Jim Cramer: Fed Reassurance Should Spur Dow Jones, Wider Stock Market to Rally

The markets have been extremely volatile towards the end of 2018 and beginning of 2019. It has been widely assumed that the sell-off in the Dow Jones and other indices has been caused by tensions between the United States and China. Markets worldwide have been affected – including the Australian, Japanese and London stock markets. Another possible cause is the Fed’s view on interest rate hikes.

Fed Chair Powell: We’re Flexible!

On Friday, Fed Chairman Jerome Powell said that the Fed had no preset path towards hiking interest rates. He added that they were constantly monitoring markets, and would respond as required. Moreover, the Fed is ready to shift its stance aggressively based on the market, similar to 2016, when four rate increases were expected but only one was implemented.

The S&P 500 index climbed 38% since election night in 2016 to the market peak during September 2018. However, rising tensions between the US and China and the Fed hiking interest rates sparked the sell-off through Q4 2018.

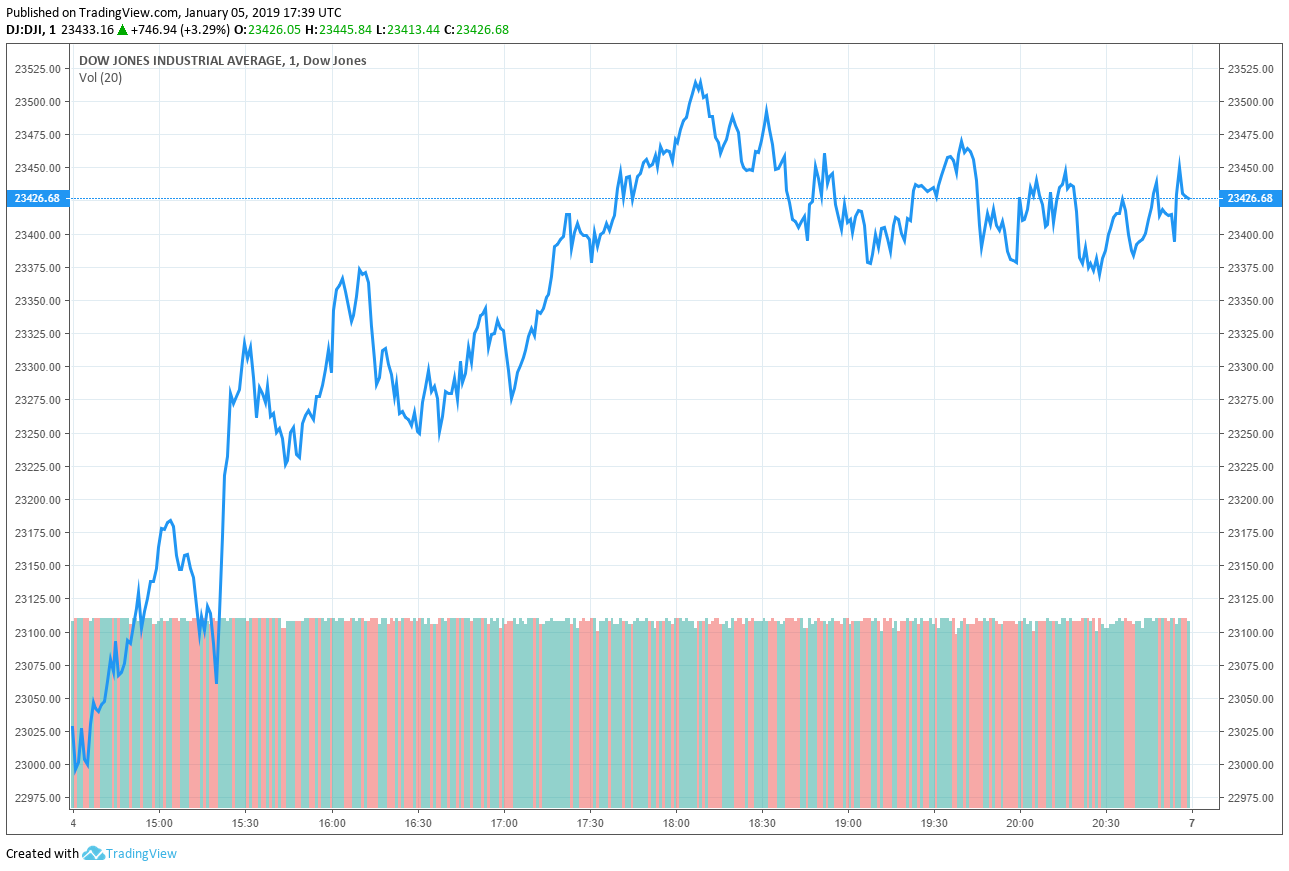

Markets subsequently experienced a surge. The Dow Jones index closed 746.94 points higher for a daily gain of 3.29%.

Powell, who spoke at the annual American Economic Association’s meeting in Atlanta, said the Fed was ready to shift its stance based on market conditions.

Markets, on the whole, have priced in the downside risk of ongoing US-China tensions. When it came to balance sheets, he stated that they were not the primary cause for the downturn caused during Q4 2018.

We don’t believe that our issuance is an important part of the story of the market turbulence that began in the fourth quarter of last year.

CNBC’s “Mad Money” host Jim Kramer said that Powell’s statements gave the market a justifiable boost.

After today, gratefully and thankfully, we can take that off the table, and I bet a ton of money actually flows back into the market given that Powell’s come around.

US-China Trade War

Moreover, the trade deal talks between the US and China are set to resume on Monday. This could potentially result in markets going positive yet again. Kramer said that the Chinese government was “ready to cave.” This signals that tensions might finally calm down and markets can chart their organic growth out.

Kramer went as far as saying that, “the market might have run its course on December 24” and “a move higher is justified.” These statements were based on the fact that earnings growth within the S&P 500 companies has grown year over year. In 2017, there was a net 17% gain, along with 27% in 2018.

Although earnings growth is projected at 10% for 2019, analysts might have to revisit their targets given Powell’s reassurance.

Featured Image from Wikimedia Commons