Meet Warren Buffett’s Greatest Investment That He Will Never Make

Warren Buffett is concerned about the stock market, and rightfully so. His next major opportunity is gold. | Image: Johannes EISELE / AFP

- Warren Buffett should be buying gold this year as the commodity is expected to surge in value.

- The stock market is expected to face turbulence.

- The flight to safety and constrained supply will be catalysts for gold.

Warren Buffett’s faith in the stock market is legendary. The Oracle of Omaha has cut his teeth in the U.S. stock market and is an ardent advocate of the asset class. But there’s a chance that Buffett has lost confidence in the stock market of late, which is why he should be looking at gold as an investment.

The billionaire investor’s Berkshire Hathaway is reportedly sitting on more than $128 billion in cash. Buffett has gone four years without making a big deal, and it’s not surprising to see why he may be afraid of putting in stocks.

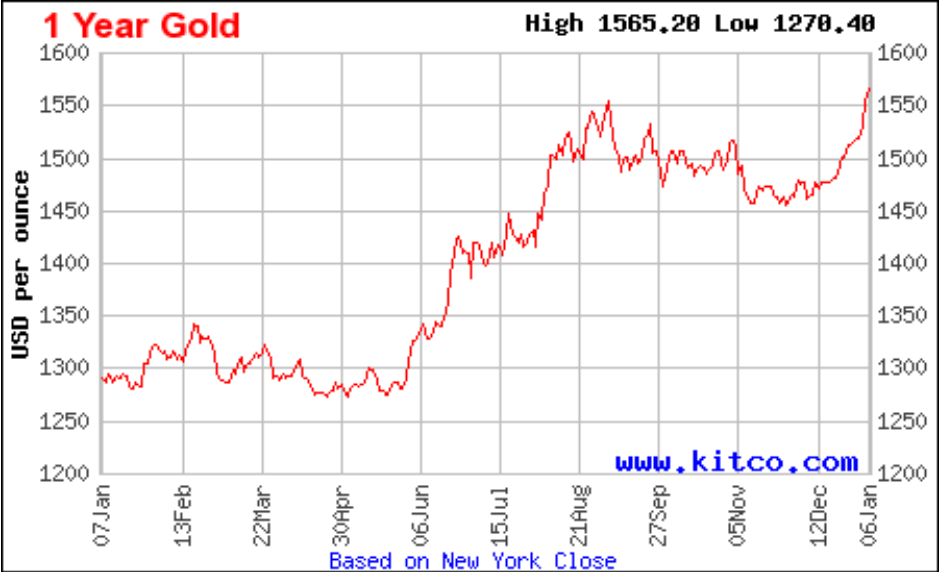

Gold prices are set to soar in 2020

Gold is currently trading at a spot price of $1,566 an ounce, but it’s widely believed that the commodity will end the year past the $2,000/oz. level.

City Index technical analyst Fawad Razaqzada is one of many who believes that gold will hit that magic mark this year thanks to a correction in the stock market:

If U.S. stocks were to correct themselves in 2020, then this surely could lead to elevated levels of safe-haven demand for gold … As the U.S. equity market bubble finally bursts, safe-haven demand could nudge gold past its 2011 peak of $1,920, before tagging the $2,000 psychological hurdle.

Razaqzada’s prediction is already coming true as investors are abandoning the stock market and loading up on gold thanks to geopolitical tensions. This is something Warren Buffett should have done as the rising tensions between the U.S. and Iran have sent gold prices to seven-year highs . Equities are expected to struggle in 2020 in light of a protracted conflict in the Middle East.

Higher oil prices will dent consumers’ spending power in the U.S. and also hurt corporate earnings. That’s bad news for Warren Buffett as he might have to keep sitting out of the stock market this year. The other option for Buffett is to buy gold.

Gold demand is expected to remain strong in 2020 on the back of central bank buying and the flight to safety, laying the groundwork for higher prices. Constrained supply will also play a role in boosting gold prices. BMO Capital Markets forecasts that gold production will decline in 2020, paving the way for prices to increase.

Warren Buffett’s hunting ground is in trouble this year

In his letter to shareholders a couple of years ago, Buffett had said :

The magical metal was no match for the American mettle.

The legendary investor was comparing gold’s returns to that of stocks, albeit in a skewed way. He was comparing how much a $10,000 investment made in stocks and gold back in 1942 would be worth in 2018. But what Buffett conveniently forgot is that the price of gold in the U.S. was fixed by law until 1975 .

It’s a noble thought to have faith in America’s economy and invest in the stock market. But Buffett seems to be forgetting that the American economy is not in the best of shape this year, and companies listed on the stock market are overvalued. If U.S. companies are unable to meet earnings growth targets in 2020, their stock prices will crash in the event of a correction.

U.S. consumer confidence is in the doldrums, manufacturing activity is weak, and Trump seems willing to risk a war with Iran.

Gold will continue to shine in such a situation. As it turns out, gold prices have handily beaten the broader stock market in the past 20 years and the yellow metal is your best bet at a time when a crash is in the offing.

So, it would be prudent for Warren Buffett to seriously consider an investment in gold this year and put his billions to work. If Buffett doesn’t do that, gold could become the greatest investment he never made.

Disclaimer: The opinions in this article do not represent investment or trading advice from CCN.com.