Litecoin Price Doubles in 2019: 5 Cataylsts Fueling the Rally

SFOX says there are 5 factors fueling Litecoin's remarkable 2019 surge. | Source: Shutterstock

The broader crypto market has been stuck in a narrow trading range over the short-term, but there’s one cryptocurrency whose value has nearly doubled year-to-date, and that’s Litecoin (LTC). The fifth-biggest coin, which is currently trading at $60.75, has benefitted from a few high-profile partnerships inked by Litecoin creator Charlie Lee, not to mention a push toward confidential transactions.

After trading in the shadow of its larger sibling bitcoin (BTC) for so long, Litecoin, whose primary use case is “peer-t0-peer electronic cash,” is finally forging an identity of its own.

Cryptocurrency prime dealer SFOX outlined five catalysts that have driven the LTC price to levels it hasn’t seen since September 2018 on persistently-solid trading volume to boot.

1. Mainstream Litecoin Adoption

The Litecoin team are masters at getting merchants to integrate LTC payments into their systems. Just ask Bob Moore Auto Group, which according to Lee “signed on with @AliantPayment to accept Litecoin at their dealerships,” starting with an Oklahoma City location. This means customers can pay for their Subaru with LTC.

Merchant support of crypto is necessary for wide-scale adoption, and Litecoin has been one of the most successful projects for this. In addition to auto, Litecoin has also been featured in the UFC octagon, and LTC is being accepted as a form of payment at an upcoming K-pop concert the Litecoin Foundation is sponsoring. Also, according to SFOX:

“LTC’s partnership with Spend, announced on Feb. 13, increased the number of locations LTC can be spent by 40 million locations.”

2. Attractive Fees

Cryptocurrency is known (not always correctly) for its cheap fees versus traditional money transfers and credit card transactions. Litecoin is no different, as evidenced by a November 2018 transaction worth $62 million that only cost the sender $0.50 in fees on the Litecoin network . Also, Litecoin Core version 0.17.1, which is available on GitHub for testing, is designed to slash transaction fees even further, by 10x, which could also explain the bullish sentiment surrounding the coin. As a result, transactions can be completed in near real-time.

3. Speedy Transactions

Blockchain transactions have been plagued by slow confirmation times at the point of sale. If crypto is ever going to achieve wide-scale adoption, they must speed up to compete with the seconds it takes to make a purchase using Visa and Mastercard.

The Lightning Network is a layer-two technology that is designed to accelerate Bitcoin and Litecoin blockchain transaction confirmation times to “seconds or milliseconds.” Nearly 5,000 merchants currently support Litecoin Lightning Network payments via Coingate.

4. Greater User Privacy

Charlie Lee stirred great excitement around the project when he revealed that he would begin pursuing confidential transactions , saying:

“Fungibility is the only property of sound money that is missing from Bitcoin and Litecoin.”

Last month, the Litecoin Foundation announced a collaboration with privacy coin Beam to potentially integrate the Mimblewimble protocol , which would add scale and privacy to the cryptocurrency.

