Litecoin Metrics & Price Are Strengthening but Is It Too Much, Too Fast?

The litecoin price rebounded more than 14% on Wednesday, just weeks before the fourth-largest cryptocurrency undergoes a "halving." | Source: Shutterstock

By CCN.com: As the bitcoin price barrels toward $9,000, the cryptocurrency community is riding high. Litecoin Creator Charlie Lee is among them, retweeting a meme from 2017 when the bitcoin price was nearing the $9K level for the first time ever. Now that bitcoin’s seemingly on its way back and beyond, other cryptocurrencies are also enjoying a bull run – including Lee’s Litecoin.

LTC has added nearly 13% in the last 24 hours alone, bolstering the per-coin price to $115 on trading volume of roughly $7 billion. Litecoin Foundation Director Franklyn Richards recently evaluated some of the network fundamentals, suggesting that while the metrics have strengthened alongside the bull market, a pullback could be up ahead. He even used the dread “b” word – bubble. Let’s take a look at the findings.

The Litecoin network has experienced a resurgence in user interest this month after “on-chain metrics began flatlining” earlier in the year, according to Richards citing BitInfoCharts data. He characterized the “network interest” in the platform as a “delayed response” to the performance in the LTC price. After all, in the first four months of the year alone, the Litecoin price more than doubled.

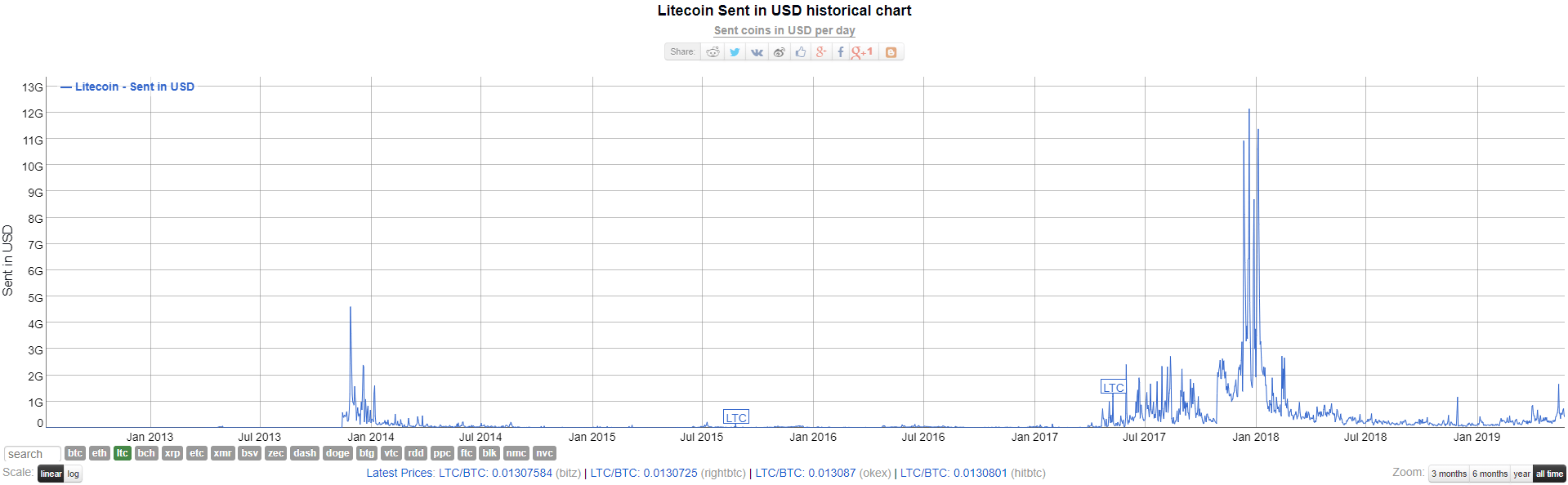

But now things are beginning to click on all cylinders, possibly even too well for Litecoin. Based on BitInfoCharts data, “Litecoin sent in USD” surpassed $1.6 billion in mid-May. It is currently hovering in a more comfortable range of roughly $500 million.

As Richards points out:

“These numbers still pale in comparison to the initial 2017 runup in price where values regularly exceeded $2Bn and hit an eye-watering $12Bn daily at the highs.”

Litecoin Is the Master Marketer

Litecoin has been heavily promoting the brand at major events and has won over celebrity personalities such as UFC Fighter Ben Askren, among others. They are angling for inclusion in the latest Spedn app that supports cryptocurrency purchases at major retailers, which would bolster LTC’s use cases as a currency.

Incidentally, Litecoin’s average transaction value is a lot higher than for microtransactions. It’s gone from approximately $7,000 to roughly $20,000, having peaked at $47,000. That’s a lot of Starbucks. According to Richards in the post:

“Such sizeable transactions indicate the network is still primarily being used by affluent individuals to avoid traditional monetary transfer fees or as a speculative asset in which to invest. Not that this is necessarily bad, however, it runs contrary to the idea of these networks being used by the everyman for smaller daily payment”

Another bullish sign is the number of active addresses reaching 80,000, which incidentally could be misleading depending on the number of addresses a user has. The number of daily transactions, however, is on the rise, going from 20,000 to 27,000. All good news.

“B” Word

Now here’s the rub. Richards warns that while the “metrics appear to have jumped with this latest recent monster rally up in market price,” it’s been disproportionate. He said:

“Price has by far and away ran away from any on-chain metrics, meaning while this growth is positive it is not currently sustainable and we could see a pullback. Otherwise, we may risk finding ourselves in another bubble scenario sooner than we realize.”

Charlie Lee has previously stated that during the late 2017 bull run, he thought the price was headed to $1,000, which never materialized. Meanwhile, as long as bitcoin remains in this bullish pattern, it’s hard to imagine the silver to BTC’s gold giving up ground any time soon.