Mark Cuban-Backed Unikrn ICO Sued by Disgruntled Investor

Unikrn, an esports gambling startup that raised approximately $31 million through an initial coin offering (ICO) in 2017, has become the latest ICO-funded project hit with a class-action lawsuit by a disgruntled investor.

The Seattle-based company, which launched in 2014 as the world’s only fully-licensed and regulated esports betting platform, has been sued by lead plaintiff Las Vegas resident John Hastings for allegedly skirting federal securities violations by offering UnikoinGold Tokens (UKG) to the general public, rather than just accredited investors.

According to documents filed in Unikrn’s native Washington State, Hastings claims that although Unikrn called UKG utility tokens, they functionally operated as security tokens, since most buyers acquired them in the expectation that they would go up in value. This, the complaint says, made UKG an illegal securities offering.

“Investors in the UnikoinGold ICO, including Lead Plaintiff and the Class, made their investment with a reasonable expectation of profits,” he argued in the suit. “Defendants have crafted a flimsy façade that UKG Tokens are not securities by claiming they are ‘utility tokens.”

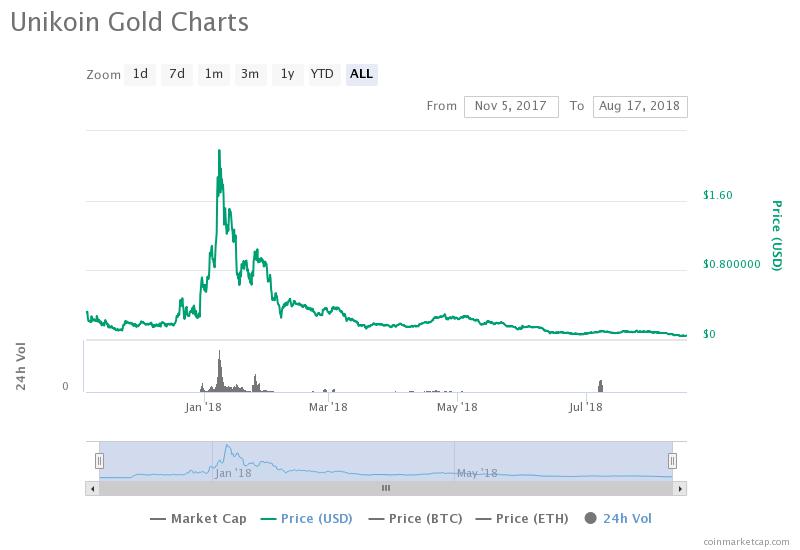

The performance of this investment failed to live up to expectations, however, and UKG has plunged in value against both USD and BTC. At one point in early January, UKG was worth as much as $2.47, though the tokens are now trading at just five cents.

Unikrn is the latest in a growing line of ICO-funded projects who have been hit with class action lawsuits by investors seeking to recoup their losses by persuading a court to rule that the offerings were conducted illegally. This list includes Tezos, which raised a then-record $232 million in 2017 and now ranks as the 18th-most valuable cryptocurrency.

UKG’s ICO presale attracted a number of notable investors, including billionaire Dallas Mavericks owner Mark Cuban and crypto-billionaire Brock Pierce, as well as cryptocurrency hedge funds Pantera Capital and Blockchain Capital. Prior to holding an ICO, Unikrn received traditional venture funding from Ashton Kutcher, among others.

Unikrn CEO Rahul Sood told GeekWire that the company has retained Seattle law firm Perkins Cole and tends to “vigorously defend” its interests in court.

Featured Image from Shutterstock