How Fidelity’s Bitcoin Custody Launch in Q1 2019 Crucially Shows Institutional Demand Still Exists

Fidelity is reportedly set to launch a bitcoin custodial service for clients in March. | Source: Shutterstock

On January 30, Bloomberg reported that Fidelity, the world’s fourth-largest asset manager, is set to launch its Bitcoin custody service by the end of the first quarter of 2019.

Three sources who asked to remain anonymous reportedly said that the plans are still private but the firm plans to introduce Bitcoin storage first, followed by Ethereum (ETH) custody.

Why Fidelity Pushing Forward With Bitcoin Custody is Meaningful

As one of the biggest mutual fund operators in the U.S., Fidelity works with more than 13,000 financial institutions.

It established its intent to penetrate into the cryptocurrency sector in late 2018, with the appointment of former Chain president Tom Jessop as the company’s corporate business development head.

Since then, with the introduction of Fidelity Digital Assets in October of last year, the company has moved forward with its plans to help institutional investors invest in the emerging asset class.

At the time, in an official statement, Fidelity Investments CEO and chairman Abigail Johnson said:

Our goal is to make digitally-native assets, such as bitcoin, more accessible to investors. We expect to continue investing and experimenting, over the long-term, with ways to make this emerging asset class easier for our clients to understand and use.

Earlier this week, Fidelity told Bloomberg it is already working with a group of eligible clients to build a set of products that could efficiently handle the inflow of capital from traditional markets to cryptocurrencies.

In the months to come, Fidelity emphasized that it will actively engage in discussions with its existing investors and strengthen the infrastructure supporting the asset class.

“We are currently serving a select set of eligible clients as we continue to build our initial solutions. Over the next several months, we will thoughtfully engage with and prioritize prospective clients based on needs, jurisdiction and other factors,” Fidelity’s statement read .

The focus on Bitcoin custody and institutional investors by Fidelity Investments comes in a time during which major companies in the cryptocurrency sector in the likes of Blockchain and Coinbase are shifting to retail customers.

In early January, The Block reported that Instinet executive Jonathan Kellner is no longer joining Coinbase to lead institutional sales in a move that confirmed Coinbase’s shift in interest from the institutional market to retail investors.

Dan Romero, a Coinbase executive, said :

Jonathan is an exceptional leader, but it was the right decision for us to focus on this area of the market. Crypto is an incredibly fast-moving industry and market conditions can change pretty quickly. We are focusing on the crypto fund area of the ecosystem.

Blockchain, the most widely utilized Bitcoin and Ethereum wallet platform, also saw Jamie Selway leave his position as global head of institutional markets as the demand from institutional investors for cryptocurrencies reportedly declined.

Fidelity’s ambitious approach in targeting the institutional market in a period wherein an increasing number of companies are moving away from it shows the asset manager is confident in its ability to lure in institutional investors into the cryptocurrency market.

Price Doesn’t Matter For Institutions

For institutional investors, as VanEck crypto head Gabor Gurbacs previously said, it is crucial that the cryptocurrency market is equipped with regulated, transparent, and well-structured investment vehicles.

Especially to firms that hold trillions of dollars, Gurbacs said that it is of less importance whether Bitcoin is valued at $3,000 and $10,000.

“Large financial institutions are more focused on proper market structure than short term price fluctuations. How do we properly value digital assets? How do we custody digital assets? Are their ETFs available with proper market and investor protections? Most large institutions do not really care if Bitcoin ends 2019 at 3,000 or 10,000,” he said .

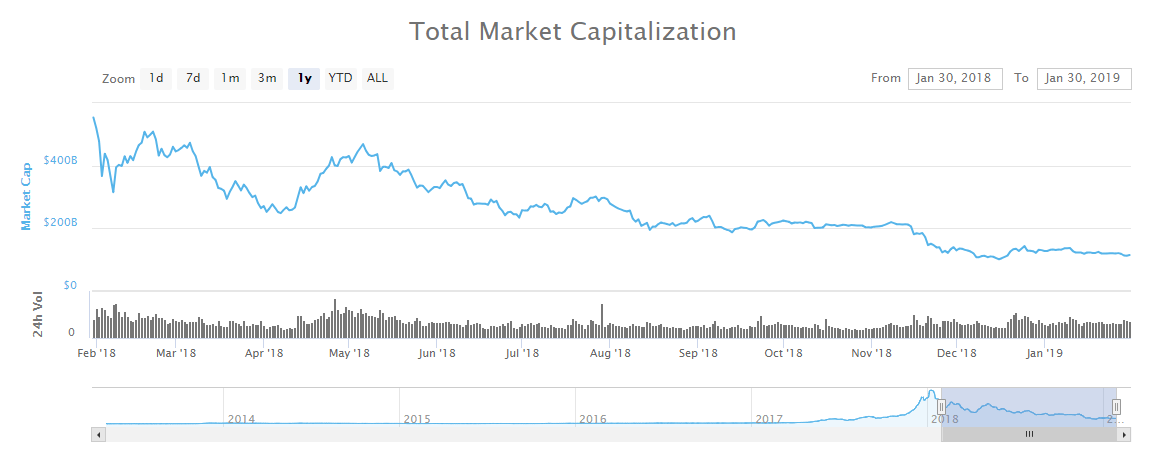

Even if the bear market of cryptocurrencies is extended throughout the next few quarters, if large institutions continue to improve on the current structure of the market, the asset class could appeal to institutions in the long run.