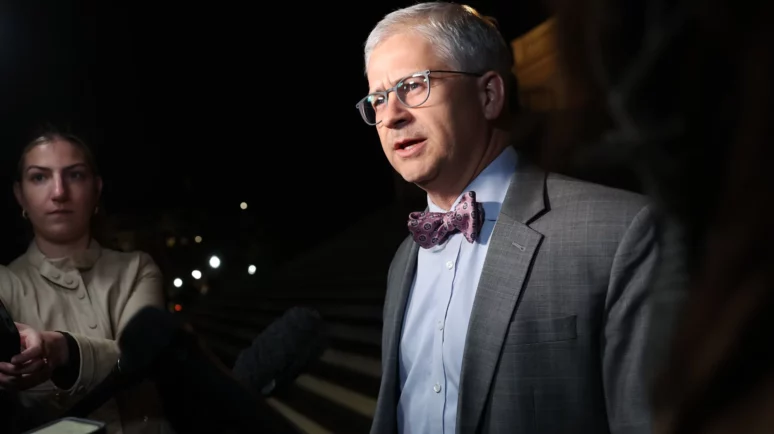

- Congressman John Rose accuses Gensler of overstepping the agency’s regulatory mandate.

The US government’s Bitcoin holdings have swelled to an estimated $13.82b. According to Arkham Intelligence, the government holds 216.8K BTC, which is over 1% of all Bitcoin in circulation.

This increase is primarily on the back of criminal seizures. At the same time, the SEC is being vocally criticized for its aggressive enforcement actions, particularly after its recent notice against the trading platform Robinhood.

US Government’s Bitcoin Holdings Surge

The US government seized 3.94K BTC, valued at approximately $251m, during a legal trial in January. The case was tied to Banmeet Singh’s drug funds and alleged money laundering in the US.

The case and similar criminal seizures boosted the government’s total Bitcoin reserves to 216.8K BTC. The total crypto portfolio of the US government has now reached $14b.

While the US government is managing considerable amounts of cryptocurrency in its attempt to regulate financial transactions, the securities regulator is facing increased criticism.

Congressional Criticism of the SEC

Congressman John Rose has taken a strong stance against the SEC’s issuance of a Wells Notice to trading platform Robinhood.

A Wells Notice is a formal notification of an enforcement action against Robinhood. Rose believes the action exceeds the agency’s mandate to protect investors and ensure fair market practices.

Rose argues that such actions by SEC Chair Gary Gensler and the agency are stifling innovation in the digital assets market. He advocates for legislative measures to refine and restrict the regulatory reach of the SEC, ensuring it supports rather than hinders technological advancements.

Legislative Responses to the SEC Actions

In response to perceived regulatory overreach, other lawmakers are also taking action. Representative Mike Flood had introduced a proposal to repeal SAB 121. The standard could be repealed in May.

The Staff Accounting Bulletin No. 121, issued by the SEC, addresses the obligations of entities that hold crypto-assets for platform users. This bulletin guides how these entities should manage and account for the crypto-assets they safeguard.

The SEC says that guidance enhances transparency and investor protection by ensuring entities disclose the risks and accounting methods associated with safeguarding crypto assets.

Additionally, GOP Tom Emmer has criticized the SEC’s frequent use of Wells notices as attempts to intimidate the digital asset industry, suggesting a disconnect between the regulatory body and the sector it regulates.

The SEC Criticized But What is Next?

As the US government continues to amass a significant portfolio of Bitcoin through seizures, lawmakers are pushing back against what they see as the SEC’s intrusive regulatory tactics.

While the SEC enforcement action keeps the US in a state of flux, any Congressional action and changes to Staff Accounting Bulletin No. 121, take away the SEC’s powers in crypto cases.