Here’s Why Netflix Stock Will Rebound from Ugly 30% Crash

Netflix stock is down 30%, but the NFLX technical picture suggests a major rally waits on the near-term horizon. | Source: Shutterstock

By CCN.com: Netflix stock remains firmly in the limelight – for all the wrong reasons.

NFLX shares are down nearly 30 percent from their all-time high, and the stock has plunged more than 22 percent since mid-July following a brutal earnings report.

Many armchair traders believe that Netflix stock could dive even further.

However, while it’s true the stock looks bearish, its technical picture suggests that it will likely regain its bullish momentum soon.

Netflix’s Uptrend Remains Intact as It Forms a Bullish Continuation Pattern

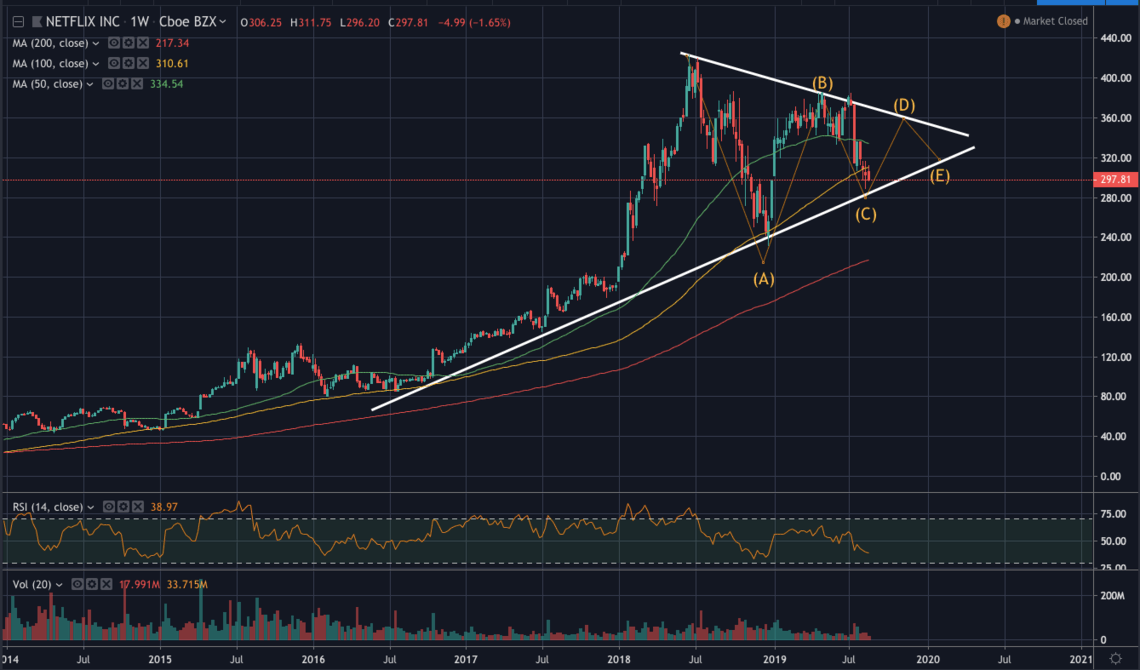

A closer examination of the equity’s longer timeframe reveals that Netflix is forming a symmetrical triangle pattern. This is a bullish continuation pattern suggesting that the stock is taking a pause from its uptrend.

Once this pattern is resolved, we can expect the stock to rally.

Based on this analysis, Netflix should bounce toward the $350 area for the D wave of the triangle.

That’s an outlook also shared by widely-followed pseudonymous analyst TraderStewie :

“With yesterday’s nice hammer candle close, I’m now starting to see a decent looking #FallingWedge pattern in this one again! Notice the MACD and RSI action. $330 to $340 target area.”

In addition, Wyckoff Stock Market Institute co-owner Todd Butterfield spoke to CCN.com and shared his view on Netflix. He said:

“Netflix on the three-year chart did a classic Wyckoff ending action with a Preliminary Supply (PS), Buying Climax (BC), Automatic Reaction (AR), and a Secondary Test (ST). This meant that the rally needed to pause and refresh itself, or correct the previous rally. With the oversold reading and Fibonacci support, it now has a chance to regain its footing and try another run at the $385 resistance area.”

The Wyckoff whiz supports the bullish view of consolidation and a near-term bounce. For now, it appears that the dump is over and there could be room to make a quick buck by buying the Netflix stock dip.

Disclaimer: This article is intended for informational purposes only and should not be taken as investment advice.