Housing Market Sees Rising Sales In June, But Prepare For Another Dip

Pending home sales surged in June, but the rally might now last as virus cases continue to spike. | Image: AP Photo/Gene J. Puskar

- Home sales have risen for the second consecutive month, while house prices are also increasing.

- Surging Covid-19 cases may prevent sales from rising in July and August.

- The end of the federal moratorium on foreclosures may result in a housing market downturn.

Pending home sales increased for the second consecutive month in June, climbing 16.6% compared to May. House Prices rose 4.5% annually in May, indicating that the U.S. housing market is bucking trends visible elsewhere in the economy.

Continued housing market growth has caused the National Association of Realtors (NAR) to change its annual forecast for 2020. It’s now predicting an overall 3% decline in home sales, as opposed to a sharper fall of 7%.

Yet, May and June’s growth may not continue in the coming months. Covid-19 cases rose considerably in July, while the supply of homes remains low.

Housing Market Continues to Ignore Pandemic

The U.S. housing market is still ignoring the ongoing Covid-19 pandemic. It seems that while the “real” economy of jobs and incomes continues to teeter , assets such as houses, stocks, and gold continue to rise.

The NAR’s latest report shows that pending home sales spiked 16.6% in June, the second consecutive monthly increase. They also rose by 6.3% compared to a year ago.

The NAR’s chief economist, Lawrence Yun, is surprised by these figures:

It is quite surprising and remarkable that, in the midst of a global pandemic, contract activity for home purchases is higher compared to one year ago.

Yet the rise isn’t particularly surprising when you remember that mortgage interest rates have hit all-time lows.

Consumers are taking advantage of record-low mortgage rates resulting from the Federal Reserve’s maximum liquidity monetary policy.

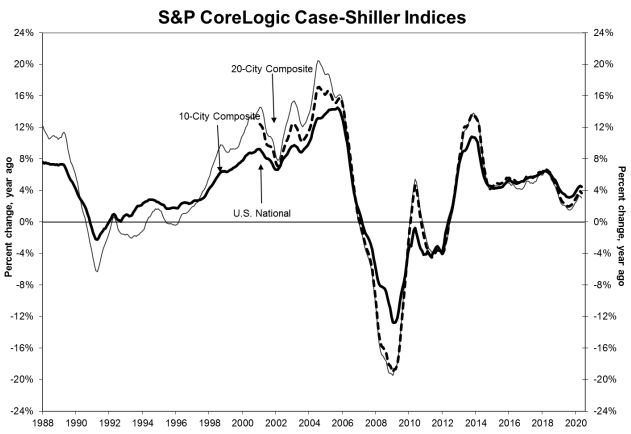

It’s not only buyers who are benefitting from low rates. Existing owners are also benefitting because house prices are rising steadily above inflation. According to the recent S&P CoreLogic Case-Shiller Index, home prices rose 4.5% annually in May.

Home values had also risen 4.6% annually in April, underlining how the housing market is insulated from broader economic stress.

Growth Unlikely to Last

Rising home sales and values paint a rosy picture of the housing market. When you add the fact that the U.S. homeownership rate has hit its highest level since 2008 , things start to look very positive.

This is unlikely to last. Growth in home sales could stall in July and August, as numerous states battle Covid-19 waves. Florida and Texas witnessed record new cases in mid-July. Many states are seeing record daily deaths only now .

This is hardly the ideal environment for further rises in housing market sales. Covid-19 cases were declining for most of June when the surge in signed contracts was recorded.

Then there’s the ongoing supply crunch. The NAR reports that the supply of homes for sale declined 18% annually in June .

At the current rate, the existing inventory of 1.57 million homes would be sold within four months. Either the rate of house sales needs to decline, or more houses need to come to the market.

It’s a different story when it comes to house prices. Assuming that supply does remain relatively low, prices will continue to rise for the foreseeable future.

The only possible exception comes from the threat of foreclosures. The moratorium on foreclosures ends on August 31 . If it isn’t extended, the housing market could face a wave of defaults. House prices would likely feel the burden.

Disclaimer: The opinions expressed in this article do not necessarily reflect the views of CCN.com.