Millennials Insanely Tout Bitcoin and Andrew Yang as Their Retirement Plans

Universal Basic Income-toting Andrew Yang is promising millennials a better future if they vote for him. | Source: Chip Somodevilla / Getty Images / AFP

More than any other generation, millennials face dismal retirement finance prospects.

According to a recent report , those born between 1981 and 1996 face numerous economic disadvantages relative to other generations such as baby boomers and generation X.

Consequently, they are expected to face overwhelming retirement finance challenges when they start leaving the workplace around three decades from now.

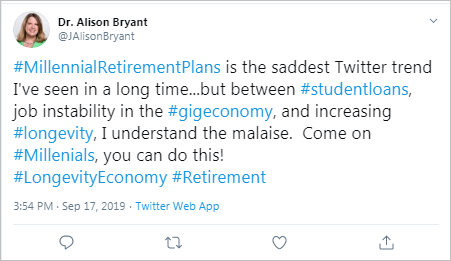

That, however, did not stop social media users from making fun of millennials under the hashtag #millennialretirementplans. The retirement plans proposed on Twitter ranged from the bizarre and hilarious to serious ones.

Owing to the well-known millennial appetite for avocados, there was no shortage of ideas of how this could turn into a (not-so lucrative) retirement plan.

Silicon Valley, the New Master for Millennials

Given that millennials came of age at a time when information technology was exploding, some of them are planning to ride on the coattails of the Silicon Valley giants of today (even though it is not clear whether those giants will still be existing when retirement comes around, and in what form, if so).

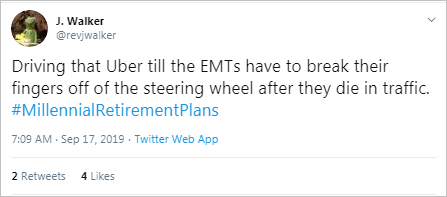

Among the culprit for their poor economic state and prospects, the gig economy has received its fair share of blame. This is because the jobs are sometimes backbreaking with poor pay and offer little or no automatic enrollment in any retirement program. Some millennials were unsurprisingly quick to point out that they probably will die slaving for some tech platform.

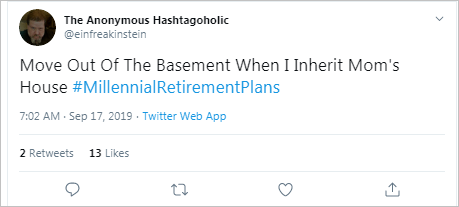

For others, their plan is to wait for their parents’ demise.

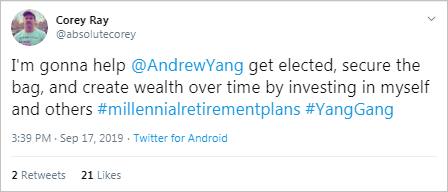

The growing economic inequality has seen U.S. presidential candidates propose various solutions to bridge the gap including offering a universal basic income to everyone. No surprise then that some millennials are now counting on the pro-bitcoin presidential candidate Andrew Yang to save the day.

Bitcoin to the Rescue!

And still, others are putting all their hopes on bitcoin. This is not far-fetched given that millennials have a higher affinity for crypto compared to prior generations. But I digress.

Aside from the jokes, some recognized the seriousness of the matter by admitting that millennials have been dealt a worse hand relative to generation X or baby boomers. Fortunately, they enjoy better health and are thus expected to enjoy longer years as productive citizens. This could mean they have relatively more time to save for retirement compared to other generations.