5. Upcoming Litecoin Halving

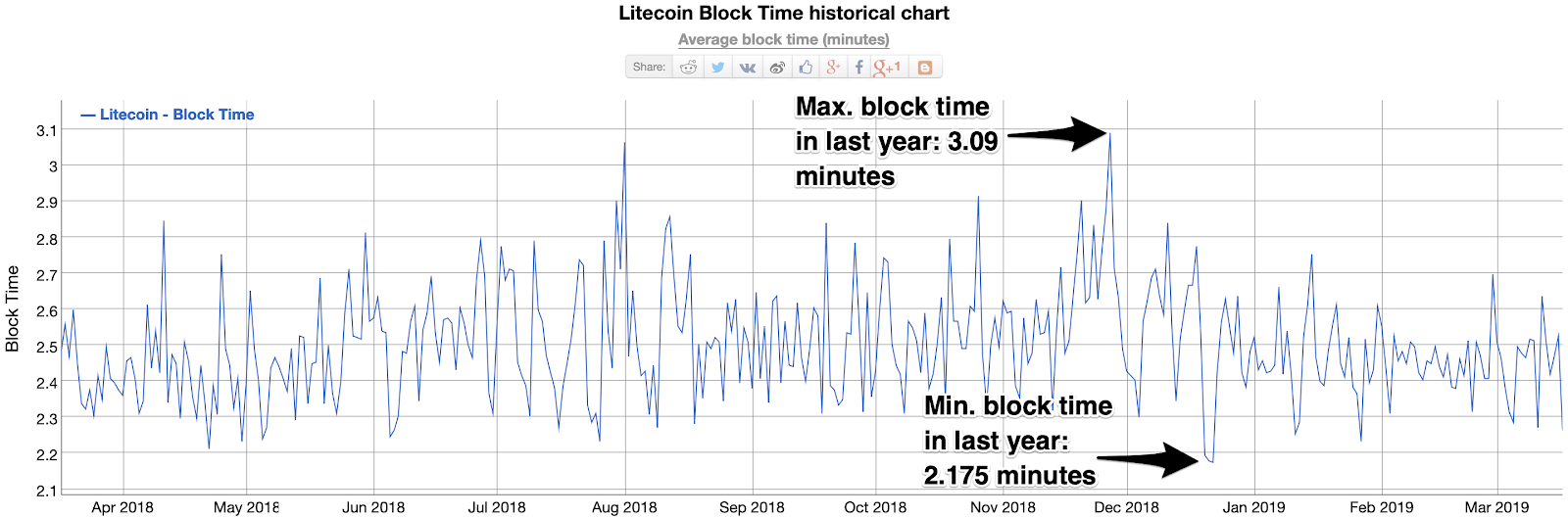

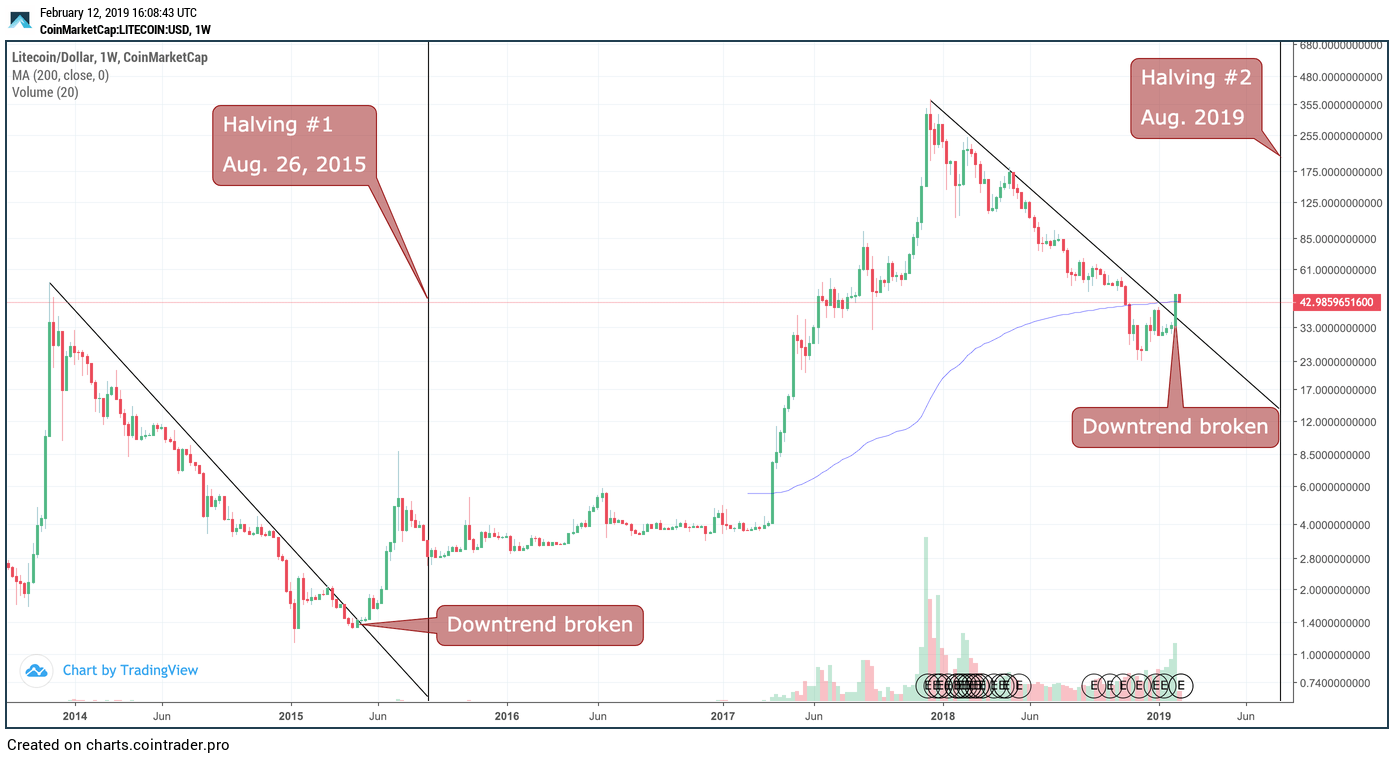

Litecoin’s next halving event is expected to occur in August 2019, which will slash the mining reward in half and reduce the number of LTC entering the market. This supply/demand dynamic could already be baked into the LTC price – or could fuel future gains.

What a Difference a Year Makes

In late December 2017, Charlie Lee revealed that he had divested his LTC portfolio, which incidentally coincided with the start of the bear market that continued throughout 2018.

While it could have just been a coincidence, 2019 is looking a whole lot better for Litecoin – and the rest of the crypto economy as well.